The life of common man revolves around some financial goals which he/she wants to achieve. Buying a house, Comfortable retirement, children future planning and their marriage are those primary goals which all people would like to see through. However, the limited resource that one has does not allow allocating money towards all of these, which impact some of the goals.

To go through the entire process, you need to first identify your goals and quantify them. Then analyze current financial situation and utilize your limited resources in meeting the financial goals. Changes should be made in your cashflows, if required. Once implemented, review it periodically to accommodate any change in your financial situation during your lifetime.

However, many individuals find it difficult to implement a financial plan. Primary reason for this is the change in lifestyle recommended by their planners. Even if it gets implemented it loses track in between and the entire objective of creating a financial plan becomes useless.

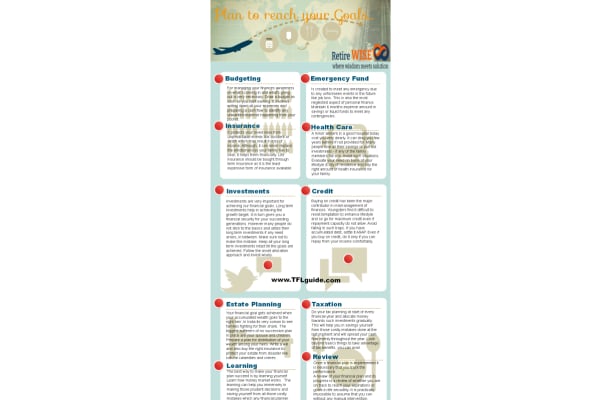

Financial Planning strategies recommended by most planners are not new innovations but mostly follow the basics of personal finance, which if followed rigorously, can help immensely in achieving life goals. Listed below are 10 basic strategies (your checklist) which drives success story of any financial plan.

Financial planning is all about making good financial choices. That’s why it’s something you should do over the course of your whole life – even before you have a lot of money saved. In fact, it’s one of the most important things you can do for yourself and your loved ones.

Dear Hemant its very good

Thanks Vinod.

A timely article …. as always, HATS OFF for your work sir.

Thanks Sunil.

PLEASE WRITE SOMETHING ABOUT REALSTATE INVESTMENT,HOW MUCH ONE SHOULD INVEST IN THIS FINENCIAL PRODUCTS

Check this

https://www.retirewise.in/2012/12/can-i-afford-a-house-at-current-prices.html

Excellent article..

Thanks Preeti.

Hi Hemant,

Very well written except for the credit bit. You are right when you say credit is bad when it is not used for income generation. However, there are smart ways you can use Other People’s Money (Banks) to your advantage (income generation) . This works through credit and I would personally call it good debt.

If you referring to credit cards, yes it is bad debt and needs to be settled ASAP as it probably has very high interest rate charges. Debt taken for income generation purpose and executed and managed properly can accelerate your income thus taking you closer to your financial goals.

Happy to stand corrected if you disagree.

Regards

Lloyd

Hi Lloyd,

I know what you are hinting towards when you say “there are smart ways you can use Other People’s Money (Banks) to your advantage (income generation) . This works through credit and I would personally call it good debt. ”

For me this is leveraged investment & is like double edged sword.

Hi Hemant,

Thanks for your reply. I agree when you say it’s a double edged sword but then most fortunes were made with OPM and leveraging. These people have known their game (business) well enough to make that sort of money.

I know you care about your client’s assets when you get into defensive mode but you never better than most that there is always some sort of educated risk involved when leveraging. Just my opinion…:)

Regards

Lloyd

Hi Lloyd,

There is bit difference between business & investing.

Most of us have no clue about risk because “risk is what is left over, after you think you have thought of everything.”

Dear Mr.Hemant,

Very good article and collective reminder of many lessons you have been giving.

Thanks

Sekar

Thanks Sekar.

Good refreshing article. Always enjoy reading the basics.

Thanks Vivek.

It is a very good article .

Thanks Rameshwar.

Exhaustive and covers all the aspects required to create a comprehensive financial plan. Unfortunately, in India, structured financial planning is yet to take off in a big way, though the process has started. Most of the mass affluents and the HNIs still prefer dealing with the large agent force who just sell off the shelf products like insurance policies,New Fund offers and IPOs.

Hi Annapuran,

Agree with you but good part is salaried class has already started realizing its importance.

Hemant a very informative article. I would request if you could throw some light on how to go about planning for long term goals and allocating the required investment cost accordingly.

Hi Bhupendra,

Subscribe to this – you may find your answer

https://www.retirewise.in/free-e-course

Hi Hemant

Very useful post.

Thanks Anil.

Nice article….

Thanks Deepak.

Good article, sir

Thanks Kapil

Hi Hemant,

The article reminds me of myself. I got the plan created and then dropped off the radar for one year because of one thing or another. But mostly because I had difficulty in changing myself – the daily tracking of expenses, buying pure insurance etc. But now I am on the right track. I can tick most of the things from your checklist above but still a good long way to go.

Anurag

Hi Anurag,

Good to hear that now you are on track 🙂

Very good article!

Thanks Sonali.

Dear Hemant,

I need to talk to you regarding my Financial Planning.

may you please let me know the fees structure for the same

Regards

Dhuriaraj

Hi Dhurairaj,

You should check this link for our services

https://www.retirewise.in/services/financial-planning-services

Dear Sir,

I ve just started reading your articles and found it very useful as I am totally new to the concepts of Finance. Thanks a lot for all the efforts you put in to make the articles easy for newcomers.

Waw it’s superb article. its very helpful to us.

Thanks Sam

Very Useful Info In Checklist. Thank You For Sharing With Us, Hemant Beniwal.

Thanks 🙂

Welcome Sir

Comments are closed.