With the substantial increase in medical cost & new developments in medical technology – it’s a very common question these days – How much Health Insurance do I need?

This question has become even more important after the launch of PMJAY – where the poor will get Rs 5 lakh health coverage.

With my 15 years experience of working with individuals on their financial plans – I am confident that most middle-class people are undercovered when it comes to health insurance In India.

Note – You can also get “How to choose health insurance – checklist” from the end of this post.

Read – Term Plan – the right way to take Life Insurance

How much Health Insurance do I need?

Unlike life insurance, there is no straight formula to assess how much insurance coverage you should have.

You need to understand the type of policies available and then match any of them with your perceived medical needs.

There are insurances plans tailored to meet various needs from those of a student to those of elderly people. Each of these is beneficial at different stages of your life cycle. So, you should evaluate plans according to the phase you are in.

4 Reasons to buy Health Insurance Do I Need?

Must Check – What is Insurance?

Identifying adequate health insurance coverage

Identifying health costs is the most difficult part of medical insurance as there is uncertainty regarding what type of illness may arise. But a reasonable assessment can be made based on the cost of medical treatment you might have to incur in the case of hospitalization.

Since the cost of medical treatment varies from city to city, the first level of assessment should be a hospital whose services you would avail in case hospitalization is required. So, think about the following before you decide how much health insurance you require:

- Which hospital would be your first choice for treatment, if any medical emergency arises?

- How much is the approximate cost of hospitalization there?

This will give you an estimate of your potential healthcare costs and should form the basis of your decision regarding how much health insurance coverage you need to purchase. There is always the chance that you will have to resort to bigger hospitals in case of a specific illness; so keep that in mind too.

While determining the quantum of health insurance you have to purchase, also consider the benefits already available to you through schemes like Group Insurance from your employer. All this will help you to reach the figure for the amount of coverage you will need while dealing with medical emergencies.

Watch This Video for Why you need health insurance?

Amount of health insurance required

Medical inflation is estimated at 15% in India. The prices of medical procedures and healthcare have been rising steadily. Therefore having health insurance is a basic requirement. The important point is to determine the amount of health insurance.

The following are factors to consider for health insurance –

Age – When you are in your 20s, you generally do not need a big cover. You can consider health insurance of Rs 2,00,000 to Rs. 3,00,000 for yourself and then increase it gradually as you enter your 30s and 40s. It is good to increase it by 10%-15% at intervals.

If you need to buy a health cover for your parents or spouse and children, then you should consider their age, lifestyle, and health. You can look for family floater plans.

Affordability – Health insurance premium is an important factor. You need to determine what how much you can afford. When you are in your 40s or 50s, it is important to have a substantial amount.

But if you cannot afford it is still better to buy a smaller cover as any financial assistance during a medical emergency is useful. Percentage of your income goes towards the premium.

Affordable Plans – Apollo Optima Super Top Up

Lifestyle – Do you have a healthy lifestyle or are you a person who has a high-stress life or has no time to exercise or follow a healthy diet? If your job entails traveling a lot, it might be difficult to have a regular exercise routine and you might have to eat unhealthy meals. In such cases, it is important to have a good amount of health coverage.

Family History – If your family has a history of obesity, diabetes, or any other such lifestyle disease, there are high chances of the next generations to get it. It is then important to have the right health cover.

Requirements – There are different types of policies other than simple health insurance. There are accident covers, senior citizens plans, critical illness insurance plans, etc. You have to determine your requirements and buy appropriately.

There are other factors too. If there have been high medical expenses in the past, it might make sense to take a substantial cover. If you want to ensure a certain hospital, a certain doctor or the type of patients facilities in hospitals, you need to make sure your health cover takes care of these requirements.

If you are employed, the employer might be offering you a group employment plan. Check its coverage and buy more insurance if required. It may not be very comprehensive and have limitations.

Read – Health Insurance for Parents

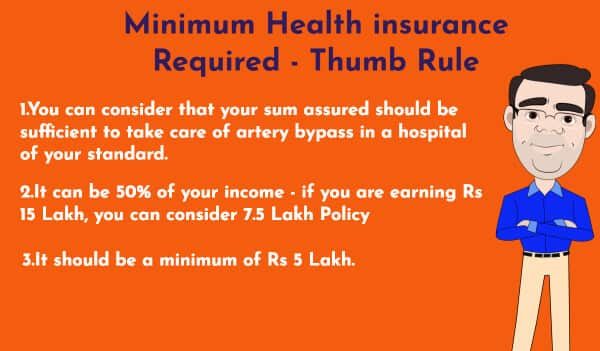

Minimum Health insurance required – thumb rule

If you are looking for a simple thumb rule –

- You can consider that your sum assured should be sufficient to take care of artery bypass in a hospital of your standard. or

- It can be 50% of your income – if you are earning Rs 15 Lakh, you can consider 7.5 Lakh Policy. or

- It should be a minimum of Rs 5 Lakh.

Views of insurance experts on Health Insurance coverage

“A young family living in an urban area should be a floater cover of Rs10 Lakhs, supplemented with the maximum top-up available, taking the cover to around Rs 20-25 Lakhs.” Mahavir Chopra

“For a middle-class family, a minimum sum assured of Rs5 lakh is necessary. One can opt for a floater policy and if the parents are included the sum assured can be Rs 7.5 lakh. Over and above this a ‘top-up’ plan can be bought.” Nayan Shah

Here are a couple of health insurance plans and their premium amounts –

1) The Optima Restore Individual health insurance plan from HDFC Munich for a 35-year-old person living in Mumbai for a sum insured amount of Rs. 5,00,000 is Rs. 8,852 approx per annum including taxes.

2) SBI General has a family plan for 4 people living in Mumbai with the primary person of age 35 years and a sum insured amount of Rs. 5,00,000. The premium payable is Rs. 17265 approx.

Check – Apollo Restore Vs Religare Care Health Cover

It is important to assess the different factors and requirements before buying a plan as if you are unable to pay the premium, your plan will be discontinued.

Insurance is an important component of financial planning. It is best to treat it as financial protection rather than an expense to get the best benefits from it.

Hope this post gives you a good idea about how much medical insurance that you need.

Now answer my simple question and get “How to choose health insurance – checklist” that I published in my book Financial Life Planning.

How much health insurance (employer + separate policy) you have right now?

{If you can share the name of the plan, that will be great.}

Please, leave your answer below in the comment section. You will receive the free PDF with a checklist from my side.

If you have any other questions or suggestions regarding ‘How Much Health Insurance Do I Need’ – feel free to add them in the comment section.

Thanks Hemant for touching this important point. I was really confused after launch of Arogyam yojan by govt, right now I have Rs 5 lakh family floater from Apollo.

But I am not sure if that will be sufficent as most budgeted hospitals will be crowded after PMJAY.. what’s your view?

Hi Daksh,

It’s a valid point & people in middle class is going to face huge pressure due to PMJAY – they have to increase insurance whether they like it or now.

I have 3 lakh insurance from my employer.

Hi Tarun,

Check this https://www.retirewise.in/health-insurance-policy-group-medicalim-employer/

I have 5 lakh Insurance cover from my employer (Oriental Insurance Company) and3 lakh top up that I personally bought from United India

Thanks for sharing

Service is a big issue in health policies. For even a small claim , you may have to run pillar from post. For one cataract eye operation of my mother, the amount of 20000 (Rs. 5000/- I paid as co-pay), I have to write to even PMO thrice after writing and speaking to TPAs and insurance companies several times and that too , when I have raised the claim after 8 continuos years of premium paying period (about 24000/- per annum for 5 lakh family cover)

Hi Abhishek,

Sorry to hear that – can you share the name of the policy?

Hello Hemant,

I have #2 plans (Apollo Munich Optima Restore Floater Plan).

3 lacs (effectively 3+3 lcs now after non claimed #3 years) for me (38 years) + my 1st child (10 year)

3 lacs (effectively 3+3 lcs now after non claimed #3 years) for my wife (36 years) + 2nd child (7 years).

I am however not very sure of if this is the best suited way to progress.

I could be useful if you could compare few plans and highlight important pros and cons of some famous / good plans.

Thanks

Nitin

Hi Nitin,

We have reviewed many insurances policies in past – use search area on top right

I have Apollo Munich Optima Restore Floater Plan 🙂

https://www.retirewise.in/religare-care-versus-apollo-optima-restore/

15 lakhs individual

Apollo Munich Optima Restore

Same here & used twice in last 5 years – claim settlement was smooth.

I have 4-lacs HDFC Ergo Health Suraksha Silver Plan.

Ok

I have 4 Lakh coverage from my employer (United India Insurance) and 6 Lakh which i bought personally from Star Health Insurance

Thanks for sharing.

i have 3 lack of insurance you should also take at least one insurance for your life.

Thanks for sharing.

Hemant,

I am a 33 year old individual with weak immunity (as docs said when I was young). I have some digestive issues (piles) due to which I must eat healthy and walk daily. I may get married in 1/2 years. In light of this, can you recommend the amount of health insurance for me & my would be spouse after 1-2 years? Or do you recommend I buy individual one right now and then modify it to family policy later?

hi!

I am 43 years old businessman and having Star Health comprehensive insurance policy with coverage of Rs.25L for my family (2 Adult and 2 kids). Do you recommend any other policy at lesser/same premium and added benefits along with good claim settlement ratio?

Hi Hemant

I have only Employer provided Health (Floater) insurance plan of 5L by The New India Assurance. Researching for a separate plan since last six month from my side but confused over what features to look in a H.I. plan for.

Beside this, Now as many Govt. (in my case -Uttarakhand Govt.) is providing Health Insurance (foc upto 5L Rs) to all it’s people; for that I request your suggestions/ Review/ Article/ Analysis.

1.5 Lakhs from Employer and 5 lakh from Religare.

HI Hemant,

I have start health insurance policy of 15 Lakhs plus 4 lakhs mediclaim from company. I have accumulated 6.75 lakhs of bonus so far and my renewal is in near future. So far i have not made any claims.

1? Do you think i should continue with Star. currenly they have changed their investors.

2? This time I am planning to renew it for 10 lakhs sum assured considering 6.75 bonus accumulation. Please suggest if this is right choice

Thanks,

Gaurav

I dont have any health insurance right now. Im considering between apollo & max . Pls sharw your checklist with me

Comments are closed.