We Financial Planners always insist on asset allocation, which is optimum mix of different asset classes. Each of these asset classes are available for investment and we can make different recipes out of them, but in Mutual Fund we find a category of fund called the “Balanced Mutual Funds” or “hybrid equity oriented funds”, which are ready-made meals for asset allocation. Through this post, let’s try to understand the feasibility of investing in a balanced fund and why should an investor invest in a balanced fund? (You can also check which is Best Balanced Mutual Fund)

In life also we balance lot of things – the professional life and family life, rented house and own apartment, needs and wants etc. And, if you get a formula to balance any one of these, you will be thrilled. I recently read “8 hours sleep & rest, 8 hours recreation, family, friends and 8 hours of work. Tweak this rule and your life will tweak.”

Same way balanced mutual funds can also be helpful in balancing your portfolio & provide you higher returns. Investment in them can provide you certain benefits as mentioned below. If you feel you are facing these situations, balanced funds can really be a good solution.

Benefits of Balanced Mutual Funds

1. When you are not diversifying at all: Lot of investor put money as per the climate. When equities will do well they will draw cheques for equity investments only and when they suffer a loss the money is diverted to bank FDs. And when the market roars they grump and get premature withdrawals on FDs. This happens when person does not understand the nature of these asset classes. But point is “baseball cannot be played with a straight bat”. You need to be “with the assets” to gain from them. Either leave it on your financial planner or invest in balanced mutual funds. Let this worry of “investing in which asset class” pass on to the fund management. The experts are better bet for taking a decision on whether you should be over or under weight on equity or debt.

2. When you are investing for one goal or expenses: If you have a one goal or a funding requirement in long run investing in balanced fund can be a way out. One of my friend start a SIP for 5 years in a balanced mutual fund the day he buys a new car. The proceeds of this SIP are used as down payment for the next car. Similarly if you have a goal which is long term in nature and you need to accumulate a corpus over a period of time, instead of the regular RD or timing the market it is good to invest through a balanced fund. By this you will be able to diversify and allocate asset for isolated investments.

3. When you are looking for smooth landing: Investing in equity is a bumpy ride but for best return in long term you need to be friends with equity. But investing in equity needs a sound heart and patience. If you feel you cannot cope with the volatility still wish to have better returns than debt you can choose balanced funds. The returns will not be as spicy that of equity diversified fund but you will get a good deal. Also when you compare these returns on the risk-adjustment parameter, balanced fund will give you more returns on the risk taken by you.

Read – Understanding Mutual Fund with Different Perspective

Few Limitations of Balanced Mutual Funds

1. Minimum 65% in equity: Fund Managers have limited freedom as 65% is the minimum requirement to take benefits of taxation. So in case even if fund manager feels that minimum equity exposure is beneficial for the portfolio he cannot do it beyond 51%. So if you thought balanced means 50:50 or anything else – this is now part of mutual fund history.

Read: Mutual Fund Taxation in India

2. Partial withdrawal: That’s a big problem with balanced funds – think of a situation when you need some amount for your emergency need but you have parked your whole amount in balanced funds. As you don’t have any choice you will redeem from balanced funds & that mean for every redemption of Rs 100 you are actually redeeming Rs 65 from equity & Rs 35 from debt. Even if you are long term investor in equity, automatically your equity gets redeemed. In case of proper asset allocation you could have avoided this thing.

3. Limited Choices: If you want to have exposure to midcaps or only large caps, this is not possible with balanced funds as you can’t dictate your terms to fund managers.

Best Balanced Mutual Funds in India

You can check performance of top balanced mutual funds.

|

Balanced Mutual Funds |

1yr |

3yr |

5yr |

10yr |

| HDFC Prudence | 3.37 | 37.91 | 14.58 | 25.40 |

| HDFC Balanced Fund | 8.62 | 35.17 | 14.99 | 18.14 |

| Reliance Regular Savings Balanced | 2.86 | 32.90 | 14.81 | |

| Canara Robeco Balance Fund | 5.77 | 30.29 | 12.03 | 20.15 |

| Tata Balanced Fund | 6.47 | 29.58 | 12.44 | 20.03 |

| Birla Sun Life 95 | -3.62 | 27.68 | 11.35 | 19.60 |

| ICICI Prudential Balanced Fund | 8.70 | 26.19 | 8.12 | 17.66 |

| DSP BlackRock Balanced Fund | 2.99 | 25.04 | 12.37 | 20.56 |

| UTI Balanced Fund | -0.88 | 24.39 | 8.57 | 15.54 |

| Franklin Templeton FT India Balanced | 2.78 | 22.85 | 9.14 | 17.84 |

Also Check – Best Mutual Funds to Invest

HDFC Prudence Fund – the Ultimate Fund

If we are talking about balanced mutual funds & not talk about HDFC Prudence Fund – it’s like a DAY without SUN. This fund is a gem offering of Mr Prashant Jain – he is managing this fund since 1994 (since inception). I worked for HDFC Mutual Fund & got couple of chance to interact with Mr Prashant Jain – he used to say “I never changed my company. Once the private Mutual Fund opened in 1994 I started with 20th Century Mutual Fund, they sold it to Zurich & finally HDFC bought them.” That’s a big commitment from a Fund Manager, where these days’ people change their jobs like shirts.

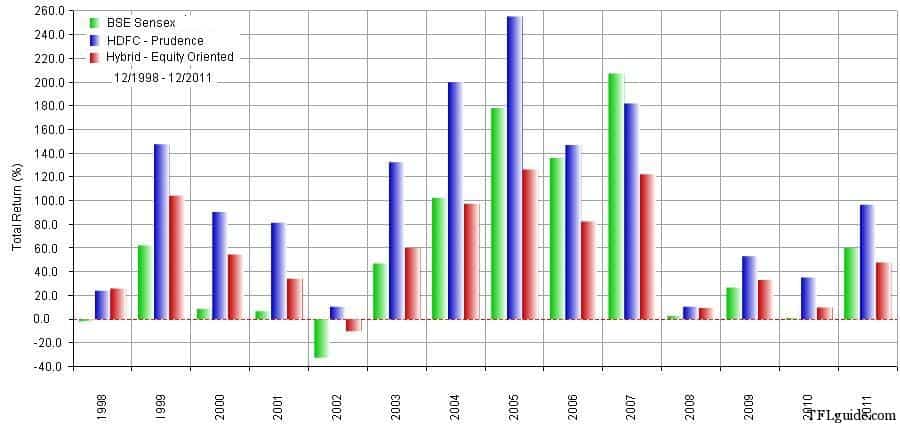

Below you can check 3 year rolling chart of HDFC Prudence fund – if someone had invested for 3 years in this fund, he always got positive returns.

Read: How to set Financial Goals

If you compare HDFC Prudence with its category – it has outperformed the category in every single period. Even it has outperformed Sensex by wide margin baring period ending 2007. This is magic of Asset Allocation.

Planning for investments is not a fixed solution concept. We have to arrive at an investment mix by checking on various ingredients and readymade concepts. Balanced fund is such concept.

I have given you enough reasons why you should or why you should not invest in a balance fund. Hope this will clarify what you are looking for in a Balanced Mutual Funds. Share your views & questions in the comment section.

Great article Hemant explaining the benefits of balanced MFs. This is indeed a very good category for people who have limited risk appetite. As you rightly said the returns are highest when compared to the risk taken.

Also, as far as disadvantage of partial withdrawal for emergency is concerned, I don’t think people should ever park emergency funds in MFs. FDs are best suited for emergency funds.

P.S. I have HDFC Prudence in my portfolio and it is indeed a great fund to invest in.

Hi Vivek

I agree with you.I will put only that money in balanced funds which is not needed by me at least for the next 5 years.For my short term as well as emergency requirements I will put money only in bank fixed deposits.

Hi Vivek K & Anil,

Regarding Emergency Fund – I am not talking about the people who have planned their financial life in someway or the other but what about rest. Almost 95% 😉

I have practically seen this happening & sometime emergency not mean real emergency but another opportunity popping – people start hopping. Or anything else that was not planned. Hope it clarifies the point.

Hi Hemant

Yes, I understand.Some people don’t have any concept of time horizon.Many start investing even in equity mutual funds without making any provisions for meeting their short term requirements and then to meet their short term needs they just discontinue their SIPs

Hi Hemant

Only yesterday I was thinking that after your post on best mutual funds of 2012 you had promised to write on balanced funds. I am glad that you have now fulfilled your promise.

Thanks Anil,

I try to keep my promise but sometime they don’t have time deadline 😉

Hi Hemant

Yes, I know you must be having many topics in mind all the time.Then you have to decide about the priority.I also face this situation many times.

Dear Hemant,

Thanks for the information once again…. & congrats for the great job tht u are doing…

I have recently started investing in MF’s via SIP’s. My funds are as follows-

1) ICICI Focussed Bluechip

2) HDFC Equity

3) FIDELITY Equity

4) UTI Dividend Yield

5) IDFC Premier Equity Plan-A.

For All i have selected the growth option. I also plan to start sip in gold fund soon. My query is do i need a balanced fund for a goal 3yrs later. Or shd i opt for a RD instead. Thanks..

Even Anil ji is welcome to answer my query….

Hi Sameer Shah

Balanced funds are best for medium term investment.For medium term I mean around five years.For three years bank RD will be ideal.Your fund selection is good.

Hi Hemant

Thanks for another nice article. My dad ( 62 yr old) had invested in HDFC Prudence (G) in 2005 as a lumpsome at NAV of 68/-. I have restarted monthly SIP of 10,000 in the same fund for him. Is this the right way or shd i divide this monthly amount equally into 2-3 balanced funds?? Is Balanced funds a good option for retired individuals who can withstand 65% equity exposure??

thanks a lot………

Hi Priyanka

Investment horizon is important.If it is more than five years then balanced funds are OK.For a shorter time frame debt fund will be a better option.If risk appetite is low then equity exposure should not be more than 30%.

Yes, you can have more than one balanced fund for diversification.

Thanks anil ji… so do u recommend MIP then?? As they have around 15-20% equity allocation…

my another query-

Which is the recommended investment for a Firm ( Limited Liability Partnership with 3 partners) tht would be safe, give moderate reurns as well as tax efficient?? As its a firm, the tax bracket is 30%. Here agin, are Balanced funds a good bet, or shd we go for a Large & midcap category ( SIP mode) thanks again….

Hi Priyanka

The most important thing is to have proper asset allocation all the time which is decided by your age, risk appetite and many other factors.For maintaining asset allocation you have to do periodic rebalancing of your portfolio.Moreover, as you approach your goals you have to gradually move from equity to debt.So you can keep a pure debt fund like BSL Dynamic bond fund also in your portfolio to do rebalancing.As far as risk is concerned there is no instrument without risk.

Hemant, I also have another query.

I am 32 yr old & have sip’s in the followin MF’s-

1) ICICI focussed bluechip

2) HDFC Equity

3) Fidelity Euity

4) UTI Dividend yield

5) IDFC premier Equity Plan-A ( All in Growth Options)

I m soon starting a gold SIP. Do i need a balanced fund for a goal 3 yrs later or is RD a better option?? Kindly advise……

Hi Priyanka

Please see the reply given to Sameer Shah.

Anil Ji , ur opinion is also welcome..

thanks a lot

Hi Priyanka

Reply already given.

Great article Hemantji. Looks like you have an inclination towards HDFC Prudence, it is a great fund to invest. Your view on Partial Withdrawal is insightful, every 100 we draw, 65 of it is from equity. I guess when you are comparing the best funds, expense ratio hardly matters because I will take a fund that performs well with slightly higher expense ratio than a fund that performs poorly with lower ER. Thanks for sharing.

Hi Mansoor

I think like me Hemant is also greatly influenced by the fund manager of HDFC Prudence fund who also happens to manage funds like HDFC Equity and HDFC Top 200.Prashant’s views are mostly similar to Hemant’s views.

Great to know Anilji. I agree with you, amongst all the fund managers in India, I respect him the most. But I also like Kenneth Andrade and Apoorva Shah. It’s a personal view based on how well they have managed people’s money.

Hi Mansoor

Yes, there are many star fund managers across different fund houses.However, I believe that fund houses also play a role in the performance of funds.Star fund manager can shine only if the fund house provides the necessary environment.I have seen many good fund managers losing their shine on quitting good fund houses.

Hi Heman/Anil

I am 32 Years Old blessed with a daughter and I am a Medium Risk appetite person. I am planning to invest in Following SIP’s, can you please check and advice me, should I need to change any MF’s. Thanks in advance.

TARGET MUTUAL FUNDS SIP Fund Type

HDFC TOP 200 (G) 1 3,000.00 Large & Mid Cap

HDFC Prudence (G) 2 2,000.00 Balance Fund

DSP Black Rock Top 100 – G 3 1,500.00 Large Cap

ICICI Pru Focused

Bluechip Equity Inst I-G 4 1,500.00 Large Cap

Franklin India Bluechip-G 5 1,500.00 Large Cap

Goldman Sachs 6 1,500.00 Multi Cap Funds

Reliance Growth 7 1,500.00 Mid & Small Cap

UTI Opportunities-G 8 1,500.00 Large & Mid Cap

Birla Sunlife 95 9 1,500.00 Balance Fund

Tata Balanced 10 1,500.00 Balance Fund

Canara Robeco Balance Fund 11 1,500.00 Balance Fund

DSP BR Balanced Fund 12 1,500.00 Balance Fund

Hi Anwar

You don’t need 13 funds.You can easily manage with four to five funds.Selecting so many funds is diversification in numbers but not in style.Select only one fund from each category as well as one fund house.

Hi ,

I have invested in following SIPs.. Kindly let me know your opinion:

HDFC Prudence – 4000

HDFC Top 200 Fund – 4000

Fidelity Equity Fund – 4000

DSP BlackRock Equity Fund – 400

UTI Opportunities Fund – 3000

IDFC Premier Equity plan A – 3000

HDFC MIP – LTP : 100000

Birla Dynamic Bond Fund – 100000

age 34 yrs

Hi Sahil

Your fund selection is good but your portfolio is not properly diversified.There is no pure large cap fund.There are three large and midcap funds.Three funds are from the same fund house.

HDFC MI and BSL dynamic bond fund are lumpsum investment

Hello ,

I want to invest around Rs 50000 every month for atleast 3 years,, and I would want to reap the benefits only after 10 years. I am willing to take a slight high risk in my investment but I am confused which funds to choose for the highest returns . Should I go for large cap or mid cap or small cap for a good return on the investment after 10 years ??

Can you suggest me the right type of fund for high risk, high return and which would be redeemed only after 10 years ??

Regards,

Austin

Hi Austin

Aiming for highest returns can not be the only reason of your investment.High risk does not always translate in to high returns.Risk and reward have to be properly balanced.Hence the portfolio has to be diversified across the category of funds as well as fund houses.

Dear hemant,

My question is i f balance fund can give this much return than what is the benafit to invest in growth fund? I am investing currently 8000/month in M.F. these are

IDFC Premier equity fund growth2000/month- 7 sip has done

HDFC Equity Fund growth1000/month -7 sip has done

HDFC Top 200 fund growth 1000/month -14 sip has done

IDFC Sterling equity fund growth 1000/month- 7 SIP has done

Reliance Gold Saving fund 1000/month- 5 SIP has done

Reliance Pharma Growth 1000/month- 5 SIP has done

ICICI Focused bluechip equity fund growth 1000/month- 14 SIP has done

These all are in Growth fund. Now please suggest me should i withdraw any of fund and invest in any balance fund but as i am already having 2 funds from HDFC than should i consider any balance fund from HDFC otherwise it would b 3rd fund from HDFC ! As you suggest not to invest more than 1 fund in 1 house but i see only HDFC fund which is giving only return more than 30 %

Hi Ashish

Return is not the only reason for selection of funds.Your portfolio must be diversified across types of funds as well as fund houses.You are already holding more than one fund from three fund houses.This makes your portfolio risky although your funds are good.

Dear Kapila ji,

Than what is the reason of selection of fund?

as i have given my portfolio to you than according to you which fund i should stop and in which balanced fund i should start the investment? please suggest and my query is how a person should decide that where he invest either in debt fund or growth fund or balanced fund? and what is the basic difference in Balance fund and growth fund?

Regards

Dear kapila ji…..

still waiting your reply…..

please reply

thanks

Dear Hemantji,

Thanks for writing such useful articles.

i have started investing in mutual funds from Jan,2011. Details are as below

Franlin India bluechip-2000

Birla sunlife frontline(G)-1000

icici prudential focused bluechip-2000

hdfc mid cap opportunity-2000

Reliance regular saving fund(G)-1000

Kotak opportunities(G)-1000

Morgan Stanley A.C.E.(G)-1000

L & T infrastructure,cumulative option-1000

are these funds good to invest for long term(10 to 15 years)?

Do i need to add balance fund?

Kindly reply.

Hi Sachin

Already there are too many funds in your portfolio.However, for the purpose of rebalancing you can consider investing in some pure debt fund or balanced fund.Try to reduce your funds. There is no point in having too many similar funds.

hello hemant sir, i have 6 lacks rupees..pls suggest me where should i park it..fmp or mis scheem of post office.

Anil Ji,

thanks for kind reply.

I will sell Kotak Opportunities,Morgan Stanley & L&T infrastructure and will start HDFC Balanced Fund.

I want to keep remaining Funds for more 15 t0 20 years. I just want to know whether remaining funds will give good returns in future or not?

Thanks & Regards

Sachin

Hemant/Anil,

Thanks for the great article. I had Rs. 25000/- invested in Reliance Top 200 fund – Retail Growth plan (formerly Reliance Equity Advantage Fund) while it was launched in 2007 and stayed quite all these years. I could not understand its performance. Is it wise to keep it like that or to close it and shift the funds to any other MF’s. Your suggestion is greatly appreciated.

Regards,

Dora.

Hi Dora

You can not sit on your investments.If the performance of a fund falters it is better to get out and invest in a performing fund.

Dear Hemant and Anil,

I am pretty new in world of Mutual Funds. I’d like to invest Rs. 8000/month. Recently, i have invested Rs. 2500/- in UTI Opportunities (G) via SIP. Could you please suggest other funds where i can lend rest Rs. 5500? I’d appreciate your help.

Thank you,

Anupam

There are a few good funds..

HDFC Top 200

HDFC Equity

DSP BR Top 100

Franklin India Bluechip

ICICI Pru Focussed Bluechip

IDFC Premier Equity A

Mind you, there are different categories of MFs (large cap, mid cap, multi cap etc). So you can go through the archives and then decide according to your requirements and goals

Hi Anupam

You can consider investing in ICICI Prudential Focused Bluechip Equity and IDFC Premier Equity.

Hi Hemant /Anil,

I am very new to mutual fund and i would like to invest 20k ..Could you please suggest me which best investment that i can go with for period of 3-5 years..I have already invested in LIC (Pension Plan) & PPF which are al long term..Now i would like to go for short term investment..Please do help me as i have just started my career and very new to this Investment Field..thx in advance

Regards,

Deepa Rahul

Hi Deepa

Investment in equity mutual funds is done when your investment horizon is long.You can consider investing in two balanced funds like HDFC Balanced Fund and BSL 95 for three to five years.

Hi Anil

Thanks a lot for your Valuable reply..And could you guide me tell exact Mutual Fund Name and Amount ie (SIP) that should be invested for the same….

Hi Deepa

Please refer to the table of balanced funds given by Hemant.The names given are exact.You can divide the amount to be invested equally or in any other ratio.

Thanks Firoz.

Terrific article Hemant. It may interest you and other readers to know that moneysights has been suggesting that I sell HDFC prudence for several months now. While that maybe the suggestion churned out by their software (aided a little by the commission carrot!?), investors must be wary of such suggestions since fund changes must be made taking into account nature of goal, timeframe, assumptions made for a goal, time, risk, etc.

Dear Anil, You have been answering investor questions competently and enthusiastically (I mean that sincerely). While I am sure readers appreciate this I think they must also realize that: financial literacy and free advice are not the same.

Hi Pattu,

It’s news to me – have you asked them the logic behind this.

It’s amazing & amusing that some software can guide people on their investment portfolio 🙂 So finally India is moving towards Quants & Algos…

No. Sometime back I asked them: ‘How do you make a living?’. I literally had to coax out the answer: ‘through commissions’. I then started ignoring recommendations. If AMC commissions are not the same specific fund recommendations logical or otherwise could mean conflict of interest wrt to investor and AMCs.

Conflict of interest is a touchy phrase among many Indians. Many get all worked up and emotional without understanding what is being said.

Investors new to mutual funds could read articles on ‘Types of Mutual Funds’ pick any large cap fund for a start and invest while they learn more about it.

Hi Pattu

I have gone through your guest article.It is terrific ( sorry for using your word but I think this is the most appropriate word )

I think many people make suggestions based on short term performance of the fund.In the short term the performance of HDFC Balanced Fund has been much better.I am also guilty of suggesting HDFC Balanced instead of HDFC Prudence.

Hemant rightly says that some people prefer spoon feeding.

Iam pretty new to the mutual funds.While reading this i got little confused with the categories in which i need to invest.Iam planning to invest 5k per month.Could anyone give me some options and also i would like to know how do calculate returns?

Hi Priyanka

If you are confused with categories then read -Best Mutual Funds To Invest In India In 2012.

In the meantime you can start investing in two balanced funds from the list given.

You don’t need to do any calculations to get returns.You can get this information from Value Research web site.

Hi

Thank you for the wonderful article, followed by some excellent advice to queries.

After reading this and many other articles, I am planning to trim my portfolio from April 2012 onwards. My query:

1) Is there any particular exit plan from one MF to another MF. I mean can I just switch from one fund to another on any given day despite the fact the funds are mostly negative due to present market positions OR I need to wait to go green before doing so.

2) I have the below MFs and am planning to revamp as under:

PRESENT Portfolio

1) HDFC Prudence (Balance)

2) HDFC Top 200 (Large & Mid Cap)

3) DSP Black Rock Top 100 (Large Cap)

4) Reliance Regular Savings (Mid Cap)

5) IDFC Small & Mid Premier Equity (Small Cap) —-> SIP discontinued

6) ICICI Pru Discovery (Small Cap) —-> SIP discontinued

7) Sundaram Tax Saver (ELSS) —-> Discontinued

8) Fidelity Tax Adv (ELSS) —-> For this year as Sundaram Tax non-performing

9) HDFC MIP —> One time Purchase and discontinued

10) Reliance MIP –> One time Purchase and discontinued

11) SBI Tax Gain —> Partially redemption (had to switch to another ELSS as this was not performing)

12) DSP BR Equity —> discontinued SIP and switched to DSP Top 100

Some of the above purchases was done in good faith to be invested in long term only to find they did not perform well and hence had to discontinue and switch to another equivalent peforming fund.

I am planning to TRIM my folio as follows (I will make sure that at least one year is completed before switching the fund to another fund)

1) HDFC Prudence (Balance)

2) HDFC Top 200 (Large & Mid Cap)

3) DSP Top 100 (Large Cap)

Can you please suggest one more to the above to make the folio aggressive. I am looking for long term about 5-7 years may be more.

Thanks

Krish

Hi Krish

First thing which I would like to tell you is that never do any investment before doing your home work. Your portfolio of 12 funds indicates that you started investing without a plan.

Investment in equity mutual funds is done to meet your long term goals and your investment horizon should be more than ten years to reap the benefits of compounding.

You have to diversify across the category of funds as well as fund houses to spread your risk.You can consider the following funds :

ICICI Prudential Focused Bluechip Equity

UTI Equity Opportunities

Quantum Long Term Equity

IDFC Premier Equity

You have to keep track of your funds.You should consider exiting a fund only if it falters in performance or if you need money.

If you select your funds carefully based on consistent long term performance then the need of frequent switchings will not arise.

Hi

Thank you for your response. Yes, you are right to some extent that I kept on investing in too many funds. But when I started, I had only few funds. They were best in the pack at that point of time. I read many articles, took advice and then invested. Over a period of time, I found some funds were not performing and were constantly on decline. So possibly the stupid thing I did was to stop further investments on those funds but kept them alive and started altogether a new fund altogether because there was no point in doing SIP in an under performing fund.

The funds I chose initially were:

1) DSP Equity

2) DSP Tiger ( I have now taken all money from it)

3) SBI Tax Gain (partial redemption)

4) Reliance Regular Savings

5) Sundaram Tax Saver (after SBI Tax Gain started under performing)

I read your last comment of choosing funds carefully, may be I did not with that above funds though everyone was saying my funds selection was extremely good at that point of time).

Anyways, no use of crying over spilt milk, some hard lessons learnt here. You have suggested 4 funds, I understand that I have to choose one of them and add to my revised portfolio as under : Am I correct in understanding this please?

1) HDFC Prudence (Balance)

2) HDFC Top 200 (Large & Mid Cap)

3) DSP Top 100 (Large Cap)

4) ICICI Prudential Focused OR UTI Equity Opportunities OR Quantum Long

Term Equity OR IDFC Premier Equity

Please do reply so that this time I wont be committing any error. I just want to stay invested for long term.

Secondly, all the unwanted funds, shall I simply Exit and transfer to my new portfolio immediately (subject that they have completed 1 year ). Is it that simple ? Please do advise.

Thank you once again for your valuable advice.

Regards

Krish

Hi Krish

The funds I have selected will give you a portfolio of diversified equity funds.All are five star funds.So you can keep all if you want.

Regarding exiting funds if the performance does not show any signs of recovery over a considerably long time then there is no point in persisting with them.You have to take long term view while judging performance.

Keep tracking performance of funds after starting SIPs by comparing with index and peers.

Hi

Thank you ever so much for your advise. Sorry to be pain, but after realizing that I was investing directionless, it makes sense for me to ask you once again that do I exit all my previous 12 Funds. I understand the 04 funds you recommended are performing funds. So if I am revamping my portfolio, surely it cannot now be 12 (previous) + 4 (present) = 16 Funds.

What do I do, gradually phase out and transfer the new promising 4 new funds and continue new SIP with the 4 funds.

Again, apologies, I wont ask you again.. just trying to get this right please.

Regards

Krish

Hi Krish

If you do not need the money immediately it makes sense to gradually come out of the non-performing funds in a phased manner and invest in your revamped portfolio.

Thank you so much for your valuable inputs. It is time for me to do some homework and revamp my portfolio. Thanks again!

Hello ,

First of all I want to thank you for the effort you take of replying to every body’s queries . I need some advice from you on the following .

I am planning to invest around 50 K everymonth in SIPs. I have chosen ICICI Prudential Focused Bluechip , IDFC Premier Equity Fund and HDFC Mid-Cap Opportunities Fund … Could you please guide me on the ratio of investment in these funds ? for Eg 50:25:25 ? Please give me your opinion .

Thankyou .

Austin

Hi Austin

Invest around 75% in ICICI Prudential Focused Bluechip Equity and remaining equally between the other funds.

Our family group’s most investments are in bank FD, L.IC., etc.

Now, we think that we have to invest in other than FD/ L.I.C., for better returns.

Please guide us for investements, as we don’t have correct knowledge of it.

Thanking you & wishing your best co-operation.

With regards.

Dinesh

Hi Dinesh

If your aim is to create wealth in the long term, you can start investing in diversified equity mutual funds.

Dear Sir,

Thanks for your prompt reply.

We want to take minimum risk. Please suggest us 3 best divesified equity mutual funds.

Thanking you & wishing your best guidence.

With regards.

Dinesh.

Hi Dinesh

I would like to point out that in the short term investments in equity mutual funds are risky and you can even lose money but if you remain invested for a longer period of more than ten years you can expect inflation beating returns.If you are not prepared to take any risk then don’t invest in equity funds.

Hello!

Investing in HDFC Top 200 and HDFC Prudence means duplication? I have been advised to chose one of these. But personally I feel both of them are gems in their own way. While HDFC Top 200 is a Mid Cap fund, HDFC Prudence is a balanced fund and undoubtedly both these funds are top performing funds for many years now.

Please advise.

Thanks

Krish

Hi Krish

To spread your risk across fund houses it is advisable to invest in only one fund of a fund house.Moreover, if the fund manager of the two funds of a fund house happens to be the same person there is a strong possibility that many stocks of the two funds will be similar.This defeats the purpose of meaningful diversification.Even if both the funds of a fund house are good performers it is better to avoid investing in both funds.

HDFC Top 200 is not a pure midcap fund. It is a large and midcap fund.

Dear Anil,

I have gone thru ur above article, its splendid work, ocean of knowledge.

I wish to make first investment in MF via SIP. time horizon is more than 10 years.

I wish to start by Balanced fund in the starting, as suggested by you above.

Please advice which fund should I choose-HDFC Balanced fund or HDFC Prudence fund?

Thanks in advance.

Hi Preet

Both the funds are good.In the past the returns of HDFC Prudence have been slightly higher than that of HDFC Balanced. But recently HDFC Balanced has given better return.Both are five star funds.You can select any one.

Thanks for Ur precious comment.

I will start with HDFC balanced, SIP of 2000/m.

Thanks once again.

Dear Sir

I also want to invest in ELSS via SIP from April2012. I don’t have any investments yet in ELSS. Should I start with it now? In case of ELSS, SIP is better or lumpsum?

Please guide.

Many Thanks.

Hi Preet

ELSS funds should also be treated like diversified equity funds.Tax benefits and three years locking period being the difference.In any case investment in equity funds is done when investment horizon is long.So you can use SIP route for investment in ELSS funds also.

Hi Hemant

Read your client- Rohan Doshi’s Investing Journey on Manshu’s blog. He seems to be very pleased with his experience.

Dear Anil ,

Thanks for your earlier suggestions .

I am a 24 old NRI . Because I am abroad I thought of taking the mutual funds in my parents name . They met with a broker friend but the broker told them that he will take 2 % service charge . Now I guess that this 2 % is applicable to every SIP payment . I was investing in the tune of around 40-50 K , so 2 % on every SIP would result in a huge amount if I continue the SIP for a long duration .

As far as I know , Mutual funds can be purchased without any ENTRY LOAD . Can you confirm the same ? Can I buy the mutual funds directly from the AMC ? Is it a complex process because I would need my Dad in India to do the required paper work . Also please tell me if my name or other family member name can be put as nominee in the respective funds in case of an unfortunate event .

Hi Austin

Yes, mutual funds can be purchased without any entry load.There is no need to involve any broker.Fund houses can be directly approached for investing in mutual funds.Paper work will be done by the fund house.Your father has to just provide the cheques and sign the application and bank mandate form.Your name can be put as nominee.

Hello ,

Sorry to bother you again . I am taking the ICICI Prudential Focused Bluechip Equity Fund , while checking their website I saw that there are 3 different types of this fund . ( Inst Growth , Retail dividend, Retail growth ) . So I am a little confused now which one to go with . Can you help please ?

Hi Austin

Go for retail growth option.

Thanks a lot Anil

Hi Hemant ji /Anil Ji,

I have read a lot of your articles. And most of the terms are cleared. Still

Iam unable how we can check the returns of a fund on yearly basis or 3 yrly basis. I meam if i want to check the fund previous year return of last 1/ 2/3 yrs how can we do that.

Hi Munish

You can get this information from Value Research web site.

thanks anil ji.

Hi,

can you help me choose between HDFC Balance and DSPBR balances.

as my exposure to HDFC AMC is high … does it make sense to switch to other AMC if yes then how about DSPBR Balanced fund??

Hi Krunnal

HDFC Balanced fund is a better choice. As I do not have information regarding your other investments in HDFC fund house so it is difficult to comment.

Your post shows that these balanced funds give maximum profit when we invest there for 3-years or more. What are the alternatives to book quick profit ?

Hi Krishna

Investing is a get rich slow and not get rich quick process.

Anil Ji,

In may 2012 i will get a amount around 70000 as a performance bonus. waht you will suggest should i invest in debt funds or in some other . My time horizon is two year. after that will buy a car for my family.

Hi Munish

For investment horizon of two years go for bank fixed deposit.

Very well written article.Another advantage of investing in a balanced fund is that the investor is taxed only when he/she withdraws from the fund ,though the fund manager does regular portfolio re-balancing( buying/selling) to maintain the equity/debt ratio . An investor who does his own balancing through a portfolio mix of equity and debt funds in the same ratio will have to bear the tax implications each time he/she exits or switches between funds.

Balanced fund provides the best of both worlds but one must make a careful analysis before chosing a fund. Secondly this fund is not ideal for everyone. Selecting a fund category depends on many factors which must be evaluated. Seek proper advice from a registered advisor for assistance.

No fund is ideal for everyone.

Kapilji

Can you please advice my fund selection for SIP for 15 years for wealth management mentioned below. Please suggest whether these funds are good performing and my planning is on right track ?

ICICI Prudential Focused Bluechip Equity – Rs 4000/-

UTI Opportunities – 5000/-

Quantum Long Term Equity – 4000/-

IDFC Premier Equity – 2000/-

Regds

Vikram Kumar

Hi Vikram

You are doing fine.

Hi, Hemant/Anil Kumar,

I had invested about 90,000 in HDFC Equity and 1,00,000 in HDFC Top 200 as lumpsum about a year or so ago. Is it wise to remain invested in these or exit right now and invest in a balanced fund like HDFC Balanced ? Pls guide ..

Shambhavi

Investing systematically is a better option than lump sum investment. You should not exit unless you are badly in need of money now as you will be a loser under the present condition of the market. Moreover, investment in equity mutual funds is done with a long investment horizon.

Hello,

I am Lakshmipathy G. I am new to mutual Funds.

I have read some of your links from tflguide.com and my other favourite jagoinvestor , It gave most insights for financial planning.

Now i want to start investing in Mutual Funds. Now I need your suggestions to make it a reality.

1) Goal 1:

Investment Objective : Retire in 10 years.(Achieve Freedom from working for money).

SIP Amount : 20,000 Rs per month.

Risk Appetite: 30-40% loss should be fine.

(20,000 * 12 * 10 = 24 Lakhs -Total Investment. Expecting in case of loss atleast 15 Lakhs after 10years).

Age :31 Years

Marriage: Planning to get married this year.

Dependants: Parents Depend upon me.

Profession : Software Engineer by profession, Musician by hobby(hoping to convert into a profession after 10 years).

Monthly Expenses: 30,000 per month on a average.

Expecting Returns : 12- 15%

Expecting Amount :(50 -60 Lakhs)

Tax Savers: Not planning (Is this correct?)

Gold Funds : Less idea So not planning (Is this correct?)

Index Funds : Less idea So not planning (Is this correct?)

Equity with Growth/Dividend Option : Planning for Growth Option(As i heard Dividend calculation will be little complex)

Plans : 70% Equity and 30% Debt.

Equity: 70%

Large Cap Fund : 15% (3000 Rs)

Large & Mid Cap Funds :15% (3000 Rs)

Multi Cap Fund : 20% (4000 Rs)

Mid Cap Fund : 20% (4000 Rs)

Debt : 30% (Considering Balanced Fund as a Debt Fund)

Balanced Fund : 30% (6000 Rs)

To kick start my self, i thought of doing something in HDFC.

I saw four funds like

HDFC Equity .(CAGR 23.54%)

HDFC Balanced.(CAGR 17.45%)

HDFC Top 200.(CAGR 23.58%)

HDFC Prudence.(CAGR 21.79%)

As i have read from your articles, selecting a same fund house for multiple funds is not advisable.

I am not sure whether to go for a Equity Or Balanced(HDFC Balanced or HDFC prudence)?

If Equity then HDFC(HDFC Equity or HDFC 200) – Large Cap Fund?

If Balanced then (HDFC Balanced or HDFC prudence) – Balanced Fund?

For Large Cap Fund, I am thinking of ICICI Prudential Focused Bluechip Equity OR DSP BlackRock Top 100 Please Advice?

For Large & Mid Cap Funds, I am thinking of UTI Opportunities or HDFC Top 200?

For Multi Cap Funds, I am thinking of HDFC Equity Or Reliance Equity Opportunities Fund – Retail Plan -Growth?

For Mid Cap Funds,I am thinking of IDFC Premier Equity Plan A Or Birla Sun Life MNC Fund (G)?

For Balanced Funds HDFC Balanced or HDFC prudence – Balanced Fund?

Need your help on this?

2) Goal 2:

Investment Objective : Child Marriage or Child Education after 20 Years.

SIP Amount : 3,000 per month.

Risk Appetite: 0% loss

Age:31 Years

Expecting Returns : 8.6%

Expecting Amount :20 Lakhs

Plan : PPF for 20 Years.

So not considering PPF For the first Goal.

Please help to make my dream reality.

You are 31 and not even married. I don’t understand why you want to retire in ten years. For retirement planning keep your investment horizon long.

Sir,

Can you please advice my fund selection for SIP for 15 years mentioned below. Please suggest whether these funds are good performing and my planning is on right track ?

HDFC Mutual fund (tax saver growth) -monthly SIP -1000

SBI – Magnum TaxGain Scheme -monthly SIP -1000

ICICI Prudential Focused Bluechip Equity -monthly SIP -5000

UTI Opportunities -monthly SIP -5000

HDFC TOP 200 -monthly SIP -3000

IDFC Premier Equity -monthly SIP -3000

Regds

Vikram

I am not an expert but this looks good to me. However, don’t keep on investing blindly for 15 years, keep checking the performance at least once a year and get rid of any non-performing funds.

Hi,

I am planning to open a SIP, please suggest me which fund should I opt for.

I want to start with investment in SIP with minimal 2k/month.

In current, all my investments are in asset class like LIC, PPF, FD, RDs.

Thanks,

Shashi

You can start with a balanced fund like HDFC Balanced.

Hi Hemanth/Anil,

I went through your articles regarding balanced MF, investment in equity MF, then investment in ELSS.

I Understood that ELSS has lock in period. we should look for long term.

In Equity core & satellite type of investments are there , we should look in diversified investment across mutual funds.

Balanced MF tradeoff risk and returns.

I am looking for long term investment 5 – 7 years. I have a strong heart and mind for market volatility. Investment method will be SIP.

i earn 5 lpa. i am 24 years old. I am investing 10000/month in FD and planning to start term insurance and PPF as per one of your articles.

1) How much % of income is regarded as best for investing in MFs.

2) Which one to choose? Equity (Large cap, midcap etc) , ELSS, , or Balanced MF

regards,

Sudheer

Since you are young you can have large exposure to diversified equity mutual funds. Select one fund from each category and keep your investment horizon long.

Thank You.. 🙂

Hi,

I would like to know would it be a good option to invest in a theme based MF via SIP. I currently have SIPs in Large Cap eqity MF’s:

1. ICICI Focused Bluechip

2. HDFC top 200

I am planning to start an SIP in one out of SBI FMCG Fund or HDFC Balanced fund. Is it a good option to go for FMCG fund??

Thanks

Rajan

Both funds are good but serve different purpose. You can invest in FMCG fund but exposure should be limited.

Please advise on the SIP portfolio as under

Large Cap

1 ICICI Prdential Focused BlueChip

2 Franklin India Bluechip

L&M Cap

1 UTI Opportunities

M&S Cap

1 IDFC Premier Equity Plan A

2 HDFC Mid & SMall Cap

Multi Cap

1 HDFC Equity

2 Quantum Long term

Balanced

1 HDFC Prudence

Debt

1 Franklin Short Term Income

ELSS

1 ICICI Pru Tax Plan

2 Franklin Tax shield

3 HDFC Saver

I am planning to invest 5000 pm in each, please advise the following;

Should I keep both large cap or 1. If 1 which one.

Should I keep both M&S cap or 1. If 1 which one.

Which multi cap should I keep

Which 2 ELSS should I keep.

In addition, I am planning to start 2 ETF of 5000 PM each.

Please advise the best portfolio for long term investment plan with average risk.

Already replied.

Please advise on the SIP portfolio as under

Large Cap

1 ICICI Prdential Focused BlueChip

2 Franklin India Bluechip

L&M Cap

1 UTI Opportunities

M&S Cap

1 IDFC Premier Equity Plan A

2 HDFC Mid & SMall Cap

Multi Cap

1 HDFC Equity

2 Quantum Long term

Balanced

1 HDFC Prudence

Debt

1 Franklin Short Term Income

ELSS

1 ICICI Pru Tax Plan

2 Franklin Tax shield

3 HDFC Saver

I am planning to invest 5000 pm in each, please advise the following;

Should I keep both large cap or 1. If 1 which one.

Should I keep both M&S cap or 1. If 1 which one.

Which multi cap should I keep

Which 2 ELSS should I keep.

In addition, I am planning to start 2 ETF of 5000 PM each.

Please advise the best portfolio for long term investment plan with average risk.

Select one fund from each category and not more than one fund from a fund house.

Thanks for the response. It would be a great help to suggest the best portfolio since selection from the list is becoming bit difficult.

Thanks for your comments. I am planning to go for SIP as under;

Large Cap – ICICI Prdential Focused BlueChip – INR 5000 pm

L&M Cap – UTI Opportunities – INR 5000 pm

M&S Cap – IDFC Premier Equity Plan A – INR 5000 pm

Multi Cap – Quantum Long term – INR 5000 pm

Balanced – HDFC Prudence – INR 5000 pm

Debt – Franklin Short Term Income – 5000 pm

As you suggested I have kept one fund from each category and from fund house. I need your support for the following;

Should I keep Debt fund in my portfolio

Do I need to rebalance the amounts for each fund

Since I have already kept funds from ICICI/HDFC/Franklin, and I need to have ELSS for Tax saving (being NRI PPF is not allowed), please advise which ELSS I should keep.

1 ICICI Pru Tax Plan

2 Franklin Tax shield

3 HDFC Saver

Please advise on the above request.

Dear Hemant / Anil,

Please advise on the above request.

Thanks Anil,

Unfortunately, you have not replied to my basic question as under:

1) Do I need to rebalance the amounts for each fund (Fund selected are ICICI Prdential Focused BlueChip – INR 5000 pm / UTI Opportunities – INR 5000 pm / IDFC Premier Equity Plan A – INR 5000 pm / Quantum Long term – INR 5000 pm / HDFC Prudence – INR 5000 pm / Franklin Short Term Income – 5000 pm)

2) Should I keep Debt fund in my portfolio

3) Since I have already kept funds from ICICI/HDFC/Franklin, and I need to have ELSS for Tax saving (being NRI PPF is not allowed), please advise which ELSS I should keep.

a ICICI Pru Tax Plan

b Franklin Tax shield

c HDFC Saver

Dear Hemant / Anil,

Awaiting your kind support and guidence.

Dear Hemant / Anil,

Awaiting your kind support and guidence on below;

Thanks for your comments. I am planning to go for SIP as under;

Large Cap – ICICI Prdential Focused BlueChip – INR 5000 pm

L&M Cap – UTI Opportunities – INR 5000 pm

M&S Cap – IDFC Premier Equity Plan A – INR 5000 pm

Multi Cap – Quantum Long term – INR 5000 pm

Balanced – HDFC Prudence – INR 5000 pm

Debt – Franklin Short Term Income – 5000 pm

As you suggested I have kept one fund from each category and from fund house. I need your support for the following;

Should I keep Debt fund in my portfolio

Do I need to rebalance the amounts for each fund

Since I have already kept funds from ICICI/HDFC/Franklin, and I need to have ELSS for Tax saving (being NRI PPF is not allowed), please advise which ELSS I should keep.

1 ICICI Pru Tax Plan

2 Franklin Tax shield

3 HDFC Saver

Your fund selection is OK.

Dear Sir,

We have never invest in Mutual Fund.

Is this right to start investment in Mutual Fund through SIP ? If yes,

please suggest us in which co. is the best for new investor. Our goal is to

get good returns in our investments.

Further also guide us that is it right decision to invest in “BIRLA SUNLIFE

CENTURY SIP” for the purpose of Investment in Mutual fund along with Life

Insurance ?

Please advice us, your guidance will be very useful to us.

Thanks & Regards.

Dinesh

Investment and insurance should not be mixed. You can start with a SIP in good balanced fund.

Thanks for your prompt reply.

O. K., Investment and Insurance should not be mixed, then advice me which are the 5 best balanced fund, so that I can start with a SIP.

I am new Investor, so only balanced fund is suitable to me ? or Should I invest in differenct type of mutual funds ?

Thanking you & awaiting your earliest advice.

With regards.

Dinesh

Thanks Anil,

Unfortunately, you have not replied to my basic question as under:

1) Do I need to rebalance the amounts for each fund (Fund selected are ICICI Prdential Focused BlueChip – INR 5000 pm / UTI Opportunities – INR 5000 pm / IDFC Premier Equity Plan A – INR 5000 pm / Quantum Long term – INR 5000 pm / HDFC Prudence – INR 5000 pm / Franklin Short Term Income – 5000 pm)

2) Should I keep Debt fund in my portfolio

3) Since I have already kept funds from ICICI/HDFC/Franklin, and I need to have ELSS for Tax saving (being NRI PPF is not allowed), please advise which ELSS I should keep.

a ICICI Pru Tax Plan

b Franklin Tax shield

c HDFC Saver

Hi

Could this be a dream portfolio for long term wealth creation at least 10 – 12 years away for retirment please.

HDFC Prudence

DSP Top 100

Reliance Regular Saving Equity

ICICI Pru Discovery

I am tempted to add Quantum Long Term Equity to the above . This will help in neutralizing the aggressiveness of the overall Portfolio with only DSP Top 100 conservative.

Am I thinking on right lines? If not your valuable suggestions please.

Thanks

Vikas

Iinvest 3500 pm in mutual fund.2500in balancegrowth fund (sip)1000 in equity fund. Should icontinue or withdraw.

Hi Devendra,

You can continue with your portfolio.

Hello Hemant & Anil.I must appreciate your dedication & helping nature..

I want to invest lumpsum 4 lacs.

Aim of investment is to yearly payout divident or something like that & to be used it as a rent of my flat so that it could lower the stress on my sslary.Please suggest me proper fund.

My 2nd question is I am doing SIP in DSP Black rock top 100equity fund reg. Plan growth since 1year.Can I stop it &start SIP in icici focused bluechip?j

Thanks & regards.

Dear Mr. Mandawar,

Its difficult to plan for a fixed amount from mutual fund sinvestment. But yu can supplement it with a fixed income instrument like FDs to achieve your objective. Monthly Income plans are a goo dopton when you wish to have regular income.

Both are good funds and switching to other should result from under performance for a long time and not due to difference in returns.

Sir,

I’m planning to invest in Mutual Funds and Sector fund through SIP of Rs.10,000/-pm for 10 years. Here i chose some funds but not sure of stable assets and funds allocation. Kindly suggest me in funds selection and what amount should I invest in each fund. And any alteration recommend will be more helpful.

My ASSET ALLOCATION:

Sector fund:

1. SBI Magnum FMCG Fund

Large & Mid Cap Funds:

1. DSP BlackRock Top 100 Equity

2. ICICI Prudential Focused Bluechip Equity OR ICICI Pru Discovery Fund ???

3. HDFC Top 200

Mid & Small Cap Funds:

1. IDFC Premier Equity Plan A

Thank you.

Hello sir,

Can you please give review on HDFC LifeGrowth Plus , an ULIP plan from HDFC

Hi Pranesh,

Go through the following link:

https://www.retirewise.in/2010/04/what-is-insurance-investment-or-expense.html

nice article

Dear Sir,

I am planning to invest in MF SIP(balanced funds). About 3000 PM. Please if you can suggest which fund should i invest and for how long should i keep for better returns.

Also please if you can let me know the difference between GOLD ETF and Gold fund, and which is the best to invest in from these 2. I am also planing to invest in gold also.

dear anil ji,

i have doing sip investment

ICICI dynamic:-2000

hdfc equity:- 2000

HDFC top 200:- 2000

ICICI pru focuse blu chip:- 2000

now i wan to start a investment in balanced fund. can you guide which balanced fund i can start for investing.

Comments are closed.