Indian investors often fancy and try to predict the actions of Foreign Institutional Investors in India or the Role of FII in the stock markets. And this fancy is not without reason – the FIIs are after all hold a substantially large share of Indian capital markets. According to IBEF, a Trust under Ministry of Commerce and Industry, Government of India, FPIs/FIIs had invested ~Rs. 4,433 crore (US$ 597.94 million) in 2021-22 up to June 22, 2021.

Various research over the year since the Indian capital markets were opened for foreign investments, there have been a strong correlation between the FIIs activity and market movements. This not only includes the secondary equity markets (listed stocks), but also the primary markets (IPOs, private placements, qualified institutional buyers, anchor investors), and the debt and bond markets.

Must Check – How and Why Stocks Price Change

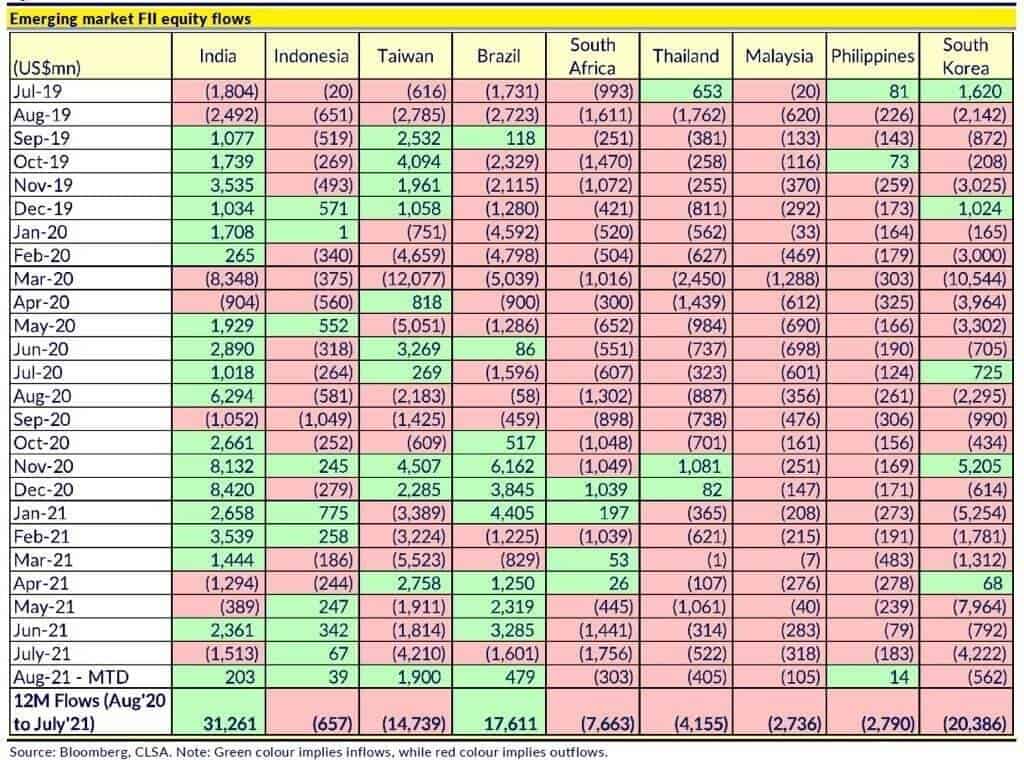

For example, the US Fed’s taper-tantrum of 2013-14 caused FIIs to pull out from emerging markets, including India, causing the markets to go in a tailspin despite strong fundamentals. And the sustained bull run from 2015 was initially largely driven by FIIs coming in droves month after month. Today, the bull run seems to be sustained by the frenzy among local investors – both retail and institutional.

So, one needs to understand the depth and breadth of the involvement of FIIs – which is already very dense – in order to understand the factors that drive the Role of FII Indian capital markets.

What Is a Foreign Institutional Investor In India (FIIs)?

FIIs are investors or Foreign investment funds that are registered in a country and make investments in the stock and bond markets of other countries. The goal of the foreign institutional investor is to anticipate the movement of the markets in the target country and make investment decisions based on the analysis to benefit from such movements.

Investment by FIIs are regulated by the SEBI and the RBI defines and maintains the cap or ceiling on such investments. The different types of FIIs who are allowed to invest in India are:

- Asset Management Companies

- Endowments

- Foreign Mutual Funds

- Hedge Funds

- Insurance Companies

- Investment Banks

- Pension Funds

- Sovereign Wealth Funds

- Treasury Funds

- Trusts – Private and Public

- University Funds

FIIs Vs. FDI

Unlike Foreign Direct Investment, FIIs do not really invest in the economy for the long term. They are there only for investing in the capital markets and benefit from market movements in the prices of listed securities. Because of this they are overly sensitive to market movements, exchange rates, interest rates, and political scenarios, and can pull out money anytime.

Read – How to Select a Stock for Investment?

FII vs FPI

One should not confuse FII with FPI or Foreign Portfolio Investor, though the recent changes in definition by the market regulator has clubbed them. FPIs are investors that invest in securities for the long term to passively benefit from the regular stream on income that their investments bear. Usually, they do not churn their portfolio as fast as FIIs do and stay put for the long haul.

With these distinctions in mind let’s now focus on what FIIs are, how are they regulated and how do they affect the Indian capital markets.

The Heft of FIIs

For a long, the foreign institutional investors have swayed the Indian markets as they were one of the biggest blocks with an almost insatiable appetite and an unending reservoir of cheap money. Their funds ran into hundreds of billions of dollars and even a fraction of that huge sum was able to affect the market sentiments here.

Therefore, since the FIIs were first allowed in the early 1990s, in the Indian markets, till very recently, if they poured money into Indian markets they zoomed, and when they pulled the plug, the markets tanked. This made them an object of desire and envy at the same time for most investors, companies, market analysts, and even the government of the day.

The people kept close track of the actions by the FIIs and external factors that could affect their decisions. Even a slight change in the interest rates in the US, the UK, or Europe could result in billions of dollars going in or out of Indian markets in a matter of days. This used to affect the exchange rate, making currency management that much more difficult.

Even today, after the enhance participation by retail investors and DIIs becoming almost as prominent as FIIs, they still hold sufficient heft to control the market movement. But over the years, their actions and movements have become more predictable.

Must Read –My Favorite Investment Movies And Lessons Learnt

Regulations Governing FIIs.

FIIs have been an important source of capital in emerging markets, but due to their volatile nature, India has placed limits of varying degrees – both in percent terms and absolute terms – on the total value of assets an FII can purchase.

These limits are not broad-based or blanket, but case to case -in some cases up to 100% foreign holding is allowed and is some others none. The purpose of such limits is to curb the influence of FIIs to an extent on individual companies and on the overall financial markets.

This way the potential damage that FII fleeing en masse might inflict can be curtailed and spread over a longer duration to help the retail investors.

FIIs can invest via the Portfolio Investment Scheme (PIS) by registering with the Securities and Exchange Board of India. According to SEBI data, over 10,000 foreign bodies are registered with it under FPIs and Deemed FPIs (the erstwhile FIIs/QFIs).

The rules governing FIIs are strictly followed. Generally, FII investment in a company is limited to a maximum of 24% of its paid-up capital. To allow investment beyond this limit, if it is approved by passing a special resolution passed by the company’s board. In strategic sectors, like public sector banks, the ceiling on FIIs’ investments is only 20% of their paid-up capital.

The RBI monitors the compliance of these limits daily. It does so by implementing cutoff points at 2% below the maximum investment limit thereby giving it sufficient time and headroom to caution the Indian company receiving the investment. Then only the final 2% is allowed to be purchased.

Read- Sensex PE Ratio – is Stock Market Overvalued?

Important Points to Remember

- Although today FDI investments are clubbed with the FII and FPI. But remember that FII is now an umbrella term that includes active business owners (FDI), passive investors (FPIs), and speculators (FIIs).

- India has seen substantial investment by FPIs and FIIs with close to Rs. 4,433 crore (or USD 600 million) in 2021-22 up to June 22, 2021 (Source: IBEF).

- Foreign Institutional Investors route their money into emerging economies because of greater growth potential there.

- Short-term investments in securities is also common among some FIIs – this can, on one hand, boost the liquidity in the market, but on the other hand can cause instability in the money supply.

- FIIs act as both a catalyst and a trigger for the receiving markets. They can encourage better performance and corporate governance by voting by their feet. Also due to completely unrelated reasons can alienate a company or a market leaving the retail investors to fend for themselves.

- Foreign institutional investors directly affect the stock and bond markets of the country, the exchange rate, inflation, and overall market sentiment.

- The actions of FIIs are driven by many factors – external and internal – that may be too difficult to predict even approximately. Some of them are:

- The US and European interest rates

- The International crude and commodity prices

- The international geopolitical stability or lack thereof

- Performance of the international markets

- Performance of the Indian markets – standalone basis and vis-à-vis other emerging economies

- Inflation, interest rate, and growth scenario in India

- Taxation policies and other regulations in India

- Future prospects of the overall sector, industry, and the security

- FIIs today can invest in already listed, unlisted, and to-be-listed securities and participate in both the primary and secondary capital markets.

If you have any questions add them in the comment section. If you are looking for Financial Guidance – let’s have a call.