The recent demonetization drive has also made people look for alternate methods of doing business. It has made people aware that there are cashless methods to conduct transactions as well. In this context let us look at UPI – which looks better than many existing solutions.

Let’s move towards CashLess society or at least LessCash society.

Image courtesy of tungphoto at FreeDigitalPhotos.net

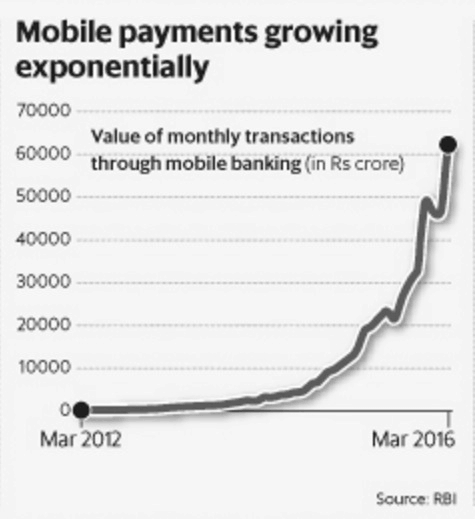

The graph below shows the tremendous rise in the usage of mobile phones for money transactions in India.

1) What is UPI?

The National Payments Corporation of India (NPCI) has introduced Unified Payments Interface (UPI) along with the RBI and Indian Banks Association.

UPI is a technology that facilitates immediate transfer of funds from one entity to another through smartphones. You can facilitate transfer of money without cash in hand or a debit card or credit card either between people, between two organizations or between a person and an organization.

2) Oh! So it is yet another payment method just like NEFT or IMPS or RTGS?

Yes it is another payment method. The technology is somewhat similar. But UPI is different in many ways. You can pay directly from your bank account to any person or entity without any steps like typing card details, net banking credentials or e-wallet login details. It is very easy to conduct transactions using UPI compared to other methods.

3) How safe is it then?

UPI is a safe transaction method. There will be a 2 factor authentication – Virtual ID and the M-PIN number which is a constant. The transaction will be encrypted.

4) How is UPI different from other payment methods?

For online transactions using cards, you need to remember and type in a lot of details like card number, expiry date, CVV number, OTP etc. UPI is simpler as you will have to enter only the M-PIN for transactions, once your account is registered.

E-wallets are specific and non centralized in nature. For example, if you have Paytm or FreeCharge in your phone and want to pay using it but the merchant or seller does not have it, you cannot use it. You need to load funds in the e wallets regularly. On the other hand UPI is centralized. It can be used across banks and merchants. It is connected to your bank account, so it need not be refilled with money.

In NEFT payments, bank details are required. There are restrictions related to non-banking hours, holidays etc. RTGS has a transaction limit where the minimum amount has to be Rs. 2,00,000. It also has restrictions regarding service hours. Charges range from Rs. 25 to Rs. 50 excluding service tax. There are no such issues in UPI transactions. They can be done 24×7 all through the year. Charges for NEFT transactions range from Rs. 2.50 to Rs. 50 plus service tax depending on transaction amount. UPI can be used for amount up to Rs. 1,00,000 and the charge is supposed to be around Rs. 0.50 per transaction but right now its free.

IMPS and UPI are pretty much similar. UPI is sort of built on the IMPS architecture. IMPS and UPI require registration before use. But registration of UPI is faster and immediate compared to IMPS. In IMPS only push transactions are allowed. In UPI, pull and push transactions are allowed. What does this mean? For example, your neighbour has borrowed money from you and you want it back. You send a request for payment to him through UPI. If he approves it, you will get your money immediately in your bank account. For IMPS, you have different MMIDs for different bank accounts. In UPI, you have one virtual ID that can be linked to different accounts making UPI transactions simpler. IMPS can be used for higher amounts provided you use IFSC code and account number. UPI can be used for transactions amounting up to Rs. 1,00,000.

5) How do I get UPI and start using it? (Max 2 mins)

- UPI works on smartphone technology. You need a smartphone and the UPI application of any of the banks offering UPI transactions downloaded on your smartphone or any other UPI app like Trupay powered by some bank.

- You download the UPI application of any bank (it’s not compulsory that it should be only of your bank – if your bank is HDFC but you can still use SBI app).

- Register your details, a PIN and a virtual address. An example of a virtual address could be <YourMobileNumber@Bank> or <abc@bank>

- Add the bank accounts that should be linked to this address.

- You will get a notification if you have a MPIN or not. If you do not have it, you can create one either within the UPI app or using the bank website.

- Your UPI account is set up.

This id can then be used for money transactions. For example, you need to pay for the taxi company for the service you availed. You give your virtual address to the taxi driver. He will input the same in his UPI application and request for the taxi fare. You will get a message requesting for authentication. Once you confirm, the money will be transferred to the taxi company. You do not need to carry cash or card. The transaction is immediate.

Currently 31 banks are offering UPI transactions – most of the major banks. The bank accounts should be in one of these banks for the transactions to be successful.

6) Why should I sign up for one more payment method?

UPI is a secure and hassle free way to transfer money. You can pay your bills, pay for online shopping and pay for your purchases using UPI. There are no steps like waiting for the OTP message or remembering the IFSC code or remembering answers to security questions set up 5 years back like you have to do in net banking transactions. And your banking details will not be shared with other entity.

It is a step towards a cashless economy. A cashless economy restricts number of black money transactions, tax evasion cases. It also provides for a transaction trail which is helpful to find out criminal activities if any. UPI is a great tool after demonetization drive. People had a shortage of cash but UPI could be used to continue business.

UPI provides security as you need not have a lot of cash at home or in your office. There is lesser chance of loss or theft of cash and cards. Adopting UPI will make transactions smoother for people across India be it large or small payments.

7) How do I use UPI to receive payments if I am a merchant?

You can create use any of the bank application and request money by inputting customer’s Virtual ID. Or you may use Trupay like platform where you can register yourself as merchant and request payment by only using customer’s mobile no. The request will go to customer’s phone and he can approve the payment by only inputting MPIN.

8) How do I use UPI to make payments to merchants?

You may use any of bank UPI application to send payments to merchant’s Virtual ID. If merchant does not have a VPA, you may still make payments to him in his bank account using Trupay application without going through the pain of net-banking add beneficiary process. Money moves immediately into the bank account of merchant.

Do you use cashless transaction options or do you prefer to transact in cash? If you use cashless options, we will be interested to know your favorite payment method.

Thanks a lot Sir, for Sharing such a valuable information . i rally appreciate your efforts for making awareness to UPI.

Thank u ,,, Hemanth. Very use full article and information..

In India to motivate people ( whether one wants to receive or pay money) the transaction charges should go or least

People don’t know comparative data on it – sadly everything is in fine print – not clearly said

Highly informative.I am thankful to you.

Thanks a lot for the valuable info on UPI.Its an eye opener for “me type guys” who always have a fear of hackers.

I just want to kno onething….If i have an ACCOUNT and VPA of ICICI bank……can i link SBI account in that VPA id of ICICI? as Its there in the BHIM app.

pls clarify

I am a mom looking to talk.

Comments are closed.