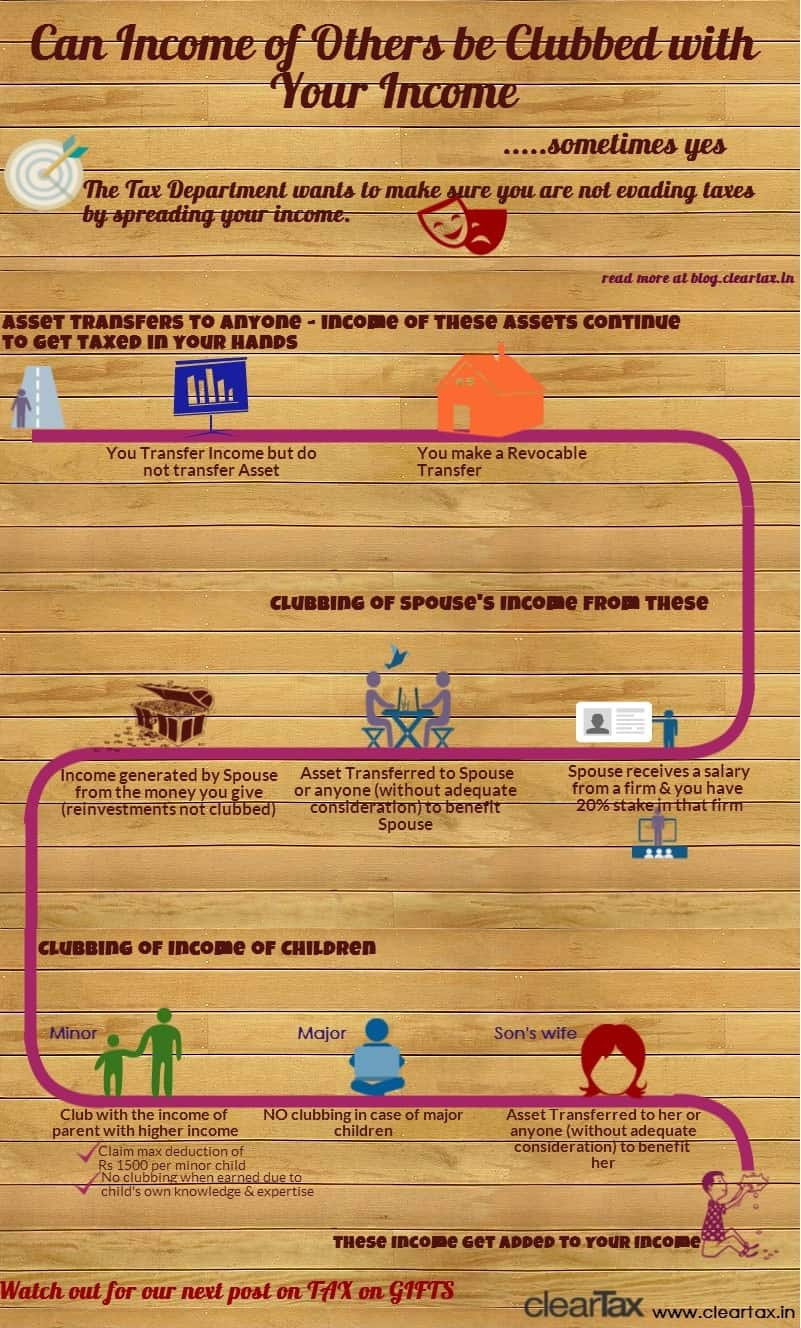

Many times you transfer assets to a relative like parent or wife or buy assets for a relative especially non-earning family members in their name with your money. This is done either for emotional purposes, providing financial stability to the relative or to save some tax liability. In certain cases, when this asset earns income, you are liable to pay tax on it. This income is clubbed with your other sources of income. (Income Tax Section 60 to 64) Similarly if the asset incurs loss, the loss is also clubbed with your income to calculate your income tax.

Let us look at the situations that are considered as clubbing of income as per the Income Tax Act –

- You are allowed to transfer an asset to your spouse. If this asset earns income, it will be clubbed to your income while computing income tax and you are liable to pay it.

- You can transfer an asset to your child (own legitimate child/ adopted child). You are liable to pay tax on income accrued on this asset. If the parents are divorced, then the income is clubbed with the income of the parent who has custody of the minor child.

- If you transfer an asset to your son’s wife, and there is income earned, that amount is required to be clubbed with your income and you should pay tax on it.

- You can invest in assets in your spouse’s name. For example, you can buy shares or invest in Mutual funds in your spouse’s name. The income earned from these assets needs to be clubbed with your income while filing Tax Returns.

- If you transfer income to another person, this income will be included in your income and be computed for tax liability.

- If you have property in your name and convert it to HUF (Hindu Undivided Family) property, then income earned from this property is to be clubbed with your income for tax computation.

Source: www.ClearTax.in

Still looking for ways to save tax?

There are some other ways in which you can reduce your tax liability –

- If you transfer an asset to your parents or siblings, the provision of clubbing income does not arise and you do not have tax liability on the income earned on this asset.

- If you invest in instruments like PPF, life insurance for your spouse and/ or children, your income is eligible for tax deduction under Section 80 C and 80 D of Income Tax Act.

- If you buy health insurance for your parents, you are eligible for tax deduction.

- You can also invest in PPF and Senior Citizens’ Savings Scheme in your parents’ name. You will not be eligible for tax deduction but your money will earn tax-free interest.

- You can gift money to your spouse, siblings or adult children who can invest in PPF. You will again not be eligible for tax deduction but your money will earn tax-free returns.

- Gifts given before marriage to would-be spouse is not considered in clubbing of income.

- Cross Gifts which means you give your brother’s children gifts and he gives your children gifts. Such transfer is also not included in the giver’s income. (this may be counted in tax evasion)

If you would like to read this topic in detail – check this

Blunders people make: I have seen lot of people who invest in the name of spouse or kid but don’t show that in ITR – someday that may land them in tax scrutiny & penalties.

Have you considered clubbing your income provisions? Do ensure that you keep the above mentioned points in mind so that you do not break any laws of the Income Tax Act.

Sir, Thank you very much for the informative article.

Hemant- If I buy a property jointly with my wife, & she is first holder. Payment goes 50% from my account 50% from her account.

What will be tax implications on income earned from such property?

Raghvendra,

Any income from this property will be distributed in ration of ownership. So if there is 50% ownership then the income will be equally divided.

So Vikas, how does ownership ratio gets divided for jointly owned property?

Is is basis on how much each owner pays while buying or based on registry?

Hi ,

my CA had advised me to transfer XX amt per month to my spouse as household expenditure .. if she shaves a part of that and invests , then it would not be clubbed under my IT , but she wud have to file tax return .. have not yet started this though ..

Is that correct ? is there a XX amount that is considered reasonable /acceptable as per IT ?

Jayanth,

If you transfer a certain amount to your spouse on a regular basis and if she invest and earns any income on this amount, it will be clubbed with your income.

I could not understand then how to give regular sum to parents or wife or anybody?

There must be a solution to this. Else how can one compensate the sacrifices made by parents or any family memebr like brother/sister/wife etc?

Should they show it as a debt and debt repayment?

Ramadevi,

Giving regular sum to your parents or wife for regular expenses is not an issue. But there are tax implications on transferring larger amounts without any consideration and if the money is invested by spouse. You can seek guidance of a tax expert on your specific situation.

Hope I am not exceeding the “free advice” limit. One small clarification.

“Giving regular sum to your parents or wife for regular expenses is not an issue” If parents are in a different place and the son/daughter is in a different place with his/her own family, how can a regular income be given for expenses? Many times mothers /sisters or grand parents sell their gold and help to pursue higher studies. How can that be repaid? If one repays, and the othr person invests in something??? My question is, it is a sort of unofficial hand loan which is repaid. How to reflect that so that this tax implication can be avoided

Ramadevi,

When money is received from close relatives then gifting is the most viable provision available to ensure you can show the source of money. For cash or movable items a gift deed is not neccessary and a transfer through banks can ensure the legalities. But as i have stated earlier there are clubbing provisions in come cases if money is further invested.

In case of borrowed money, if on interest, making some documents may prove beneficial otherwise the repayment through bank transfer should reflect the loan repayment to the concerned relative.

These are my views and a tax expert will be able to answer your queries more efficiently.

Very good and enlightening article. Thank you.

If I make PPF payment in my grand child’s account , is it allowable by Income Tax.

I make payment in PPF a/c of my grand child and I do not claim for 80C then is it allowable to deposit PPF amount in my grand child’s a/c.

What happens at the time of maturity.

Does it amount to Gift? Have I to declare in IT return?

Thanks

Lopa,

You can contribute in your grandson PPF account only if you are his guardian. If parents are alive and operating his account then you won’t be able to invest in his PPF account. However, you can gift the amount to your grandson.

If I transfer money to my sister in a year, which is a huge amount say around 1-2 lakh. Is it still taxable? While filing returns do I have to submit any proofs for that?

Ashutosh,

Brother and Sister relationship comes under specified relatives and so gift tax is exempted for your sister. If you have paid your tax liability on your income then you don’t have to show it again in your ITR. But your sister will have to show it if her income goes beyond the basic exemption limit.

Hi I have querry regarding one method of income spreading –

I have one share trading account in my name and other in my major child’s name. Child has some income of his own but not in taxable range. I am in highest income slab.

I have occured some speculative gain in F&O. I transfer some of this gain to my child’s trading account by doing pair trading in which I occur loss and my child gain. Is it a legal way of spreading income? If it is illegal then under which clause?

Thanks

P K Agarwal,

Your query can be best answered by a good tax expert as it is related to legality of transactions in equity trading.

Dear Hemant,

I would like to ask a query. I am a salaried person and If my wife is not working but maintaining a ELSS a/c. So can i get Tax benefit for myself.

Thanks

Regards

manoj

Manoj,

You cannot claim tax exemption or benefit by investing in ELSS on your wife name. The investment should be in your name.

I am a retired person.I have made short term capital gain in share market.But my total income is less than taxable limit.Shall I have to pay income tax on the ST capital gain amount?

Aloke,

The income tax on short term capital gains from shares is fixed at 15% and not added to your income much like others. Thus this tax is irrespective of your personal income tax slab . However, if your other income excluding the short term capital gains is below the exemption limit then you may be able to take the benefit while calculating your tax liability.

You should consult a tax expert for a detail clarification.

Hi Hemant,

I gifted cash amount to my wife who is a private tutor. She files her ITR even though her income is below the taxable income. This cash will appear in whose ITR and who will show the investment returns from this cash income in during tax filing?

Abhishek,

The cash amount is the money received by your spouse and so will come under her income. But the mount will be tax exempted. In my view since your wife is filing her ITR as a working spouse the investment returns will add to her income.

But do take view of a tax expert.

Abhishek,

Some clarifictaion..

As stated earlier the cash transfer will be tax exempted for your spouse since the relationship falls under the definition of specified relative under Gift Tax Provision. But if there is any income earned on investing the money, then it may be added to your income as per Income Tax Clubbing Clause. However, there are certain conditions where the clubbing rule does not apply which is before marriage, on seperation, Karta of HUF gifting co-parcenary property to his wife or spouse acquiring property through the pin money (i.e. money given an allowance for household purchase).

Do consult a good tax expert to get a clear picture on tax exemption of the investment returns in your situation.

Hi

I have invested 10 lacks in my wife’s name last yr and received around one lakh interest on it. This is reflected in her 26AS and some TDS also deducted.

She has other incomes also.She used to work before and has FDs on her name . All other FDs are her own money which she earned before. Can I declare the interest income which I deposited in her account without clubbing or declaring her PAN ?

Biswajit

Biswajit,

Clubbing of income provision is applicable in case of housewife. If your wife has been earning and has been filing her ITR then the income she receives from gifted money will be counted as her income.

For more clarity you can consult a tax expert.

If a child stay both father’s and mother’s custody individually for 6months and separation occurs between these parents, if the child earns any income then who will be the actual tax payer or what will be the process of this clubbing?

HI,

I HAVE MADE A SHORT TERM GAIN THIS FINANCIAL YEAR in MF,WHERE I HAVE BOOKED GAIN AND INVESTED PART AMOUNT IN MY

WIFE FOLIO?I HAVE MADE SOME SHORT TERM LOSSES,Can I SET THEM AGAINST THE GAIN WHICH I HAVE MADE In My Investment please advise?

My husband transferred some amount to my bank account which accrued Fixed deposit interest during the financial year. Now, my husband plans to club these interest income, accrued out of my FD , with his own income.

However, My form 26As reflects these deposit against my PAN number. Can I not file this FD income as a part of my income during the financial year ?

Will this lead to 26as mismatch, if i don’t declare this FD as part of my income ?

Sir,

Myself transferred 3 lakh Rps to my would be wife in the year 2014. We got married in march 2015. Now my question is whatever she earns through her FD in the year FY 2015-2016, is clubbed with my total income.

If yes, how can I show that clubbing amount and deducted TDS in my ITR.

Kindly advice.

Thanks

Dear Sir,

A flat was purchased in april 2014 For RS 3000000/-( thirty lacs only) in the name

of my wife and son by availing a loan of RS 1425000/-in their name.

registration cost was RS 281000/-

Total amount incurred for purchase was( RS 3000000/- +RS 281000/-)RS 3281000/-

An amt of RS 1856000/- (RS 3281000/- -RS 1425000/-) was funded by me and my elder brother by separate gift deeds.

The HL was closed by me on april 2016 from my retirement benifit.

Total interest on loan was RS 264000/- for 2 years. The said flat is proposed to be sold in january 2017 for an amt RS 3500000/-.

The sale price to be credited to my wife’s a/c jointly with me(2nd holder)

Q 1: is there any capital gain?

Q 2: who is taxable for the income generated on RS 3500000/-?

Kindly advise.

Thanking you

yours faithfully

Animesh Samanta

Hello!

I am looking to invest a large corpus in Equity Mutual Funds by using PAN number of one of my “immediate family” members, though I am not sure legally which scenario is the best to avoid clubbing.

I am in the 30% tax bracket, and so is my retired father. My retired mother is in the 20% tax bracket. My wife and mother in law are both housewives though.

I understand if i gift it to my wife, the interest from the MFs will get clubbed with my income. I am a wondering if my mother or mother-in-law will be good candidates?

Could you please suggest in what way can i gift the corpus to one of them, and not invoke the clubbing of income? Whom should i gift it to?

Amazing read. Loving this site, it has a lot of informative articles.

Wow! amazing information in this article. thanks for this post.

Comments are closed.