You must have heard stories of crorepati employees of Infosys or some other big organization – I am talking about 10 years back when salaries were comparatively low. Most of the Indian employees knowingly or unknowingly get benefitted from ESOP in India (Employee Stock Option Plans) even if they don’t understand the power of equities.

Last week I was working with one of our clients on his financial plan review & he shared details about his ESOP in India (which he never considered part of the plan earlier) – we did some calculations & our eyes popped out – based on the current rate (after adjusting cost & all the taxes) benefits were more than 20% of his net worth.

Read – How to calculate our net worth & why it’s so important

What are ESOPs- definition/meaning

ESOPs are Employee Stock Option Plans – few call them Employee Stock Ownership Plans in India. When an employee gets ESOPs from the company where he/she works, he/she gets the right to purchase a certain number of shares in the company at a predetermined price after a predetermined period or period… It is generally given as a reward for performance or tenure with the company. It also serves as a motivational tool as once you own stock, you actually own part of the company, and if the company does well the stock value rises. ESOPs also help in retaining employees. Companies give ESOPs in parts & there is a vesting schedule. So today an employee may get 3000 shares which would be given in sets of 1000 over a period of time. Usually, employees have to wait for a certain duration to exercise their right to buy shares. This period is called the vesting period. If the employee does not exercise the option of buying the shares within the vesting period, the options lapse and the employee does not get any rights. IT firms had started this trend but now many companies in different sectors give ESOPs to employees – even the startups are depending on ESOP to attract talent.

Read: Mutual Funds Vs Direct Equity – Aam Aadmi’s Question

How does an employee benefit from ESOPs?

An employee can create wealth from ESOPs if the timing (luck) is right and the company does well. ESOPs should be exercised when the ESOP value is at a lower price than the market value of the shares on that day. (to save tax but there are other factors that should be considered before exercising)

ESOP gain but Zero Risk Strategy

An employee wants to take zero-risk – he can exercise when company share is trading at a premium. If the employee sells the shares at the right time, he/she can make a neat profit – For example, if an employee gets 300 shares at Rs. 100 per share and the vesting period is 1 year, he/she can exercise the option of buying the shares after 1 year. It is advantageous if the employee exercises the option when the market value is greater than Rs.100 at that time. Suppose the market value is Rs.150 at that time, the employee can get the shares at Rs. 30000 and sell it at Rs. 45000, (Rs.150 x 300). He can make a profit of Rs. 15000. (there will be tax involved in this strategy – 30% perquisite tax & 15% short term capital gain — approximately 4500 + 2250 — still a decent net gain of Rs 8250) Employees do not have any risk as they pay money only when they exercise the option. If the market price of the shares is high, they can take the shares and sell getting high profits. They have the option to not take the ESOPs as well.

Read – 15 types of risk that affect your investments

How do ESOPs help the company?

The company can preserve cash and dilute ownership if required. The company benefits by giving ESOPs to employees. Employees benefit from the increase in the share price, so they will focus on working towards making the company successful.

What are the pros & cons of ESOPs?

ESOPs can be of great value in the long run. For example, when Infosys was really small, it gave a lot of ESOPs to the employees. They all benefitted when it became such a successful company by selling the shares in the market. ESOPs are one of the ways to participate in equities. As an employee, you will know how the company is doing and its growth plans. You can accordingly decide your investment strategy in ESOPs like if you should exercise the option, when to exercise the option and when to sell. (can try)

Companies can give ESOPs to employees when they are short on cash as an incentive. Employees will be more focused on delivering results as they have a stake in the company.

ESOPs may not be suitable for people who do not want to take risks. Sometimes ESOPs may backfire resulting in very less or no value for the employee. If you want liquidity, ESOPs are not the best option as there are many rules regarding when to exercise your options. There are also tax implications that should be considered carefully. (for every Infosys there will be 10 other companies where ESOPs earned Zero profit)

In one of my earlier post, I talked about ESOP –

WHY do we make financial mistakes

Most of the employees who get ESOP or ESPP benefits hold these stocks close to their heart. And in most of the cases I have seen that with time these stocks become their biggest financial asset or biggest equity assets. But I have to ask these people:

- Is this (your company) the best stock available in the market?

- Don’t you think you are losing the benefit of diversification?

- What will happen if your company starts underperforming – you will see tough times in your job as well as your stocks will underperform?

- And the worst case – what will happen if your company becomes next Satyam or Enron?

Must Read –11 Unusual ways of smart tax planning

What are the tax implications on ESOPs?

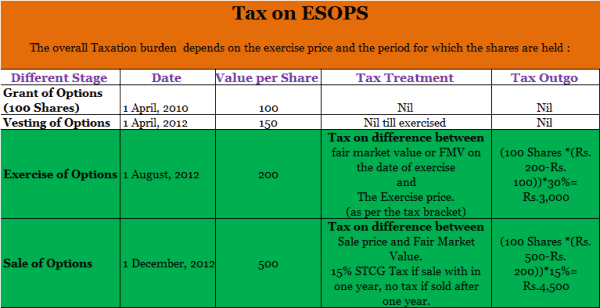

– When the options are given by the company, there is no tax.

– When the options get vested, there is no tax.

– When the employee exercises his option of buying the shares, the difference between the market value and exercise value is treated as perquisite and is taxable as per the tax bracket that the employee falls in.

– When the employee sells the shares, the profit is treated as capital gains. If the shares sold within one year, 15% capital gains tax has to be paid just like in the usual purchase and sale of shares. If the stock is sold after 1 year, there is no tax as it is considered as long-term.

– If the employee has ESOP in India of a company that is listed abroad, and sells the shares, short-term capital gains are added to income and one has to pay tax as per the tax slab that he/she falls into.

– If the capital gains are long-term, 10% tax has to be paid without indexation benefit or 20% tax has to be paid with indexation benefit.

ESOP Tax Calculator India

I have prepared no-frill Employee Stock Option Plans (ESOP) tax calculator India in excel – you can edit & use it according to your need. {you can also send suggestions & updated calculator to me on Hemant (@) tflguide.com – I can add that here}

ESOP Tax Calculator – Download

How are ESOPs different from ESPS and RSUs?

Employee Stock Purchase Scheme (ESPS) allows employees to buy shares at some discount decided by the company as compared to the market price. Shares can be bought by employees via monthly deductions from their salary.

Restrictive Stock Units (RSUs) – When the employer gives RSUs, the employee gets the shares free of cost provided some conditions are met like a vesting period, employment time-frame, etc. RSUs are gaining popularity in recent times.

Hope this article clarifies your doubts about ESOP in India. In the comment section – please share your experience with ESOPs & if you have any questions…

If I purchased ESOP shares

1000 @ ₹1000 on Oct.16

500 @ ₹1200 on Nov .16

500 @₹1500 on Dec.16

Out of it I sale 1700 on Feb.17

Then how the tax calculate. Plz tell

Interesting point you make there Hemant. However, when ESOPs are granted at a discount to the market price, employees are being taxed for the ‘perquisite’ value (Market value – grant price). Why is this so?

1. Can an employee be asked to pay a tax on a notional earning? And;

2. If later, by some business dynamic the market value trades below the Grant value then isn’t the employee at a loss?

Hi Jayant,

Employees are being taxed for the perquisite value because it’s a kind of additional earning.

1.It’s the right to convert the ESOP to share & no one is stopping you to sell it immediately.

2. Yes employee at a loss if the market value trades below the grant price.But it would be considered notional loss until he sell his shares below grant price. But once you have the shares & it’s your risk.

Hemant,

Could you please elaborate on the capital gains on sale of ESOPs of a company that is listed abroad. Are there any exemptions or investment avenues to avoid the LTCG

regards

One clarification required:

Taking an example: 1000 Esops granted @100 each on 01.01.2016

1000 Esops granted @ 200 on 01.01.2017

Exercised 1ts 1000 when the rate was 150. Rs 50 notional gain and perqs taxed accordingly

Exercised 2nd 1000 when the rate was 250. Rs 50 notional gain and perqs taxed accordingly

Now the rate is 225. and i am selling the 2000 shares @225, Total value Rs 4.5L. How the capital gains be calculated. Whether it will be on average rate or the transaction based.

1. Average rate exercised Rs 200.00 * 2000 = 400000. Rs 50,000 as capital gains will be taxed?

2. a. 1000 shares exercised @150 = 150000 is selling at 225000.00. Rs 75000 as capital gains will be taxed?

b. 1000 shares exercised @250 = 250000 is selling at 225000.00. NO capital gain rather LOSS is there.

Please guide

Hi. I would like to know the taxability of perquisite value of ESOPs of an indian company exercised by a non resident and also the taxability of the subsequent capital gain arising from the sale of such shares.

How would it be different if the company is a foreign company?

Please elaborate on the taxability of perquisite value of ESOPs of an indian company and subsequent capital gains in the hands of a non resident.

Hi,

Can anyone elaborate disadvantages of ESOP to companies towards raising funds?

Comments are closed.