A comprehensive healthcare plan and a long-term retirement plan are two important aspects of a balanced financial plan.

A healthcare plan is required to meet urgent medical expenses. While a retirement plan is for the longer term to secure one’s financial standing post-retirement. It requires meticulous planning and execution over a long period to build a formidable retirement corpus.

Must Read-Facts About Retirement Planning You May Not Have Known

But healthcare planning for retirement in India is something that most people tend to ignore. They implicitly assume their retirement funds will also serve their medical needs later. This is not a wrong assumption, provided you have an adequately funded corpus.

As people age, their healthcare needs and associated expenses increase exponentially. We inherently extrapolate our current state of health long into the future. In many cases, we assume to be in the best shape. Forever!

The goal is to design a healthcare plan today that is aligned with your retirement needs for long-term financial planning.

Before You Start! Healthcare Planning for Retirement

Visit the Family Doctor

A family doctor is hard to find but if you still have one, then do visit them. With your family’s medical history, they may help identify the risks you might face without going in for costly tests.

Even if you don’t have a family doctor, talk to the doctor who is attending to you and find out more about your health going forward. Get a comprehensive medical report to dodge future shocks.

Start Early

It is never too early to begin planning for healthcare, retirement, or healthcare during retirement. If possible, start allocating a part of your retirement savings to fund your future healthcare needs.

Involve Family

One thing that the pandemic brought to the fore – and quite frighteningly – is that we do not share! Especially about our incomes, expenses, debts, and even health. It owes to a deep-rooted culture of protecting our loved ones from the burdens we carry.

In most cases, the families are not prepared to face the challenges when they come knocking.

Start having meaningful conversations with your spouse and children about your retirement healthcare needs and plans. They might retort with “Hey, nothing will happen to you.” Or “Papa, we’ll take care of you forever.”

Make them understand that even if they want, they cannot foresee the future and be there for you every time you might need help.

Must Check – What To Do After Retirement in India?

A Comprehensive Retirement Healthcare Planning

You must consider the overall healthcare facilities in the city/state that you choose as your last home. The plan must give you the flexibility to travel, move, and live stress-free wherever you go.

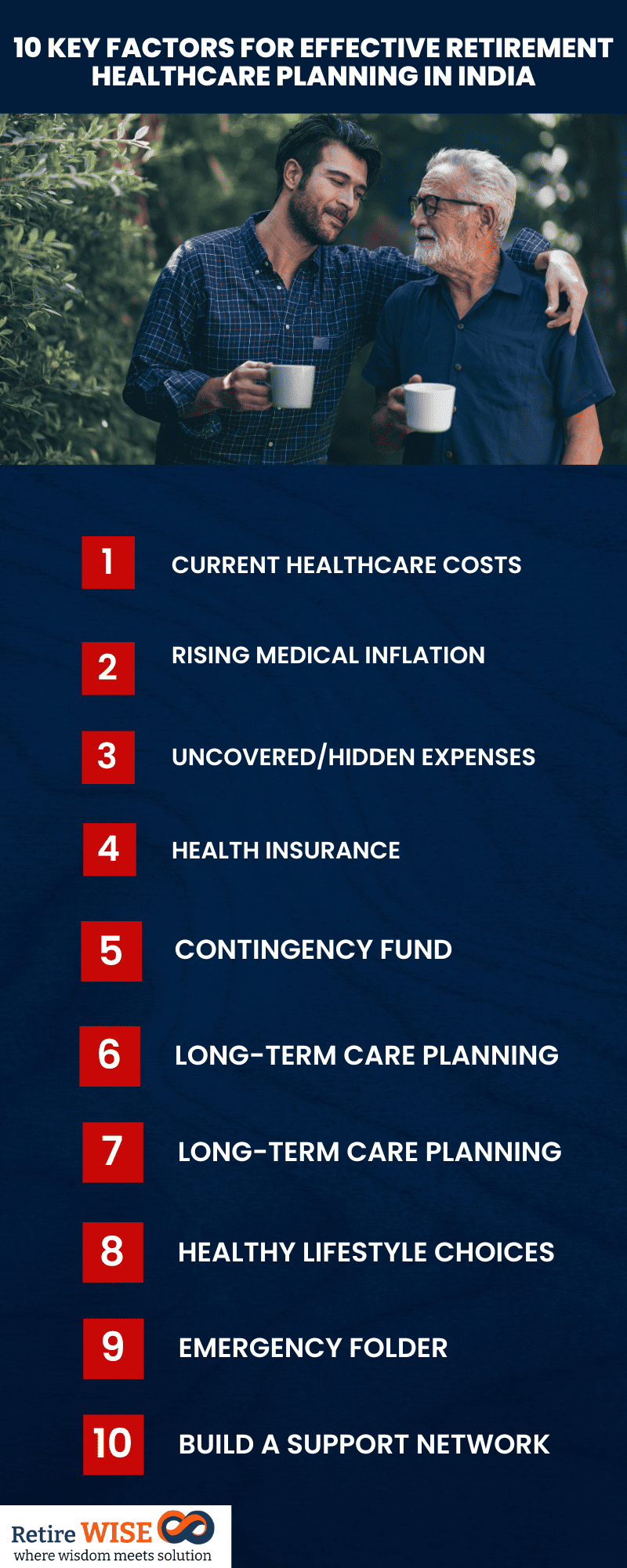

Let’s explore different facets of a comprehensive HealthCare Planning for Retirement.

Make Conservative Estimates About

Current Healthcare Costs

On comparing the current cost of any common procedure, including post-procedure care, for persons in different age brackets, you will find that they escalate dramatically with age. It is because of the additional care and complications involved with increasing age.

Rising Medical Inflation

The next issue is the increasing cost of medical services every year. Even though the published inflation figures seem to be getting under control, you cannot apply them to medical bills. Depending on the place of residence, from a small town to a metro, you can easily assume medical inflation between 10 and 20 percent, respectively.

For example, a rupees one lakh medical bill today would cost you at least rupees eight lakhs, in fifteen years at 15% annual inflation!

Uncovered/Hidden Expenses

There are many out-of-pocket expenses associated with healthcare that are not covered by your medical insurance. These include OPD visits, OTC medications, precautionary tests, many daycare procedures, and long-term home care. Add to this the costs of transportation and the caregiver accompanying you for each visit.

Health Insurance

Now with a realistic cost estimate, start zeroing in on the medical insurance plan that offers value for money. You do not need (and cannot have) two separate plans for today and the future. Continuing the same plan and increasing the cover every few years is what you need.

You need separate medical cover for your family, even if it is covered under an employer-provided health insurance plan. These plans cease to be effective during employment transition and may reduce the cover significantly post-retirement. By the time you retire, it is quite likely that you will be denied insurance by most insurers.

Therefore, carefully evaluate different policies offering adequate coverage for your present and future healthcare needs. If you do not make a claim against it, you will get the benefit of a no-claim bonus. Most importantly, you will cross the biggest roadblock of the waiting period for pre-existing illnesses.

Contingency Fund

As not everything will be covered by medical insurance, building an emergency fund for healthcare expenses is imperative to supplement insurance coverage.

Open a separate joint savings account for this purpose and keep on adding to it regularly. As, hopefully, you will not use this fund very often, you can invest it in less volatile asset classes like a fixed deposit or a more tax-efficient liquid fund.

Long-term Care Planning

As you age, the need for a permanent caregiver becomes a necessity. So, planning for long-term care or assisted living is something you cannot ignore. Long-term care includes day-time in-home assistance, home nursing services, daycare facilities, and even full-time assisted living facilities.

You can start by setting aside a regular amount to meet this need. Some life insurance companies offer long-term care insurance riders for seniors above 65, people diagnosed with a critical ailment, or having a disability requiring regular management. Though not the ideal solution, it can still make sense for a specific set of people.

Update and Review

The most ignored aspect of a long-term plan is that it may remain frozen in time.

A periodic review would help you assess assumptions in the plan against your present state – medically and financially. This way, you can update the plan before it is too late.

Must Read – Retirement Rules of Thumb

Beyond Financials

There are many things beyond financials that you must not overlook. The following are some of the most important ones.

Healthy Lifestyle Choices

Your lifestyle today will decide your life tomorrow.

A healthy lifestyle with a balanced diet, sleep, work, and workout in addition to spending quality time with family and friends helps you become anti-fragile. You can also add annual health checkups to the list if you have a family history of a critical illness or are above 40.

Emergency Folder

Having a plan and not letting anyone know about it is not in the best interest of anyone. Make an emergency folder (physical or online) with the following updated details:

- List of emergency contacts – including specialist doctor, family members, financial advisor, and lawyer.

- All prescriptions with diagnostic reports.

- Health insurance information with policy details, and agents’ phone numbers.

- Living will.

- A durable power of attorney for healthcare decisions.

- Copies of any specific medical orders, forms, or cards – like, a do-not-resuscitate order, or body/organ donation cards.

Do share this folder with your spouse, kids, or primary caregiver.

Build a Support Network

A circle of friends and peers is crucial for a fulfilling retirement experience and keeping at bay age-related ailments. Retirees with strong family ties, friend circle, social connections, and community involvement tend to live a healthier life.

Yoga, walking, playing with grandchildren, and laughing out loud with friends in city parks are nature’s own medicines! Join cultural organizations or clubs and participate in community activities to keep active.

Seek Expert Advice

Seeking advice from financial planners can get you personalized guidance for your specific situations. They help you create and integrate a comprehensive retirement healthcare plan with your other short- and long-term goals.

As You Go!

Retirement can be a wonderful time in life. By planning, you can ensure that you have access to the care you deserve, when you need it.

Prepare for the worst, hope for the best, and enjoy the present!