The launch of the Sukanya Samriddhi Yojana account (सुकन्या समृद्धि योजना ) was part of the ‘Beti Bachao Beti Pada’ campaign launched by the government. It is a Small Savings Special deposit Scheme for the girl child. It’s not just other schemes to provide social benefits but a good long-term debt investment. It is designed in a way to support her higher education and/or marriage.

Must Check – Child Future Plan – Complete Guide

Key features of Sukanya Samriddhi Yojana Account

| Definition | · The Sukanya Samriddhi account is a savings account that can be opened in the name of a girl child from the time she is born till she becomes 10 years old. It can be opened in a post office or public sector bank like SBI, Bank of Baroda, ICICI, etc. |

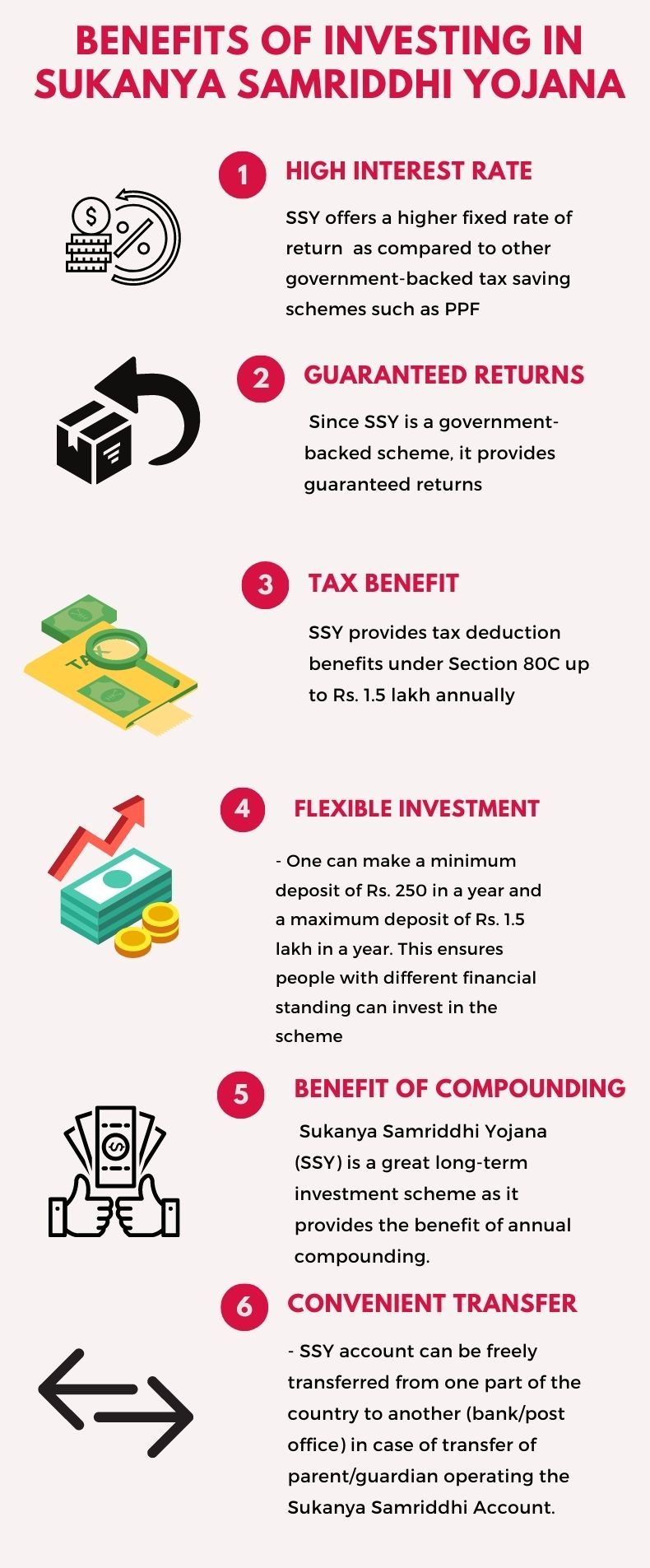

| Deposit Rules | · Sukanya samridhi yojna account can be opened with a minimum amount of Rs. 250 and a maximum of Rs. 1,50,000 in a financial year. One can deposit money for 15 years from the date of account opening. Deposits in multiples of hundred can be made in form of cash, cheque or demand draft by guardians or parents. |

| Interest Rate | · For the financial year, 2021-22, the interest rate is set at 7.6% p.a. (TAX-FREE) It will be decided every year. Interest will be compounded annually. |

| Other Benefits and Features | · 50% of the fund can be withdrawn prematurely if the need arises after the girl turns 18.

If the girl shifts to a different place in India, the account can be transferred · The account will mature after 21 years from the date of opening the account. The account can be continued till the girl’s marriage if some formalities are completed. · Under section 80C, one can get a tax benefit on deposit in this account up to a sum of Rs. 1,50,000. · When the girl becomes 10 years old, she can operate the account on her own. But deposits can be made only by the guardian or parents. · Premature closure of Sukanya Samridhi yojna account is possible in case of the girl’s death. The amount with interest will be paid to the guardian/parent of the child. |

Drawbacks of Sukanya Samriddhi Scheme

- A penalty of Rs. 50 per year is charged if one fails to deposit in a year.

- One family can open only 2 accounts even if there are more than 2 girls in the family unless there are more than 2 births at 1 time in which case, accounts for all the girl children born at the same time can be opened.

- The interest rate will be determined every year in sukanya samridhi account. Currently, it is tax-free.

- Interest rates can fluctuate.

* Please check complete details before opening the account.

Check –Retirement Planning Vs Child Future Planning

Sukanya Samridhi Yojana – from planning perspective

- First look at your asset allocation & then decide the amount that you would like to contribute

- If you know your long term goals – this scheme is much better than your FDs, RDs & other post office schemes

- If you are the one who invests in insurance child future plans – discontinue all that (get in touch with your agent/advisor) & add that amount here

- Start small & depending on cashflow & goals increase the amount in future

- Interest rates may come down in the future but you should not be worried about that – government will at least try to match inflation numbers on a yearly basis

- Only one account per Girl Child is allowed (max 2 girl child in the family)

- Illiquidity is both a plus & minus in Sukanya Samridhi – depends how you have planned your finances

- If we assume the average rate of interest that you will get in this account is 7.6% – then an investment of Rs 1 Lakh per year for 15 years (total investment 15 Lakh) can turn Rs 43,95,380.96 in 21 Years (assuming no withdrawal before that)

Download Sukanya Samridhi Yojna account – Download application form

You can also download the SSY New Account Application Form from the following sources:

- RBI Website

- The India Post Website

- Individual websites of public sector banks ( SBI, ICICI, PNB, BoB, etc)

Documentation required to open Sukanya Samriddhi Account

- Birth certificate of the girl

- Address proof

- Photo identity proof of the girl

- Photo identity proof of the parent/legal guardian

Should I invest in Sukanya Samriddhi Yojana?

Considering the woeful state of the girl child, the Sukanya Samriddhi Account is a good start to give her financial independence. It will not give returns like the equity market or mutual funds, but it is a less risky investment avenue. The current interest rate is also good. It may or may not be enough to save only in this scheme for marriage and education considering inflation but can be a part of one’s portfolio. It can be part of the debt investments. I haven’t opened the account yet but may be doing it in near future. (will prefer dealing with the nearest banks rather than post office)

Have you invested in Sukanya Samriddhi Yojana Account. Let us know your thoughts on this account. Must share this with your friends…

Hi Hemant,

It is a very good scheme implemented by Govt.. infact it is the best debt scheme in the Country better than EPF and PPF as you say. But it is completely unfair that this scheme is not available for male child. Why only for Female Child? This Country has got into a very bad habit of pleasing FEMINISM. From the govt. to media everyone is trying to please the Feminists and the Feminists keep on playing the victim cards for woman all the time there by taking away the male rights. From home loans to everything females get better benefits than men and still chants go on ki Beti Bachao. The reality of the country is completely different. 65000 males commit suicide every year as compared to 25000 females in the name of legal terrorism which is completely in favor of woman. This country needs GENDER EQUALITY NOT FEMINISM AND FOR GOD SAKE SAVE MALE CHILD.

Hi Manoj,

I think we should not consider this as another investment for everybody. This scheme is launched with a noble purpose, to save girl child in our country, to improve sex ratio and spread awareness. What would be the point of generalized scheme similar to PPF account again?

Yo, Let me guess, you have a male child fun apart, no body is equal in this country when there are so many reservations still prevailing. Let’s support the “beti bachavo” yojan. We need a change in mind set, nothing else will work for our society. Good luck, Mother India.. Jai hind!

fun apart, no body is equal in this country when there are so many reservations still prevailing. Let’s support the “beti bachavo” yojan. We need a change in mind set, nothing else will work for our society. Good luck, Mother India.. Jai hind!

Hi,

You have mentioned that ” On maturity, the maturity amount and interest are taxable” but it seems otherwise, i.e. the interest and withdrawal are non-taxable.

Can you pl re-confirm.

Regards,

Chandra

Hi Chandra,

Thanks for highlighting that – made that change. Actually I wrote this article before budget but as there was no clarity on taxation – waited for the same & posted today.

Hello Hemant,

The taxation rule can change anytime during the investment period or before maturity, there can be a possibility right?

Regards,

Chandra

Hi Chandra,

The tax rules are as similar to PPF account only. After budget, its declared as EEE scheme. So you can get tax exemption under section 80c and then relax.

Without witness you cannot open account.

Very bad process.

Hi Anmol,

I don’t think we have to produce any witness to open SSA account. So far I have visited post office, they said simply fill up the form and submit the mandatory documents. In 30 minute they will be able to provide the passbook.

Hi Hemant,

Kindly correct me if I am wrong.

No witness required

Hemant,

I have an existing account in name of my 2 year old daughter in a public sector bank. Can I convert that account to Sukanya Samriddhi Account or do I need to open a new one?

Thanks,

Pravin

You have to open a new account.

Hi Hemant,

I am a govt employee and I have one month old baby. Investing in PLI or sukanya samruddi yojana , which one is better

Hi Hemant,

You mentioned ” The account will mature after 21 years from the date of opening the account”. But I heard that “account will mature after 21 years of from the date of opening the account or if the girl gets married before completion of such 21 years after her 18 years of age (whichever is earlier). Please confirm it

Yes, its earlier of any of the below 2 points

1) 21 years from the account opening date

2) Marriage year

The girl child aged 11 years. Whether the account can be closed

After completion of 20 years if the girl’s marriage settles.

Any restriction of minimum number of years of remittance to me made

To the account

If I already have a PPF account for a girl child, can I also along with that open this account?

Yes Ramya.

Hi Hemant jee

Can you please suggest me that should I invest in LIC’s Jeevan Sangam policy ? I am 42 yr old govt servant and do not have any Insurance policy either on ,my name or my spouse name.

Thanks,

Kaushal

What I understood is we have to deposit money in SSY for 14 years from the opening of account but we / daughter(s) can withdraw money after 21 years from the opening of account. Is my understanding correct? If so what will happen to the money for those 7 years?

From 14-21 years you are supposed to get compounded yearly interest on accumulated money.

It means we will not be able to withdraw money after 14 years until we have any urgency?

You can only withdraw at the age 18 years of your girl child for the purpose of her education. 50% of the amount accumulated till 18th year can be withdrawn. Rest amount will be there till maturity. Besides that one can’t break this account.

Thanks

Are multiple withdrawals are allowed after age of 18 year provided sum of these withdraws is limited to 50%?

Hallo Hemant sir,

Again a nice and timely article.

I need one clarification on required documents to open an account.

Photo identity proof of the girl????

I have no photo identity of my 4yr girl.what should I do?What are the options?

Plz Hemant ji clarity it.

Photo id for the guardian or parent is enough. I think for the kid, you have to provide 2 photographs, and birth certificate.

Experience of Opening SSA

Quite surprised by the update knowledge of post office staff in a small town like Pataudi regarding this scheme while the commercial banks in the area didn’t have any instructions regarding SSA neither there customer care helpline.

Anyway following is the procedure adapted by me :-

1) Downloaded form from internet along with gazette notification

2) Filled the form and deposit it along with i)Date of Birth Certificate of my daughter, ii) my identity card copy ,iii) Latest electricity bill for residence proof

Note:- I had pasted photo on form on which it is written that photo is optional but at post office they told me to give them two more photos. So be prepared.

3) Please check whether they had correctly written in pass book the name and differentiate who is account holder (girl child) and who is depositor (parent/guardian).

In my case they had written just depositor name ( girl child which is not correct way) and after bringing it to their notice they promptly corrected and said they write this way on all pass books but will be happy to know the correct method.

4) Please deposit original birth certificate .Postal staff told me that there is no need to deposit original certificate and photocopy will be sufficient. Being a Birth and Death registrar earlier I know that wherever required Birth/Death certificate should be original.You can take as many as certificates as you wish from authorities by paying fee .

5) On the day of opening account you cannot do other transaction as per staff but can open account with any amount.

Overall experience was very pleasant and efficient working of staff really make me happy .

Thanks India post.

Hi Dinesh,

This is a really useful information that you have shared here. I hope many people’s question regarding this scheme will be clarified now. Anyway I will features your experience in my blog that I have started regarding Sukanya Scheme.

No photo of child required.3 photos required.

can grandfather of a girl child open ss account

If he is the legal guardian of that child, then definitely.

Hi Hemant,

Can I open this SSY account for my daughter who is born outside India but is a Person of Indian Origin (PIO)? We, her parents are Indian citizens. Please clarify.

Thank you so much sir for your great post. I would like to know more about the bank where I can open Sukanya Samriddhi Account. Can you please tell us ???

Hi pankaj,

You can open in 28 banks disclosed so far. But this operation has not yet started so far. We have to wait for few more days.

Hello Sir,

Today I’ve opened SS a/c of my daughter. Her DOB is 01.12.2004. One Post Office Employee told me to deposit amount upto 21 years age of girl & one told to deposit 14 years that means upto 25 years age of girl. I think they dont know full details of SSA.

Now I want to know from you how many years I need to deposit money in this a/c.

Thanks

You can deposit 14 years from account opening date. Account maturity period is up to 21 years from date of opening. From year 14-21 years no deposit allowed, as per information so far.

It will take some time to educated people as this is a new scheme.

Sukanya Samriddhi Scheme is applicable for NRI’s, please confirm

There is no such information so far. But right now people of Indian resident status only can open Sukanya Samriddhi Account.

1) Can non residents(NRI) invest in SSY for their daughter below 10 yrs.what is the procedure n documents required?

2) Till what age they can invest if daughter is six yrs old now,till she attains 14 yrs or till 20 yrs.

kindly revert back with solutions.

Hi Anita,

So far NRI can’t open SSA account. And in this case when your kid is 6 years old, the max deposit period will be 14 years from date of opening. Means till 20th year you can deposit money.

Hi,

Hemant Ji,

Thanks for such a nice information .

i think this scheme is better than LIC endowment policy. i this scheme person have freedom to invest more then a fixed amount. better interest rate also . now its 9.1% and will equal to ppf account interest rates for coming fin year whatever will be the condition for govt. i think so.

Hi Mr. Singh,

If you consider endowment plan from return point of view, the SSY account is far better. One can invest from Rs 1000 – 1,50,000 max in a year. In coming years PPF and SSA may have interest rates very close to each other.

Hi,

My daughter is 5 years old. I am investing every year in her ppf account 1 lakh Rs on regular basis.

What’s your suggestion? whether I have to switch from PPF to SSY or not?

Hi Chirag,

If you read carefully the features of both SSA and PPF account, the you will find them almost same. If you have more money to invest, then why not invest in both the account to make a good long term corpus?

How come none of the banks are aware of this scheme even though this was launched in Jan. Also SBI is supposed to provide a daily report to RBI on the remittances but do not have a clue to this product offering. The sad state of affairs in this country is to launch good programmes without the needed infrastructure to tap into the same. I went to Bank of Baroda and State Bank of India in Hyderabad. Both these banks are clueless to this program offering.

Hi Ganesh,

This is the sad part of our system. When Govt is telling that they are trying their level best to spread the scheme, Banks are no co-operating. Even in post-offices are not equipped with well educated staffs who can guide the queries regarding this scheme. I went to Madhapur post office Hyderabad, they gave me an old account opening form saying that mention SSA on top.

That’s what the seriousness of this system.

Dear sir,

What the closing time of this scheme.In my child birth certificate there is mention only female not mention her name. Can i also take this scheme.

Thanks & regards

I think it will be better if you can update the birth certificate and then apply. Otherwise it could be a problem in future. You know how our post office works.

If the girl unfortunately expired in these period to whom the matured amount will be hand over?

In this case which is the matured period?

What is the exact procedure in this case?

Please reply.

In case of unfortunate death of girl child, account will be closed immediately. And money accumulated till the previous month will be returned back to depositor. And the vice-versa.

Hi, can some one clarify my doubt. My Daughter is now 7 yrs old and i wanted to start this account, if i start this scheme from 1st April 2015 and i pay for 21 years from 1st April 2015 which means my daughter will be 28 yrs old, what is the fun of investing if we get the money after she is getting married, should we wait till 28 yrs for having the policy matured???

please clarify

Satya Prasad,

Although the maturity is till 21 years of age the account does offers closure of the scheme at marriage of the girl. You will have to give an affidavit that the girl has attained 18 years of age and has been married after that.

Hii.i hv my small sister n can i open her acoount in sukanya samridhi .dob is 20/09/2014

Bikaash,

Yes you can open the account. The age limit of the girl child for this scheme is 10 years and below.

Hi Sir, I would like to know that how many deposits I can made in one year ???

Nisha,

There is no limit on number of deposits in a month or in a year.

Dear Sir,

That is a very good scheme implemented by Govt. But my question is how many total deposit year 14 or 21. Pls. clear.

Thanks

Naresh,

Contribution is allowed only upto 14 years from the date of opening the account.

Sir

I am not Certified this Plan, But I Want a Account my Baby Child. So, Plz Clear the Ratio of Plan After Final 21 Year. I am interested for investment,Please Provide Calculation Chart in my email id

Thanks

Today I went to State Bank of India, IDBI Bank and ICICI Bank but all 3 banks do not have any information about this account. They told me that it may implement on first week of April but not sure.

Suunil,

Yes there are issues currently in banks for opening this account. You can open it in post office if you are comfortable with visiting the PO branch for transactions.

Dear Hemanth,

Thank you for this article. it indeed clarified a lot of my queries. I’m an NRI based in the Middle East. Can I open a SS account for my daughter and we have a SBI Retail Branch here. Can I open the account from here?

Hi,

So if a girl of 10 years opens an account, and deposit for 14 years then imagine her age. I dont think “Beti Padao Beti Bachao” is relevant. And 14 years isn’t maturity period adding another 11 years for maturity simply makes general saving not a SUKANYA. plz convince me not satisfied.

Hi Ron,

I think we should not judge this scheme with this example. The scheme is actually build thinking about the new born girl child. From that point up to 18 years 50% can withdrawal, which is relevant. And maturity is 21 years that is also relevant. I agree that for a girl with 14 years of age this scheme may not be much beneficial. But mainly this scheme is made for rural area people where girl child were mostly deprived of education.

Hi

I want to know maturity proceeding s..after 21 years can girl herself close the account and take proceedings or guardian signature required?

Suresh

Respected sir,

. Thank you for ur detail report on Sukanya yozna. Dear sir I dont ve a girl but I ve a son n I want to invest ₹ 1000 /month for next 14yrs. May I expect gain like kanya samriddhi yozna. Plz suggest me where I should invest. Plz guide sir.

thanking you

Anshuman

Hi Anshuman,

You can open a PPF account in your son’s name and deposit the money there. PPF and Sukanya scheme benefits are almost same, although interest rates differ. That is also not much gap.

I want to confirm that if I am getting 1.5 lac benefit from my ppf account that if I invest in ssy 1.5 lac later will be taxable or not under 80c.

Both investment ppf +ssy total 1.5lac or

Both investment ppf+ssy total 3 lac

please clarify

Hi Udayan,

Section 80C limit is max 1.5 lakh only. But one can invest 1.5 each at max in both PPF and SSA.

Please can I know that my baby is born in USA and she has a birth certificate over there.

So please let me can I start or not.

Dear All,

But that scheme did not fully implement in India still SBI refuse the same account.

Anybody can help this matter where I can make a complain regarding the above issue.

Hi,

Last week i opened SSA in my daughter’s name at Malleshwaram Post Office. As said there were no seperate forms for it, they gave me old form which is used for opening Post office savings account, advised me to write SSA on top of the page. They took 2 photos of my daughter as well as mine. I was asked to attach photo copy of my daughter’s birth certificate and address proof of mine. After verification they said i can come and collect Pass book after 10 days.

As of now Banks are not having info on this SSA, only Post offices are providing this service and good news is that they have gone Online. So next time payment can be made at any branches (Post office only). No need to visit same branch where account has been opened.

As per the info provided by Post Office Manager, NRIs (babies born outside India) can open SSA account provided their parents are of Indian Citizens.

i am NRI service in USA parents in India. My daughter born in USA in April 2015. Can ssy account be opened in india

Is there original birth certificate required or a photocopy bcz birth certficate can be use any other

i open a ssa in post office on April, 2015, i deposit in this a/c Rs. 9000. now i want to transferred this a/c into sbi. so how can i transferred this a/c and where i take the transfer form for this a/c please answer me.

Hi,

if we invest for my daughter and encase during the period me or legal guardian of girl child not live than what was policy status. please guide properly.

Hi,

Can I download the form online .will it be accepted by the post office

Comments are closed.