A black swan is an unpredictable event. An event that is beyond any expectation of how a situation would play out, leading to severe consequences.

Nassim Nicholas Taleb, a finance professor, writer, and former Wall Street trader conceptualized the black swan theory. He wrote about it in the book – ‘The Black Swan: The Impact of the Highly Improbable ‘.

For an event to be considered as a black swan event, it has to

- Be extremely rare and not really predictable

- Have catastrophic consequences

- Be explainable in obvious terms in hindsight

Must Read – 15 Types of Risk

Black Swan Or Just a Normal Bubble

Let us look at the two events that happened in the past to get a better idea of the concept

Black Swan – 2008 Financial Crisis in the US

The 2007–2008 credit crisis is a classic black swan case. Home prices had been rising rapidly for years. Based on the spike in prices in real estate, mortgage brokers and lenders offered loans on easy terms. Products depending on mortgages were invented and traded. Speculators bought and sold houses.

The housing bubble burst but due a black swan. (no one was expecting good quality home loans can default) People panicked and this affected the stock markets as well. This led to a major credit crunch and a severe liquidity crisis.

Normal Bubble – Dot Com (IT) Bubble of 2001

Towards the end of the 90s, technology companies were ruling the roost. There was a rapid rise in U.S. technology stock equity valuations. This was due to venture funding of Internet-based companies, speculation and fad investing.

Most of the dot-com companies did not generate revenue or profits but spent mammoth sums on marketing and brand identity. When stocks reached very high levels, leading tech companies placed huge sell orders. This led to panic and there was a massive sell-out of technology company stocks. This led to a huge decline in the value of publicly traded dot-com companies and near discontinuation of funding of Internet companies. This resulted in many companies shutting down and a massive erosion in investment capital value.

Do note that black swans need not be in the financial world alone. For example, the assassination of Archduke Franz Ferdinand of Austria by Serbian nationalists led to a butterfly effect and culminated into the First World War.

Time to recheck – What is Equity?

Taleb’s Take on Black Swan

Taleb explains in the book that it may not be possible to predict these events and therefore people are oblivious to them and do not consider them in the normal scheme of things. These events are unknown and we do not know that we are unaware of them.

Standard tools and formulae cannot be used for prediction of such events or to find out the probability of a black swan as past events do not play any part in determining the future and there are many variables involved and we do not know them.

He says that financial institutions do not look beyond their financial models which are defective and so cannot predict black swans and therefore are vulnerable to losses and crises.

COVID-19 – A Black Swan

The coronavirus outbreak is leading to multiple economic problems worldwide. Stock markets are on a free fall and commercial sector has come to a grinding halt. It will have its effects on GDP, unemployment levels and other economic indicators. A global recession seems to be around the corner.

The COVID-19 outbreak can be classified as a black swan as it is rare for a medical issue to have such a global impact. It has already led to severe consequences. In hindsight, we may be able to explain how and why the impact was so severe and what we could have done to avoid it. Moreover, there are many unknowns –

- The virus’s properties are still not understood. There is no cure or vaccine or custom treatment yet.

- There is not much information to accurately predict the rate of increasing infection or subsiding cases.

- The number of cases is increasing all over the world and we are not sure of how many people will get affected, how many will recover or how many deaths will happen due to the virus.

- We cannot predict the impact of social distancing and other social and policy measures.

Read – Portfolio Management System (PMS)

But we should have exited market?

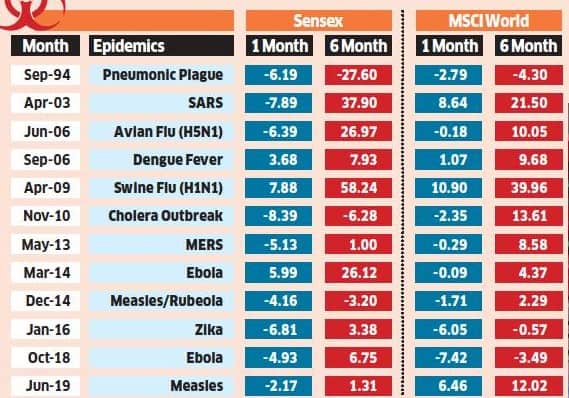

Everyone can see clearly in the rear-view mirror – actually this is hindsight bias. If someone thinks that this was predictable – he is wrong. Initially, it looked similar to any other virus that attached us in the last 20 years or maybe china’s problem. Japan was not able to decide about the Olympics 2020 or the US about lockdown.

If long term investors start reacting to every event, they will actually become a trader.

Volatality is the price of long term returns – since market returns are good, the “price” is very high.

Must Read – Hindsight Bias – Did you know it already?

How To Manage Finances During a Black Swan

In Taleb’s opinion, if a system is allowed to fail, it will be strengthened against future black swan events. For example, in the US, policy changes were made to increase regulatory provisions and transparency after the 2008 credit crisis. The author says that even if it is not possible to predict a black swan, we should plan our strategies with provisions for black swan events.

In the light of the black swan we are facing, businesses should be prudent with cash. They should be ready to face a tough financial year ahead. Organizations might also plan their future course and also include strategies to handle the unknown.

If you are employed, you might be working from home or have lesser working hours. When business gets back to usual, companies may take tough decisions such as no increments or layoffs. Be prepared for such situations both from a mental and financial perspective. You can use this time to think of your career path and decide on steps to take towards your ambitions. You can learn new skills via e-learning courses.

When it comes to financial planning and investments, do not make any hasty decisions. It is important to sail through market volatility which can cause erosion of the value of our investments. If you have a financial planner, discuss the best course of action on how to preserve your wealth.

Check – Importance of Financial Planning

Taleb in his book suggests two approaches but I don’t think these things are possible for a normal investor –

- Hyperconservative and Hyperaggressive approach – Invest a majority of your money in very conservative instruments and a small minority in high-risk investments such as venture capital or stock options. Your exposure risk to negative black swans is limited

- Speculative Insured portfolio – Invest in very highly speculative instruments but insure them in ways such as using stop-loss or buying put options for stocks purchased, etc. The other way is to buy multiple stocks so that your risk is diversified. Here your risk is taken care of and you might be able to take advantage of positive black swans.

These options are to be researched and analyzed thoroughly and implemented only if it suits your financial situation, risk capacity and risk tolerance levels are vetted by professional guidance.

If you are looking for a Comprehensive, Competent & Complied Financial Planner –

If you have any questions or obervations – add in the comment section.