Standard Deviation in Mutual Funds will tell you how risky is particular fund. While choosing a Mutual Fund – Return is not the only criteria; we have to check Risk-Returns, Tax, Inflation, Liquidity, etc. There are few more scientific formulas that help one to choose funds – we will be covering them at some later stage.

Thumb Rule: Higher the Standard Deviation of Mutual Fund – Higher the Volatility.

You can also read Importance of Beta in Mutual Funds.

If you are really serious about fund analysis, you need to understand this is all about judging returns and risk. Stripped of a lot of complexity, this task involves determining a fund’s average performance over a period of time. Let’s get down to basics and take a refresher course on this concept.

Why do we use an average? Why don’t we use the actual numbers that the average is calculated from? Obviously, because an average gives us a single value that represents the numbers it is calculated from. It is far easier to use a single number for judgments and comparisons.

Also Read: Sector Fund

But like most things in life, averages can be both good and bad. They can be trustworthy, or they can be worthless, or they can be anywhere between the two. For example, the average age of children in a nursery school is three years. You could walk into a kindergarten expecting most kids to be more or less three years old and you would not be wrong. However, the average age of students in a school is 12 years. You could walk into a school expecting most students to be more or less 12 years old and you would be almost completely wrong. Around 90 percent of the students would NOT be 12 years old — they would be all ages from 5 to 18 years.

What happened? Was the average wrong? Obviously not, but it was not a very useful figure. It would have been far more useful if you had been told that most of the individual ages in the kindergarten were close to the average but most of the individual ages in the school were far from the average.

Standard Deviation – Is the average deviation from the mean returns. It’s an indication of volatility i.e. deviation from mean returns.

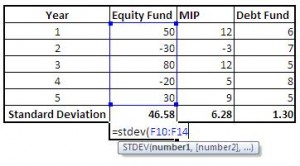

Calculation – Square Root of Variance. Where Variance is the average of the squared deviations from mean returns. Oh! Sounds complex – if you use excel it’s very simple to calculate. Check the below picture.

Must Check- Exchange Traded Funds

Calculate Standard Deviation of Mutual Fund

This is exactly what Standard Deviation does. It gives you a ‘quality rating’ of an average. The Standard Deviation of an average is the amount by which the numbers that go into an average deviate from that average. It tells us how closely an average represents the underlying numbers. Let’s put it this way: There was very little risk in assuming that the kindergarten’s average represented the real ages but there was a great deal of risk in assuming that the school’s average represented the real ages.

Risk! Isn’t that what we are trying to figure out? So a recipe for figuring out the risk level of a fund takes shape:

1. Calculate a fund’s monthly performance over a long period of time.

2. Calculate the average for all these monthly performances.

3. If the individual monthly performances are very different from the average, then that fund is risky, delivering high returns in some months and poor returns in others. If they are mostly similar, then the fund is a low-risk one, with about the same returns month after month.

Read about – 2 important categories of mutual fund – ELSS & MIP

And how do we find out if mutual funds are ‘very different or ‘mostly similar’? By calculating their average, of course. We just calculate exactly how much each month’s performance is different from the average and then calculate the average of these differences. This is Standard Deviation. (While the actual formula is complex, this suffices as a simplified explanation.)

Standard Deviation of Reliance Mutual Fund (Different Schemes)

| Mutual Fund Name | Standard Deviation |

| Reliance Media & Entertainment | 40.54 |

| Reliance Regular Savings Equity | 40.03 |

| Reliance Banking Retail | 40.02 |

| Reliance Equity Opportunities | 36.91 |

| Reliance Growth | 35.69 |

| Reliance Pharma | 35.49 |

| Reliance Vision | 33.69 |

| Reliance Diversified Power Sector Retail | 33.57 |

| Reliance Tax Saver | 33.05 |

| Reliance Equity | 28.21 |

| Reliance Regular Savings Balanced | 27.31 |

| Reliance Gold ETF | 21.23 |

| Reliance MIP | 10.41 |

| Reliance Gilt Securities Retail | 2.9 |

| Reliance Income | 2.03 |

| Reliance Short-term | 0.69 |

| Reliance Liquidity | 0.12 |

| Reliance Money Manager Retail | 0.1 |

Standard Deviation Mutual Funds: In the above table, you can notice that in equity category midcap, sector & multi-cap funds have a higher standard deviation if we compare it with large cap of balanced funds. MIP & Gold is showing low Standard Deviation. In the Debt fund category Gilt & Income have higher volatility than Liquid Fund.

But you do need to be careful of one thing — a high Standard Deviation may be a measure of volatility, but it does not necessarily mean that such a fund is worse than one with a low Standard Deviation. If the first fund is a much higher performer than the second one, the deviation will not matter much.

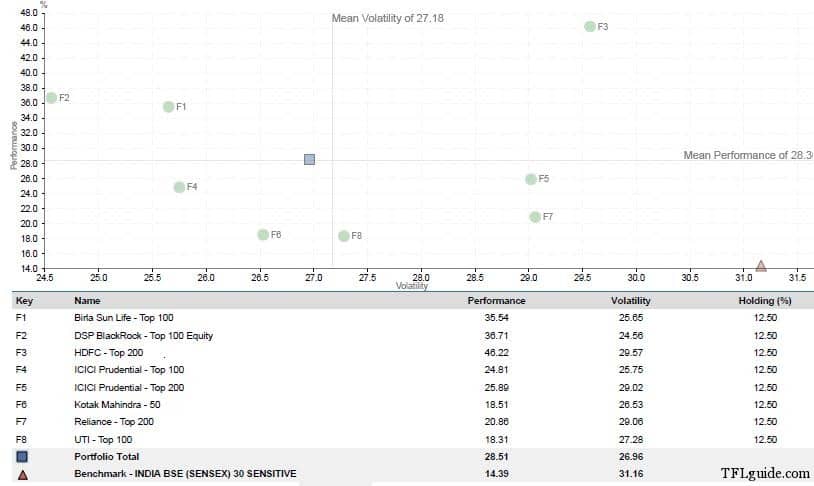

Standard Deviation of a Mutual Fund Portfolio

Now try comparing Birla Sunlife Top 100 with DSP BR Top 100 or ICICI Prudential Top 100. And also compare ICICI Prudential Top 200 with HDFC Top 200 or even ICICI Prudential Top 100. (3 years data is taken for construction of above table)

For an original and unforgettable illustration on Standard Deviation of Mutual Fund, try and compare the Standard Deviation of Sachin Tendulkar’s batting average with that of, say, Zaheer Khan’s!

Great Article.

I have not read this level of article on any of the blog or even in any personal finance magazines.

This clearly shows there is lot more than what we see from our naked eyes(returns). 🙂

Thanks Gopal.

You have rightly said “seen from naked eyes” – actually money should never be seen from eyes but from mind. 😉

i am a fresher , nd thnking to start invest,,,thnks for the insight view to take different fund into consideration

Welcome Prateek 🙂

Once again a nice article, put in simplest words possible from you. My perception about money and investment has been changing completey ever since i started reading your articles… Now I am more confident when making financial decisions…

Thanks Pradeep.

Really useful article. I am waiting for the article you mentioned in the other post of yours. One describing all the measures for mf like alpha, beta, r^2 etc.

Thanks

Hi Maneesh,

Check Beta article.

https://www.retirewise.in/2011/09/beta-in-mutual-funds.html

Sir please tell me while calculating standard deviation of quarterly returns of mutual funds, shall I use denominator n or n-1?

it is indeed a great explanation i ever read. thanks for a valuable insight in a very layman language..

a good article. Well written .

Thanks 🙂

Comments are closed.