Smart Fooling Tips

Guaranteed: This is the perfect Word for such Ads, we Indians love Guarantee.

Daily Profits: Just follow this & you don’t need to work.

Perfect: Just Read “ALL” in place of “Many”.

Truth: They are saying “We cannot be Successful without YOU”.

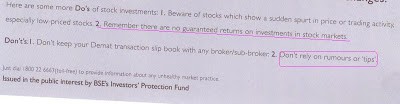

Read what Bombay Stock Exchange(BSE) have to say.

Such kinds of false promises are not only given in Equity Investments but also in Insurance & Other Investment Products.

There are no Short-Cuts in Life & same applies to Investments as well.

Always remember Investments Also follows The Rule of Farm: You will Sow the Seed, it will turn into a Small Plant & then Tree. Finally it will give you Fruits.

If something appears too good to be true then probably it is not: So better if something sounds great; then make sure you investigate well because there are more chances that it’s not that good as it sounds. हर चमकती चीज़ सोना नहीं होती|

Must remember there are no Free Lunches. These are the Big Financial Mistakes & should be Avoided.

Feel Free to Add your Comments.

Very True…nowadays some have also started making fool by sending bulk messages to people say try for a week for FREE. And some websites are sending reports what they have recommended in last few years and what is the result of that. But they never tell in which recommendation they went heavily wrong.

Hi Purvesh,

These websites or sms services should be avoided like a plague.

Very very true…. हर चमकती चीज़ सोना नहीं होती|

🙂

Hi Hemant

A nice collection of ads to fool people. Unfortunately there is no shortage of fools. I am sure some people must have been duped by these ads.

The following remark was made by a person while discussing the negative returns of equity mutual funds this year.

When even God can not give you fruit in one year how can a fund manager deliver extraordinary returns in one year?

Hi Anil,

But these guys are crazy – today I got a mail (I don’t how they get our email ids)

Subject: 4.83% + 1.8% Profit- Oct 13 Sample Trades

Hi !

We have successfully demonstrated that using strategies can be “Safer” and has a potential to provide “High Returns”

Today’s “Basket Trade” current valuation of sample strategy suggested at 9.20 am, is Profit of 7925/- for today. (rates around 11.13am)

Profit of 4.83% in barely 2 hours initiating sample investment strategy.

———————–

See you & me can understand that this is not possible but what about layman 🙁

KINDLY LET ME KNO ABOUT NIFTYSURESHOT WEBSITE. Is this trustworthy.

Hi Sandeep,

I don’t have any idea about NIFTYSURESHOT but to me it looks similar to what I have mentioned in article.

Very nice article Hemantji. Another regret after reading this :). I actually paid couple of thousands to a website called 10paisa.com few years back. Some of their recommendations worked, while others failed. Mostly failed, so I am guessing that they guessed it too. Now, I feel better to stick to some renowned names like Infosys, TCS, Colgate, P&G etc for long term equity exposure or simply stick to good Mutual Funds. There is no free lunch, but we keep looking for it 🙂

Hi Mansoor,

Very true “There is no free lunch, but we keep looking for it” 😉

How about in day trading, don’t u think the prediction is more controlled there, following technical details…

Hi Anupam,

Day trading is a zero some game & 99% of the people lose the game.

Could you please tell me more. I thought fundamental analysis and technical both are necessary and important to judge a stock’s behavior.

My knowledge is zero here and trying understand as much as possible. I appreciate your efforts so far.

thanks

HI HEMANT,

MY monthly SIP PORTFOLIO IS,

ICICI PRU FOCUSSED BLUECHIIP —Rs2000

HDFC EQUITY —Rs2000

RELIANCE REGULAR SAVINGS FUND —– Rs2000

DSPBR SMALL AND MID CAP —- Rs2000

HDFC MIDCAP OPPURTUINITIES ———Rs1000

ICICI FMCG ———— Rs 2000

RELIANCE PHARMA ——– Rs 1000

What change is required in my portfolio.

Hi Sweta,

Your portfolio looks ok.

Hi Hemant,

My SIP portfolio

DSP BR TOP100- 2000

FRANKL INDIA BLUCHIP- 2000

SUNDARAM SEL MID CAP- 1500

HDFC TOP 200- 2000

ICICI PRUD DISCOVERY G- 2000

RELIANC REG SAVGS BALANCED- 2000

MAGNUM TAXGAIN- 1500

RELIA PHARMA- 1000

Is it ok?

I want to add 8000 more to it, any changes u suggest. Can i continue this for 5-8 years or should it be reviewed for performance? Recently i visited ICICI to increase my SIP amount, he suggested me to invest in ICICI pinnacle super(which has 70% equity & 30%debt) with lockin period of 5-10 yrs. he said it will give highest NAV and approx tax free return of 16-18%. Is it safer option than mutual fund with better returns than FD for 10 yr investment? or shd i enhance my mutual fund amount only..

Hi Chavadi,

Dont go for ICICI pinacle super? It is an ULIP. Dont mix your investments with your insurance?

If you want to increase in your savings, increase in your existing funds or add HDFC mid cap oppurtunies fund to your portfolio for longterm returns.

Regards,

Playboy

A couple of years ago, in response to an SMS, I invested some money in a stock and I am still applying Burnol to my burned fingers!!

Thanks for the advice.

Hi Hemanth,

I want to refine my investment portfolio. So thought of taking suggestions from you. Kindly let me know what is your fee for consultation and how long its valid.

– David

Hi David,

Right now we have only one service – financial planning.

Dear Sir ;

Should one opt for ( On his own) for A group shares or midcap / or samll cap ONLY as a strategy for long term Investments , looking out to volatilityin The stock markets ,

Hi SS Dahale,

If you have expertise in selecting the shares, you can go for the group as you have listed. But as a long term strategy, you should have a diversified portfolio comprising of different categories then investing in one.

Hi Hemant,

I am 31 yrs old and having following SIP enrolled.

1. AXIS LONG TERM EQUITY-G – Rs. 2000 for Tax Benefit (required after 15 years for Child higher Education)

2. HDFC EQUITY-D – Rs. 2000 for Childs Marriage. (required after 23 years)

3. TATA Retirement Savings fund – Progressive Growth – Rs. 2000 for retirement.

Kindly advise your comments and also advise how much amount would be accumulated at the end of given period considering past performance so as to get rough idea if investments are in right direction.

Thanks, Nikhil

Hi Nikhil,

Read here to know about creating a portfolio:

https://www.retirewise.in/2013/09/core-satellite-fund-portfolio-investment-approach.html

rule of farm is nice and its concept is dating back me to my school days moral stories ie panchatantra aesop fables and many more

At present my MF SIP portfolio is:

1 Birla Sun Life Frontline Equity Growth Regular Plan 1500/-pm

2 Birla Sun Life Monthly Income Growth Regular Plan 1500/-pm

3 SBI Emerging Businesses Fund Growth 1500/-pm

4 HDFC Prudence Fund Dividend 1500/-

please advise

Hi satish,

Read here to know more:

https://www.retirewise.in/2013/09/core-satellite-fund-portfolio-investment-approach.html

Comments are closed.