My view was that debate between ULIP Vs Mutual Fund was settled long back but I was wrong. 🙁

A few days back someone asked – Which is better ULIP or SIP? His banker told him that Ulip vs Mutual Fund + Term Insurance is a gimmick by mutual fund industry.

Now if someone depends on his banker for financial advice how anyone can help.

We always suggest don’t mix investment and insurance but let’s still check ULIP vs Mutual Fund comparison.

Note – Get Investor Behavior Tool from the end of this post, which is most important to manage your Mutual Funds or ULIP or any market related product.

What is ULIP?

Unit Linked Insurance Plans also known as ULIPs are insurance products that combine investment and protection against risk. A ULIP holder pays a periodic premium. Part of the premium is for life insurance and part of it is invested just like in a mutual fund scheme. This continues for many years.

The investor can choose the type of investment. Investment can be made in debt or equity or in both. The investor can choose depending on his/her risk profile and financial situation.

You can read about Mutual Fund Basics

ULIPs are neither 100% investment options nor 100% insurance schemes. They lie somewhere in between –

ULIP Vs Mutual Fund

Let us look at the difference between a mutual fund scheme and a ULIP –

| ULIPs | Mutual Fund Schemes |

| They are investment-cum-insurance products. ULIP investors are offered a sum assured of about 7 or 10 times the annual premium depending on the age and get the option of investing in a variety of investment products. | Mutual Fund Schemes are primarily investment products. Investors can invest in money market instruments, corporate bonds, Government bond and equity.

They do not provide insurance cover. (few exception Mutual Fund with Insurance) |

| ULIPs offer flexibility in investment options. You have the flexibility to switch from a debt oriented option to an equity-based plan. (switch without tax implication) | A mutual fund scheme usually follows a theme – Equity, Balanced or sectoral. The allocations are pre-decided up to a large extent. (switch but consider Mutual Fund Taxation) |

| The plan holder can withdraw money. There is usually a minimum withdrawal amount. But the value of the fund should also not fall below a pre-decided amount. There will be a charge.

A full withdrawal of the policy can be done before the maturity date subject to a surrender charge & in some cases tax. |

Different mutual funds have different exit methods. In many schemes, an exit load (fee) is charged if the investor withdraws within a specified period (usually a year).

Mutual funds are much more liquid in comparison to ULIPs.

|

| ULIP Investments can be used for Section 80C benefits in tax calculation.

Maturity receipts of ULIPs are considered to be tax exempt. |

Mutual Funds investments cannot be considered for Section 80C benefits in tax calculation except for ELSS funds.

Equity Funds – Capital gains tax is applicable if you withdraw within 1 year of investment. Post that, withdrawals are exempt from tax. Debt Funds – Withdrawals are taxed at income tax rate applicable to you if you withdraw within 3 years. Withdrawal after 3 years attracts a tax of 10% tax without indexation or 20% with indexation.

|

| There are many expenses which makes it costly – Premium Allocation Charges, Policy Administration Charges, Mortality Charges, Fund Management Charges and Surrender Charges. | Usually, there are three types of expenses – Transaction charges (one-time – if your bank or advisor charge), Fund management charges and Exit load. The exit load is only applicable if the investment is withdrawn before a specific period (usually 1 year) |

| Premium has to be paid regularly or as a lump sum. | Investments in Mutual Fund can be made anytime or in the form of regular SIP investments. Investment can be made only once also. |

Ulip vs Mutual Fund + Term Insurance

Many people still have the question of whether it is better to buy a ULIP (a combination of insurance and investment funds) or a Mutual Fund and a Term Plan. Let us look at how they compare with this example –

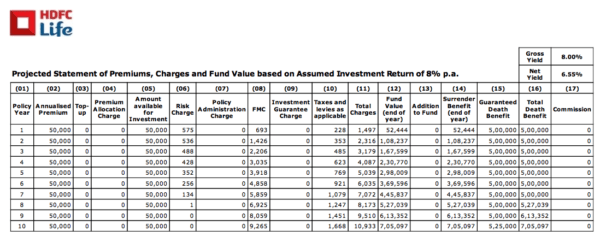

Mr. Rajiv Jain invests Rs. 50,000 for 5 years in HDFC Life Click2Invest ULIP plan for a tenure of 10 years. He has selected for the funds to be invested in a balanced fund.

| HDFC Life Click2Invest ULIP | |

| Total Premium Paid | Rs. 2,50,000 |

| Total Cost of ULIP Plan | Rs. 10,933 |

| Rate of Return on Investment | 8% p.a. (assumed) |

| Surrender Benefit at the end of 10 years | Rs. 7,05,097 |

| Death Benefit | Rs. 5,00,000 in the unfortunate case of his death in the first 9 years of the policy and

Rs. 5,25,000 in case of death in the 10th year of policy. |

Here is the illustration of ULIP this will be base of ulip vs mutual fund cost comparison-

Source

Investing in ULIP is good or bad?

ULIPs are better structured today than when they were introduced. But for an astute investor, it still makes better sense to invest in Mutual Funds and purchase a term plan. It is better to keep investment and insurance separate. You should consider the following factors before you make tour investment and insurance decisions –

- Selection of the appropriate mutual funds as per your risk profile

- Current insurance cover

- Number of Financial Dependents

- Investment goals and time horizon

My View – ULIP vs Mutual Fund for long term ?

Till this point, I don’t find any good reason to prefer ULIP over Mutual Fund. The kind of flexibility & choice that you can get in Mutual Fund is not available in ULIP. I feel still there’s room to reduce expenses – both in Mutual Funds & Ulips. The worst part about ULIP in my view is Commission Structure which is still front-loaded (more in initial years) so there’s no incentive for an agent to service & advice after initial years.

Finally, I think you would have got the answer – which is better ULIP or Mutual Fund India?

Now answer my simple question & you will get the tool to manage investor’s behavior. (It is scientifically proven that Investor behavior is the biggest factor when it comes to investment returns.)

Have you ever purchased a ULIP? If Yes, why? If Not, why?

Please, leave your answer below in the comment section.

You will receive the free PDF with Simple But Most Powerful Tool To Improve Investor Behaviour.

Hi Hemant,

Thanks for reminding me of my first financial mistake.

I got my first salary in 2007 & dad introduced me to his lic agent. He advised for a money back plan but I asked him to suggest some good ulip. So I can’t even blame anyone.

Hi Sachin,

It takes guts to accept mistakes. Really appreciate…

No I have never purchased any ULIP…I read it somewhere that ULIP is not better option….

Hi Piyush,

But you also have read at few other places it’s good. It’s important to understand principle our decision are based on.

Yes, I have invested in an ULIP – HDFC Young Star, which was started in 2008. At that point of time, I was taken in by the “flexibility factor”, where I felt that a number of options provided to me, gave me the freedom to re-balance my portfolio (the equity component), depending on the way the market was performing, at any point of time. I was also quite satisfied that the insurance part provided a certain stability to this investment, as it served the elusive goal of 2 in 1!!

However, I am convinced now that a MF with a pure term plan, works better in the long run.

Hi Japesh,

We all love 2 in 1 sounds like buy one get 2 🙂 Anyways, good that you have learned the lesson. It’s important to share this message with our friends.

Yes i had purchased a ulip based on advice from LIC agent.

But have sold off as advised by Mr financial planner.

we are ready to take this blame.. Haha 😉

I did not invest in ULIP , because I knew already that it will neither give good return as MF nor we can be insured sufficiently as in TERM PLAN.

A JAYAKUMAR

Great Jaya 🙂

Yes, one of my earlier financial mistakes. My father’s friend convinced my father and me to take a SBI Life Flexiprotect Fund policy in 2009, when the Sensex was around 9k.

The premium was 50k per year x 3 years, and I’d get tax benefits !! It will mature in 2019 after 10 years.

Having paid 150k, the current fund value is 218k (1.45 times my investment only), with the Sensex having risen 3.6 times in this period.

Since only 2 years are left, I’ll complete the tenure and then surrender the policy.

Hi Koustubh,

It’s still low but I think that’s not the right comparison because you have invested over a period of time.

Hi

I am a follower of your blog since I have started to earn money. Till date, I have invested in mutual funds, stocks and bonds but never ‘invested’ in ULIP or any other insurance product. As of now, I don’t have any dependant, so not purchased any term plan yet.

In near future also, I don’t have any intention of buying any ULIP or Money back product.

Thank you for your articles,

Sayan Kundu

Thanks Sayan – hope you are enjoying your journey with TFL 🙂

Agree with the article in principle. However, for the calculations, would have been a better idea to consider 12% as the rate of return for mutual fund. Also focus more on the lower insurance cover in ULIP plan vs TERM plan and the higher commissions generally (if that is still the case) in case of ULIPs

Good Idea Anand – will update numbers according to your suggestion. Thanks.

Yes I have made the grave mistake of investing in an ULIP, SBI LIFE SMART WEALTH BUILDER. I have paid only 1 instalment of 50k. I have decided not to pay any other instalment . I needed to pay 4 more instalments before I can get my money back since lock-in period is 5 yrs.

I had opted for 80:20 ratio for debt: equity investment. Hope market does well and I can get my 50k back.

Can anyone tell me if there is any way to get my money, whatever amount may be , before the lock-in period ??

Hi Sangram,

I am afraid – you will not get benefits of the equity market. They are going to give you saving bank interest for this. Please have a word with SBI guys.

Not bought ULIP in real sense.

But did buy UNIT LINKED SINGLE PREMIUM WITH TOP UP FACILITY PENSION PLAN also called as ULPP from HDFC STUD LIFE.

As small part of Retirement Portfolio it has worked well.

Will recommend to have 20% of Retirement folio in such plans.

Hi Rajnikant,

But how it is better than MF or NPS?

there was no NPS then in 2004,so no comparison as on that date.

i was wise to select single premium with top up because there is only 2% commison involved,it was bit difficult not to be impressed for many other ULIPS offered.My options balanced managed & defensively managed did perform well,returns point of view ,they did not lag behind much.overall expense ratio was just minimal.

i have converted full amount to annuity with return of purchase price so on my death my heirs stand to get something.

yes,now NPS & MUTUAL FUNDS WILL BE MORE WISE OPTION

Great 🙂

Yes, I had invested in ULIP i.e. ICICI Pru Life. Started with Rs 20k annual premium in 2004, followed by two more installments of 20k each in 05 and 06. So total 60K investment in three years.

Recently, i.e. in Sept 2017 I liquidated that Policy and got returns Rs 1.98 Lacs, with Life coverage for Rs 2.0Lacs thruout.

My observation is, if one can remain long invested, the returns are quite OK.

ULIPS could be meaningful, if age of Life ensured is not much (i.e. if you want to cover your Son/daughter/or self in early age of 21-30 years at beginning of Policy) to minimise insurance related loading, and then have a policy horizon of 15-20 years maturation (longterm) when it keeps multiplying.

Hi Ashok,

Thanks for sharing this.

Did buy HDFC Young Star in 2004. But exited in 2013 after comparing the performance with respect to MF schemes during the same period.

MF+Term Insurance is always better. I had prepared detailed comparison figures to prove my point and sent to many websites but no one published!!!!

Hi Gopalan,

You can email me comparison – I will check.

I had the complete file but I am not able to trace it. Now I tried to make the same for the period 2007 to 2017. Please see.

ULIPS

Sl# Name 01.04.2007 01.04.2017 RETURN PT TO PT

1 HDFC YOUNG STAR GROWTH 52.023 148.9546 186.3245103

2 HDFC YOUNG STAR EQUITY MANAGED 43.624 130.0835 198.1925087

3 ICICI LTS PENSION MAXIMISER SERVICE NOT AVL AT THE TIME OF CHECKING

4 ICICI LTS PENSION FLEXI THE WEBSITE on 19.11.2017 @ 19:15 HOURS

Actual return is lesser than the pt to pt return because of mortality charges,policy admn fee& service tax thereon

MFS RETURN PT TO PT

5 HDFC EQUITY GROWTH 136.747 550.489 302.5602024

6 HDFC TOP 200 GROWTH 100.01 405.429 305.3884612

7 ICICI PRU DYNAMIC GROWTH 60.3357 230.7557 282.4530087

8 ICICI PRU DISCOVERY GROWTH 23.7 131.28 453.9240506

9 ICICI PRU TOP 100 85.15 292.49 243.4997064

This is the actual return for the investor. In Direct plans the return will be still higher

Dear Hemant,

Firstly let me thank you for the wonderful knowledge base you’ve created for everyone. I’ve read many articles and found them to be very useful.

Let me ask you the question I’ve had for quite some time now:

I’m invested in a ULIP which matures in 2022. I had started it in Jan 2012. I was expected to pay annual premiums for first 5 yrs only which I have already done. In 2022, I’m expected to either take away entire fund value as lump sum or give Standing Instructions to be able to withdraw the fund value in installments over the next 5 yrs.

As it stands today, my investment spread over equity funds (>90%) and debt funds (<10%) that are available as part of the ULIP, is currently earning rate of return (CI) of 11%. Absolute increase is 49%. I’ve been managing asset allocation on my own so far. I'm 40 yrs old. Note, I cannot change asset allocation once policy matures.

1. At maturity, should I withdraw entire fund value or portions of it only? I don’t foresee a need in 2022 to withdraw a lump sum. If in parts, should I withdraw monthly, quarterly, annually etc?

2. At maturity should I leave asset allocation as is so it may have a high chance to earn good returns? OR Should I start moving assets from equity portion to debt portion? If yes then to ensure that

a. my entire fund value at time of withdrawal attracts zero or least tax and

b. my investment is safe from market volatility

, when should I start so as to complete the entire movement prior to maturity?

Appreciate your responses and any other strategic advice. Please let me know if you have any questions before you are able to answer mine ?

Thanks

Anand

Hi Hemant,

Appreciate if you can respond to my query dated 11th Nov.

Thanks

Anand

Hi Anand,

I read this earlier but not sure how to reply. Sorry but I need your complete financial life details to suggest you anything. I will suggest you consult a good Financial Planner in your area.

Sorry for disappointing you 🙁

I don’t buy ULIP because of there charges is too high so. My investment in MF .

This Insurance Industry can still be saved if front loading is removed. It was the same case with Mutual Funds until front loading was removed.

Hello,

Thank you very much for valuable information you provide here.

My father’s friend had got me into “Bajaj Allaianz Future Wealth Gain” Ulip plan, in July 2017.

Premium is 3 lac per annum, for 5 years, term is 20 year, sum insured 30 lac.

One of reason to go for such high premium amount said that there was no allocation charge for 3 lac premium.

It’s been few months, I am skeptical about this investment. Wht should i do? Should surrender it after 5 years?

In case you decide to keep the ULIP, ensure all your fund value sits in pure equity plans (~90%) that are under this ULIP, for the last but 3 yrs of the run. As you get closer to maturity, move systematically (in parts) your funds to hybrid / balanced plan (<65% equity) to debt plan (<10% equity). Eventually at the end of your run, all your fund value should sit in debt. You should make good returns with this strategy. In the middle years, do not make the mistake of moving funds between equity to debt and vice versa. This will cost your dearly. Have a pleasant run.

It is better not to mix two objectives in one scheme. It leaves scope for manipulation of return.

Dear Hemant

Very prudent advice. though I have already committed the mistake of investing in an sbilife child plan (equity optimizer) but however for a lower premium of 1300 pm started in 2009. Thanks.

Yes.. I have bought a ULIP Plan (Max Life Fast Track Super) for my wife on the advice of a banker. But somehow he tactically did not mention that it is ULIP. If I had heard that word, I may not have gone for that. Now is it advisable to stop paying the premium?

Regards

Sudhir

No. I always have gone with Term Insurance + MF

Yes I had purchase ULIP, HDFC Crest in 2010 with 50k premium, premiumpaid for 5 years. It will mature in 2020. I have invested 250k & present value is 503k. Risk cover is 5 lacs.

I think it’s not bad. Since last 4 years I am investing in mutual funds & will continue to do so.

Regards

Indrajeet Singh

Hi Hemant,

Glad this topic surfaced once again…. sometimes ago, I did post my comments on this for which I expected some comments from you, unfortunately that didn’t happen.

While DECLARING MFs to be superior to ULIP, how do we explain the expense structure. We all know MFs have FMC going upto 2.55% of FV which in case of ULIPs is capped at 1.35%. This makes certain ULIPs very attractive over MFs, like click 2 Invest.

My experience with MF portfolio and ULIPs over last 7 years has convinced me, if used sensibaly, ULIPs can prove to be superior to MFs (conditions apply).

Looking forward to expert comments from Hemant please…

Thanks for Your Views Vilas. Fund Management is not the only charge – you will still find premium allocation & policy administration charges. If we are comparing click 2 invest – it will be better if you look at the expense ratio of direct mutual funds. I have also mentioned in the post that scope of expenses reduction is there.

Leave alone all the charges. Even with the stated claim of low fund management charges, the returns on the NAV of the schemes of the ULIP (Actual return will further reduce for ULIP when other charges are accounted) are way below the returns on the NAV of good Equity Mutual Fund schemes even with the higher expense structure.

I had given the comparison in one of my earlier comment and mailed to Hemantji for his expert comments.

Hi Hemanth,

Right article at right time useful for one of my financial product!! Nice!!

Recently last month I have taken HDFC Sampoorn Nivesh ULIP plan with Premoum of 1lack by mistakenly (somehow he tactically did not mention that it is ULIP. If I had heard that word, I may not have gone for that) and then after that I have realized that I am putting investment in wrong place then immediately I have called to that person and told him that I am not going ahead with this ULIP plan and will cancel the same in Free look period once I receive the original policy document.

After that I have received original policy document 2 days back i.e. On 13th Nov 17 and then I have approached nearest HDFC life branch office and filled Free look cancellation form and submitted back to HDFC for cancellation of same.

Now actual story started, I have started getting calls from that person and forcing me to continue in ULIP policy as it is going to give good returns compared to MF and some bla blaa blaa.. and also if I cancel this ULIP in free look period then it will be bad remark to that person in his career so he don’t want to cancel the policy and continue at least for one year, decide 2nd year based on the performance of fund whether to go ahead with 2nd/3rd/4th year or not.

So, please suggest your opinion on above points for better understanding,

1. Will I get my complete premium amount back or are there any charges they will deduct?

2. If yes, what are those charges?

3. What will happened if pay for 1st year and left it without paying further 4 years premiums?

4. Is it really create that much impact to the sales person on cancellation of ULIPs as he is trying to convince like anything to continue?

But I clearly told him that I will not continue at any cost in ULIP to make it clear.

Please suggest.

Hi Nihal,

They will deduct a very nominal amount for mortality charges – 15 days.

The way you mentioned this product was mis-sold – you should use freelook period without thinking about salesperson.

I will also add this comment to the post – so other readers can learn.

No

I had purchased a ULIP- Life Stage Assurance Policy from ICICI Pru – paid 84 monthly installments of Rs 5000 and woke up to the reality , that I could have been better of with SIP’s for same amount. Even a debt fund SIP would have given me much better returns !!!. Costly way to learn a lesson!! I surrendered the policy and invested the Lumpsum in Birla Sunlife Balanced 95 Fund.Now I am relieved.

I have never invested, i’m 32.Today a Bank Person advised me to Take HDFC progrowth, after which i searched n found it to be a ULIP. Needs financial assisstance to start investing in mutual funds

Hi Hemant,

Thanks for providing an ocean of financial knowledge to all of us. Its really awesome.

No, I have never invested in ULIP’s, neither I advise the clients to do so. The primary reason, I feel is levying of so many charges, including mortality, which leads to less money getting actually invested, thereby lower growth ratio. The other reason is the expert’s ideology (as you also highlighted) of keeping investments and insurance separate.

Great Anuj ?

Hi Hemant,

Thanks a lot for enlightening our minds with the wisdom.

Coming to the question if I have ever invested in ULIP Plan ? No never and I have never even suggested any of keens for this. Reason- In this world of uncertainties what counts most is liquidity. One should always prepare oneself for any financial urgency.I would rather invest in some open-ended MF with term plan and monitor the same from time to time.

Cheers!

Subrato Bhakat

Hi Hemant.

I am 55 yrs old and unemployed person,having lost my pvt. services as I undergone a major accident.I do not have liabilities,& have risk cover to dependent wife from LIC.If I withdraw total surrender values from lic (Jeevan saral where no vested bonus is available to a seven years premiums paid policy holder) I can get nine lacs right now,but will loose risk cover.(also 30% of invested amount will refunded less as per IRDA rules)

Now I want to get pension till survival of me and my spouse.

If I surrender the lic policies,I will get nine lacs. Also the interest rates of banks have declined. I am in trouble,and need atleast 10k /month to survive.Kindly suggest any suitable & low risk plan to get mly. pension .

Which path is suitable to invest?

1) Mutual fund SWP

2) Mutual fund MIP

3) Immediate annuity plan of LIC like Jeevan Akshay VI

Kindly note, I don’t want return of purchase price to any nominee.I want 100% pension till survival of me and my wife.I aam free from other liabilities.Aalso I need immediate pension.

Hi Hemant,

I bought my ULIP plan just for a tax saving as suggested by one of my friend. I realised my mistake when I actually started doing my financial planning.

Now I have Mutual fund and Term plan separatly.

I have already subscribed your article and hope for a better financial planning in coming future.

Thanks for this nice article!!

Hi Hemant,

I bought my ULIP plan just for a tax saving as suggested by one of my friend. I realised my mistake when I actually started doing my financial planning.

Now I have Mutual fund and Term plan separatly.

I have already subscribed your article and hope for a better financial planning in coming future.

Thanks for this nice article!!

Thanks Mr Hemant,

For open my eyes to understand about the difference between investment & insurance.

I have mixed both together & wasting money.

It’s very lovely information on ulip vs Mutual fund. Nice work, Keep sharing. I Look forward to read more.

Thanks 🙂

Hello sir, never invested in ULIP because i was not sure about investment in market as a whole. So have term plan. After going through some coveted blogs decided to start SIP in MF shortly.

As of today, when mutual funds (LTCG) are taxed 10% (above 1 lakh per year) do ULIPs now makes any sense or it is still not worth looking at?

Comments are closed.