What are Sovereign Gold Bonds?

The Government of India launched the sovereign gold bond scheme (SGB) in November 2015. The bonds are being issued by RBI till March 2022. The aim was to reduce the demand for physical gold and move some of the country’s domestic savings into financial savings.

Must Check – 5 Benefits of Gold Monetization Scheme

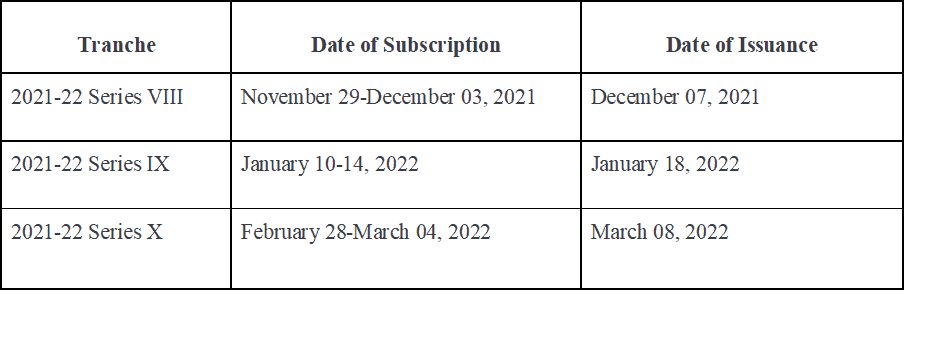

Just recently, the seventh tranche was closed for subscription and the bonds were issued. If you did not subscribe to it and want to, there are three more tranches. The details are as follows:

How do I subscribe to them?

The bonds will be sold through most banks, Stock Holding Corporation of India Limited (SHCIL), Clearing Corporation of India Limited (CCIL), certain post offices, and recognised stock exchanges – NSE and BSE. You can subscribe to it either by filling a physical form or online. This time, the online subscribers got a discount of ₹50 per unit. Once you are issued the bonds, they will be transferred to you in a Demat form.

Check – Do Not Invest in Gold Just for The Returns

What will be the price

The SGBs in Series VII were issued at Rs 4,765. The price is based on the simple average of closing price of gold of 999 purity, published by the India Bullion and Jewellers Association Ltd for the last three working days of the week preceding the subscription period.

Are there any eligibility criteria?

Residents of India, HUFs, and trusts can invest in these bonds. The minimum permissible investment is 1 gram of gold, and the maximum limit is 4 kg for individuals and HUFs and 20 kg for trusts and similar entities. The know-your-customer (KYC) norms are the same as that for purchase of physical gold.

What is the holding period?

The tenure of the bond is eight years. You will have an exit option after the fifth year.

What will be my returns?

Investors will receive 2.5% per annum payable semi-annually on the nominal value. Apart from that you will stand to gain if there is appreciation in the value of gold.

Check – Does it make much sense to invest in tax-free bonds?

What are the tax implications?

There is no tax liability if the bonds are held until maturity. Capital gains on SGBs sold prematurely in the secondary market are taxed as per your income tax slab rate, if held for 36 months or less, and at 20% with indexation benefit, if held for more than 36 months. The interest earned is again taxable as per your income tax slab rate.

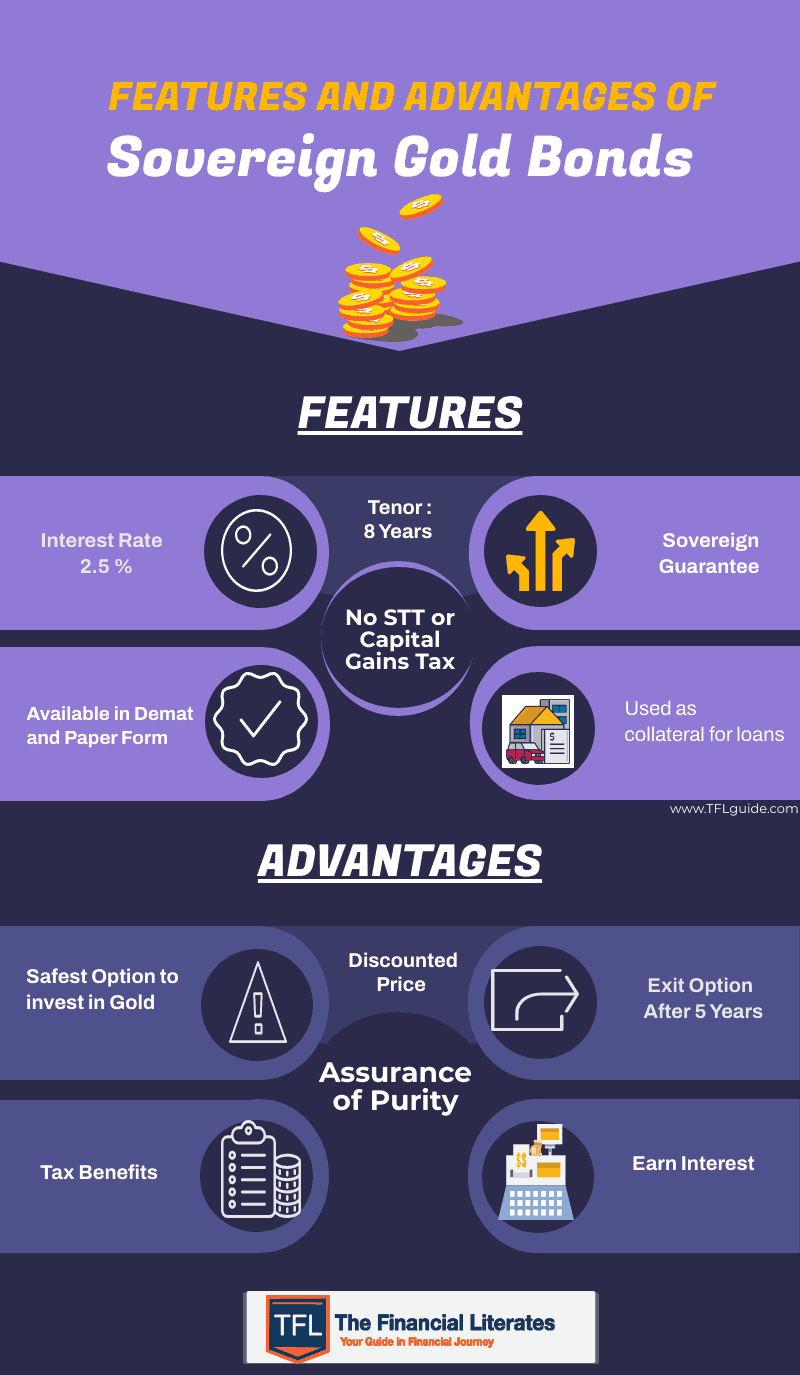

Key Features of sovereign gold bonds

- The bonds bear interest at the rate of 2.5 percent (fixed rate) per annum on the amount of initial investment. Interest will be credited semi-annually to the bank account of the investor and the last interest will be payable on maturity along with the principal.

- The bonds will be available both in demat and paper form.

- The tenor of the bond is for a minimum of 8 years with an option to exit in the 5th, 6th, and 7th years.

- The bonds will carry sovereign guarantee both on the capital invested and the interest.

- The bonds can be used as collateral for loans.

- No STT or Capital Gains Tax (as per Government of India guidelines)

Advantages of sovereign gold bonds

-

- A superior alternative to holding gold in physical form.

- Risks and costs of storage are eliminated. Investors are assured of the market value of gold at the time of maturity and periodical interest.

- No issues like making charges and purity in the case of gold in jewellery form.

- Held in the books of the rbi or in Demat form eliminating the risk of loss of scrip etc.

Should I invest in sovereign gold bonds?

There are many positives to investing in these bonds:

- Gold usually performs well when other asset classes such as equity are on a downtrend. The price depends on various factors. In the last few months, rising US dollar and treasury yields have largely led to lower prices.

- Investors get tax benefits and regular interest payout.

- These bonds are a better option to invest in gold as you will do away with worries like storage cost, making charges, theft, etc.

But do remember that gold usually has prolonged periods of low returns and short periods of high returns. Therefore, it is important to invest for the long term. These are also illiquid assets.

Gold can form part of about 8%-10% of your portfolio. It adds to the diversification of the portfolio and acts as a hedge against underperformance in other assets.

If you have any questions regarding SGB add them in the comment section.

What if I invest today and at maturity gold price is less than buying price? I’ll be forced to sell at a loss then.

Comments are closed.