WHY

We all need to take control of our money, but too often – money controls us.

The number one stressor in the lives of people is money. People have anxiety, frustration, confusion, and dissatisfaction surrounding one’s investments and overall financial life. This can happen when we have no clear idea of what we want from our life, and no real system to help us in achieving it.

WiseWealth will help you to realize your personal and financial GOALS. By developing a clear plan (+ continuous planning) we will provide you with the structure to help you achieve what you really want from your life.

All this & more at very affordable fees.

WHOM

WiseWealth service is for people who understand the importance of comprehensive financial planning but still not able to commit to full process due to paucity of time. People who need a coach to guide them & people who understand that they do not aim to be next Warren Buffett but still want to achieve their goals with peace of mind.

WHAT

WiseWealth clients receive more than a plan and advanced planning tools to achieve their GOALS. They get something that maybe even more valuable: guidance, accountability, and help at every turn.

Key Features

WiseWealth Can Answer…

|

Investment Strategy

|

HOW

If you decide to work with us, we’ll breakdown WiseWealth into two parts – Wealth-Health Checkup and WisePlanning (ongoing advice and monitoring). Let’s start with stage one.

STAGE 1 – Wealth-Health Checkup

When was the last time you had a financial health checkup? To get to where you want to be, it’s important to know where you are now.

- Risk Profiling through the psychometric test (Risk Appetite)

- Networth & Asset Allocation Analysis

- Risk Analysis – Risk Tolerance Vs Risk Capacity Vs Risk Taken

- Short Term Goal Achievement Test

- Mutual Fund Review & Detailed Report

- BONUS 2020 – Creating a Basic Plan for Long Term Goals (this is available for people who are availing WiseWealth service this year)

Steps: Wealth-Health Checkup

- You pay the fees

- We share information that we require & risk profiling link

- You provide details

- We analyze & create reports

- We send reports & discuss with you over the phone

Upon completion of this assessment, we’ll know if you have any risk factors to be aware of. Risk factors are behavioral/financial factors that you and your advisor need to be mindful of in order to help position your financial plan for success.

STAGE 2 – WisePlanning

If you like taking the collaborative approach with your planning, and you don’t want to manage your own investments, we will offer you WisePlanning at no extra cost. (we earn on investments similar to any other advisor or banker – this takes care of investment advice & continuous support)

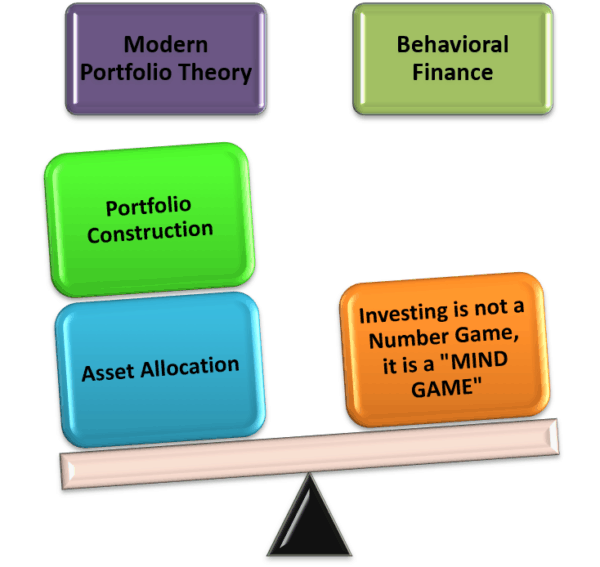

Plans are worthless but the process of planning is vital. A plan assumes that you know what’s going to happen – even though you don’t. By contrast, planning in its truest sense is a reality-based process that allows for life’s unpredictability. I think this image can help you in understanding…

Steps: WisePlanning

- Investment Portfolio Setup

- Creating a Basic Plan for Long Term Goals (Stage 1 – Bonus 2020)

- Support in implementation

- Regular investment monitoring & review

- Follow-up meeting every 3-4 months to check your investment & plan progress

- Availability of qualified Planner – who you can reach out to via phone, email or WhatsApp as your situation changes.

WiseWealth clients will also enjoy access to their customized dashboards to see everything at a glance. We call it your FundSketch, and it provides you with a place that you can access anytime, anywhere, to check out everything that’s going on in your financial life.

Fees: Onetime fees of Rs 7,500 + 18% GST = Rs 8,850 (For first 20 clients in 2020 – we are absorbing GST, so your Fees will be Rs 7,500/-)