Hemant Beniwal is a CERTIFIED FINANCIAL PLANNER and his Company Ark Primary Advisors Pvt Ltd is registered as an Investment Adviser with SEBI. Hemant is also a member of the Financial Planning Association, U.S.A and registered as a life planner with Kinder Institute of Life Planning, U.S.A.

He started his Financial Planning Practice & TFL Guide Blog in 2009. "The Financial Literates" is a dream & mission to make Indians Financial Literate.

Nice Illustration..

Thanks Radhey.

Thanks Hemant.

Today I am asking something again : Where from in Chandigarh someone can do a CFP course ? Please share some information as I need it for a near one. You may please mark me a mail in this regard.

This will be of great help.

Eagerly waiting for your reply.

Dear Nishi,

Go to FPSB india Site .

Check the EP directory option.there are various education provider.

Before you going to any education provider.

If you have any exp. in financial background so just ask for concession or negotiation it would cost 20000To 25000 with study material.

if you don’t have exp. so they might be give.

And meet to faculty also and ask one question to their faculty when nothing is implicit in the pre and post retirement question in retirement planning module. If he say end so institute isn’t update if they say begin. so they are right.

I had rectified whole book of retirement planning and tax. investment planning book many EP aren’t truly committed to service. check your mat. also is your material update as per FPSB assessment year?As the amounts are to be withdrawn are for a year, they are more likely to be in begin mode. A person should have a year’s expenses and investment in retirement planning in advance rather than waiting upto the end of the year to get first withdrawal or saving from a fund.

Some exception are bond ,sip,annuity certain.

My opinion is just like a sugar in milk.

Regards

SAdashiv kashyap

Thanks a lot Mr. Kashyap.

It was helpful. 🙂

Dear NIshi,

Its Not a big deal .

I am happy to here help you. If you need any help about this course.

You said right Its very true Good Financial literacy ,good people about TFL.

Regards

SAdashiv kashyap

Hi Nishi,

Hope you got your answer.

@Sadashiv – Thanks

Yes Hemant. Thanks for the concern.

Everyone here is helpful, maybe its your goodness which is spreading.

hello hemant..nicely explained. thank you.

Sir,

Thanks for infomative article. As always, it is quite helpful.

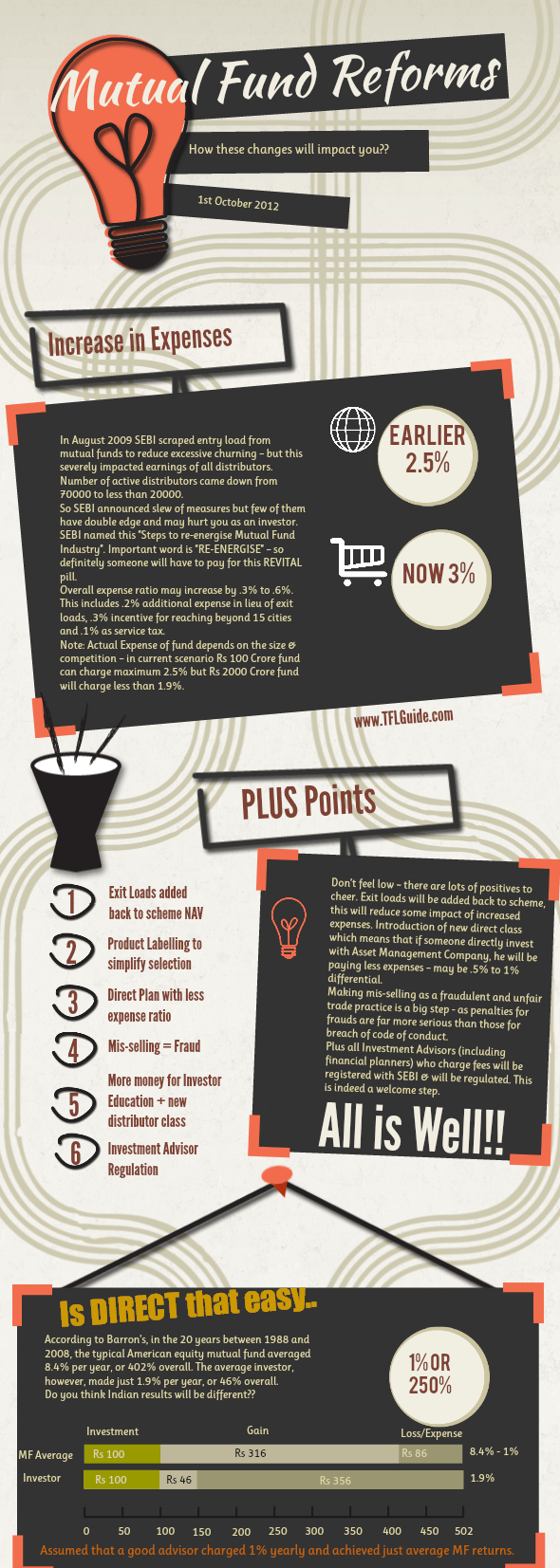

I did not understand last point in the article. Does it mean that if I invest Rs.100 and if MF earns Rs.500, I will make only Rs.46? and rest (Rs.356) will go in MF expenses (I guess to fund house and MF manager)?

Thanks,

Harsh

Hi Harsh,

8.4% returns are after expense returns – answer is “Investing is not a Number Game, it is a MIND GAME” 🙂

Hemant,

This is Anantharaman from Chennai. 5 Years before I bought 20 years Money back policy with 5 lacks Sum Assurance from LIC. Every 5 years they will give one lack, On completion of 20 years they will give one lacks + accrued bonus. Last month, I have completed 5 years and I got one lacks from LIC.

Now I become a family man with 1.5 years female baby. Now I would like to go with extra life insurance/extra earning to cover my family. Pls suggest some suitable insurance for me? And also suggest shall I continue with 20 years Money back policy or not?

Thanks in advance for your suggeation.

Thanks,

Anantharaman D

Hello Hemant Sir,

i read all your article & pass it to my friends, they also like it

i did not understand much from these article so asking you a simple question.

i am doing SIP in HDFC top 200 (1000rs) & reliance gold fund (1500rs) both in growth.

i have got promotion & my salary is increased by 10%, so shall i increase my SIP amount or shall i continue with the same.

also let me know if i am investing in wrong fund or shall i stop/switch.

thanks you in advance.

Hi Hrishikesh,

I am not sure why you are investing more in gold in comparison of equity.

hi Hemant Sir,

thank you for reply.

it was by mistake i feeling SIP form. i wanted to make 1000 only.

then did not changed after that. So what you suggest, shall i make

2000 in HDFC top 200 & 1500 in relinace gold saving.

a nice article as usual. I have a question, how independent mf adviser will be affected by these changes, can u enlighten me on this..,

with best of regards & thanks

Hi Indrajeet,

It’s like who know driving, they’ll drive their car by own merits. Those who don’t, either they’ll learn or hire driver. A smart busy executive always prefer to hire a driver as they give priority to manage time.

Question is for those executives who hire, if you see the ratio of demand and supply of drivers… ooof confusing.. 😉

Hi

I read regularly your articles.

You are doing a wonderful job.

I have one single question:

Please explain the last dash board .

Impact over investing directly and thru agents.

you mean to say going thru the advisor one has made annual returns 1.9 and direct invessting he has made 8.4 annualised returns?

Please help me to understand!

Just vice versa if someone was having good advisor 🙂

excellent Illustration..Thanks

nice info graphics ! however does last graphics give message that it would be better not to select DIRECT PLAN for mf investments ?

Hi Bharat,

Not exactly – it says direct is not that easy choice…

Hi Hemant,

I read almost all articles in this site. Sorry to say but this particular article i did not understood.

Can you please explain me with an proper example.suppose i am investing 2000 per month (SIP) in HDFC top200 fund. What difference it will make once this new rule is implemented.

(at present I am investing through ICICI demat account)

Thanks,

Anand

Hi Anand,

I am not sure about what are the charges you are paying for ICICI direct but let’s assume there are no charges.

If difference in Direct plan (direct from AMC website or office) or agent (ICICI Direct) is .5% – your returns will be lower by .5% in case if you are going through agent. (If agent is not in position to make any positive diffrence)

Hi Hemant,

Please help me understand the effect of increase in charges on already invested funds.

Hi Ajay,

It will impact even existing investments but you will come to know about exact number after 2-3 months.

Hi Hemant,

Thanks for the article.

The last point about direct investment about which many including me has doubt.

What I understand is if I directly invest in equity (via Demat account stock buying ) instead of Mutual Fund then the average of the profit per year is 1.9%. However if u invest via Mutual Fund you get an average of 8.4% return.

Is this what u ment or something else.

With Regards

Subhojit

Hi Subhojit,

First read this – what’s the exact change:

Direct Plan (applicable from 1st Jan 2013): Right now funds have 2-3 classes like retail, institutional & super institutional – categorization is done on basis of investment size & the only difference is expense ratio. Now SEBI has asked mutual funds to have only 2 classes – normal & direct. Introduction of new direct class means that if someone directly invest with Asset Management Company, he will be paying less expenses – may be 0.5% to 1% differential. So it is good for DIY (Do It Yourself) clients where decrease in expenses will improve their returns. But is Direct that easy choice? Read this

“According to Baron’s, In the 20 years between 1988 and 2008, the typical American equity mutual fund averaged 8.4% per year, or 402% overall. The average investor, however, made just 1.9% per year, or 46% overall. “

Do you think Indian results will be different??

Still you have query feel free to ask.

Dear Nishi,

I want to share one more thing you can go for CPFA through NISM . it is parlel course as CFP. If you are passinate as like hemant Sir. you must go for CFP.

otherwise CPFA is gd course it will save money and time also.

whatever we learn from edcation provider its only calculation and theoritical part .the practical knowledge and case study different from Study matarial .

So it is advisable to join CPAFA.when you will finish CPFA. join various excel training and workshop it will boost you more compare to join education provider for CFP.

dont join RNIS its not upto the mark for cfp ep.

try for ICOFP or IIFP. they good education provider .

Again I say my opnion are just like sugar in milk .

Regards

sadashiv kashyap

Dear Hemant ji,

Ques 1. I cannot calculate what will the effect of increase in expense ratio in future.

so, should I worry about increase in expense ratio.or continue my investment as it is…..

Ques 2. After 10 days I am going to invest in HDFC balanced mutual funds 1000 per month for 10 years. what will be the effect of increase in expense ratio.Assuming 12% return.

Ques 3. should I invest through mutual funds or directly.

Regards

omkar

Informative article. But for the common man from a non-finance background, approaching AMCs for investments in mutual funds just to save between 0.5 % – 1.00 % in expenses may not be a good idea. This would mean they will not only have to take care of all the transactions and tracking the fund performance themselves,even choosing the right scheme among the plethora of options will have to be done by them.

i recently come to know about , Indian energy exchange , (IEX);

what is it ? how to trade with it ,

if one has / have DP and demat and trading account with broker like religare, commodities -securities ,

can one get procedural explanation , how it(trading in it) works ,

with regards

Dahale s s

Hi Dahale,

These products are for institutional players – keep a safe distance.

Dear Hemant and other Experts!!!

I have been breaking my head since last few days to revamp my portfolio, after reading your article ” Balance Funds – Best of Both Worlds ” I read several articles after that, picked up data from Value Research to make sure I diversify correctly with no overlapping. I have about 9 funds which I am trimming to 4.

Honestly, I am not confident enough whether my proposed portfolio looks good. I am looking for long term capital appreciation for retirement which is at least 15 yrs away. Can you please please look at the below funds I have selected and see if I need to anything more or revise any of them.

HDFC Prudence (Balanced)

DSP Top 100 (Large Cap)

Reliance Regular Saving Equity (Multi Cap)

ICICI Pru Discovery (Mid and Small Cap)

Shall I also add Quantum Long Term Equity to the above or not required?

All other experts, please put in your valuable comments as well.

Thanks in advance.

Vikas

Sorry, I addressed you as Hemant Ji, not sure where that ‘Ji’ got erased. 🙂

Dear Sir,

Could you please suggest me 3 best equity linked savings schemes to avail the tax benfit. I will invest through SIP mode.

Thanking you

Hi GN

You can read this

https://www.retirewise.in/2013/01/best-tax-saving-mutual-fund.html

would like to read new comments on this

Dear Hemant,

I agree that investing through a qualified and truly knowledgeable adviser does make a lot of difference, however under present scenario my observation is :

1. You will find very limited number of true advisers ( at least in small cities/towns). I have observed that % of commission & incentives offered in schemes is on their top priority ( I agree this being their source of livelihood but what about the Investor’s Hard earned money). Further more most of them are even afraid to qualify the basic simple NISM certificate examination and are happy to appear for CPE – refresher course even it is costing 3 times than the exam fee. This shows their knowledge update with changing time.

2. With direct plan offering 1% difference to NAV , it’s cumulative effect would be very much in longer duration following the basic principle applied while investing early in mutual fund – ” Cumulative effect”.

3. The return comparison shown by you if for the period 1988-2008, however the scenerio today is quite different, an aware investor has number of tools and forums(internet sites/ magazines) available to update their financial knowledge and take a prudent decision. I feel it would be better off than blindly following any single human being.

4. My hope is that we should be in system where true advisory service would gets its due recognition and honorarium and SEBI should take some more similar steps like – making “Mis-selling a crime offense” and raising the Bar of Investment Advisory services.

What is thé différence between taking SIP through Any broker and directly taking through AMC or CAMS: does it affect gain investor will be getting at maturity. Which option is better.

Hi Mayank,

There are some cost associated while investing in mutual funds.Although the agents commission through entry load have been scrapped, there were fund management charges and others which are recurring. From Januray 2013, for investors SEBI came out with a direct option where even these charges are reduced a bit for people who invest directly through AMC.

Comments are closed.