“Price is what you pay. Value is what you get.”

— Warren Buffett in an annual letter to shareholders 2008

The above quote from the world’s arguably richest investor says two things – price does not value, and you can always overpay. When each day billions of shares exchange hands in hundreds of stock exchanges around the world, their prices tend to be volatile – sometimes too much.

It is common to see the How Stocks price change within a few seconds. The simplest reason behind this volatility is the principle of demand and supply.

Must Read – Role of FIIs in Indian Stock Markets

If you agree to buy a share that I own, at a higher price than the previous transaction, the asking price for the whole market goes up. Similarly, when I agree to sell a share at a lower price than the rate of the previous transaction, the stock price for the whole market goes down. It’s that simple.

It is easy to know that the stock prices are rising because their demand is high, or their prices are falling as they are not in demand. But to understanding the factors behind that rise or fall in demand and supply is quite challenging. There are many visible & invisible, controllable & uncontrollable, and active & dormant market forces that affect the Stock prices to change.

Must Read –Direct investing in stocks is risky

Top Key Factors Affect Stocks Price Change?

The prices of the stocks of a company start rising when investors feel that the company has the potential to grow its profits, and it is worthwhile to become part of the success story. The net worth or value of the company is the product of its per-share price and the number of shares outstanding.

The free and open marketplace determines the stock prices, where the sellers and buyers both quote a price, they are willing to sell/buy it for. There are many factors determining the buy/sell prices such as the earnings of the company, economic strength of the country, the valuation multiple, and liquidity to name a few.

We can divide these factors into categories like fundamental, economic, technical, and sentimental reasons.

Fundamental Factors

In a perfectly efficient market, share prices would always follow the fundamentals of the companies. By fundamental we mean current earnings and future valuation multiple

Current Earnings

As an owner of the shares, you have a claim on the post-tax earnings of the company. There are multiple measures for finding how the company is earning on a per outstanding share basis. The simplest of them is the EPS (earnings-per-share). Calculate the price-to-earnings (P/E) ratio on current earnings to know how much you are paying for a claim on current earnings. The other measures include free cash flow per share and dividend yield.

Future Valuation Multiple

With each share you buy, you are buying proportionally into all the future earnings as well. A future valuation multiple tells you how much faith you have in the company and the price you would pay for expected earnings.

The valuation multiple, the stock price represented as a multiple of earnings, is a way of representing the discounted present value of the anticipated future earnings stream.

Companies may retain some of those earnings for reinvestment in the business, while with the remainder they can pay dividends. The future valuation multiple expresses an expectation about the future and is usually represented by the P/E ratio.

Check – Alternative investment funds (AIFs)

Economic Factors

If only fundaments played a role in stock prices, things would be easier. But various economic factors that are external to the stock markets are also in the mix.

Economic Strength

The sectoral, regional, and country’s economic strength (measured by its GDP growth rate) and stability also matter. If investors have trust that the future would be better, they will invest to earn more in the future, otherwise, they will hoard their savings and consume today. Research suggests often the economic and market factors account for the majority of the movement in the prices of a stock.

Download E-book – How and Why Stocks Price Change?

Benchmark Interest Rates

The central bank of each country (RBI in India) sets the benchmark interest rates that affect all the lending and deposit rates. A higher interest rate regime results in tougher conditions to survive and grow, and vice versa, affecting stock prices.

Technical Factors

High-volume traders and algorithms consider technical factors and drive the bulk of the stock prices. These factors solely come into play only when the markets are open.

Trends

The stock price sometimes moves in tandem with its short-term trend line. If a stock has recently picked momentum, seen higher volumes at higher prices, then many traders would start giving a buy call on it. Conversely, when a stock loses its momentum, it can take a beating in a matter of days and go out of flavor.

The oscillations in both directions are completely irrational and can go up t any limits. This happens with the broader markets when they are in their “bull” or “bear” phases.

Liquidity

Here liquidity means the volume of the stock transactions taking on a daily basis. If a stock has too many scrips changing hands, it is considered liquid and a safer bet as in times of a crisis it could be sold to clear the position at an instant. On the other hand, the illiquid stock barely finds any takers at higher prices as everyone wants to avoid getting stuck with them. Small caps almost permanently suffer from liquidity discounts.

Must Read –How to select a stock for investment

Sentiments Factor

The market is the collective term used for all the traders and investors participating in it. As with any human endeavors, markets are also influenced by human sentiments – fear and despair beget prices crashing, and hope and optimism bring on stratospheric valuations.

Market sentiments are irrational, biased, subjective, and headstrong. These sentiments can be short-term fads or long-term; for a company, sector, or the complete market; bearish or bullish, and can change with any news or trigger event.

News

Sentiments are often driven by the news – outbreak of a pandemic, supply chain blockage, labor unrest or migration, war breaking out, scandals coming to open, new drug discovery, strategic tie-up, new product launch, competition facing legal troubles, etc. Some of them are good for the stock prices and some are bad. Sometimes bad news may turn out to be a blessing in disguise or vice versa.

The Bottom Line

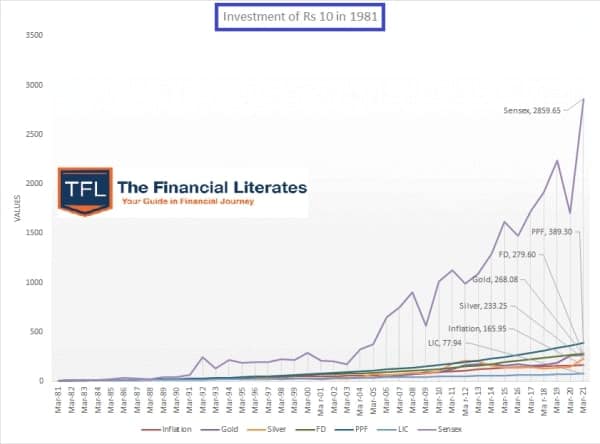

Despite so many things pulling the stock prices in different directions, the market should have crashed long back. But the resilience of a great company with a strong business model in a decently growing stable economy will only bring you wealth and prosperity in long term.

Take for example the stock price of Asian Paints, which was trading in the range of Rs. 30 in 2005, and at Rs. 80 in 2009 jumped more than 35 times in just 12 years to touch an all-time high of Rs. 2845 in January 2021! It is still trading above Rs. 2550 at 32x gains, despite recent corrections.

“It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

— Warren Buffett in an annual letter to shareholders, 1989

How Much Do You Know About How And Why Stocks Rise In Value? Feel free to add them in the comment section.

Thanks Hemant. Excellent article again. Explained in simple terms for laymen as always!

Request you to write a similar basic article on stock market terms, like call and put options, derivatives, forward buying/selling, hedging, etc.

Thanks Dhruv Ji.. I don’t think the terms that you mentioned have any relationship with investments 😉

Comments are closed.