A family not only gives you love and support – physically and emotionally – but it can also help you financially.

When it comes to financial help from the family what comes to mind at once is a loan or gift from parents or in-laws, for education, weddings, businesses, and in case of emergencies.

But that’s not all, your family can help you in saving taxes too!

Also Check: How to Reduce Interest burden on Home Loan

Very few among us have ever wanted to pay taxes but then we must mandatorily. By understanding the provisions of the Income Tax Act, you can make use of different investments and deductions available to you and reduce your tax liability.

But making use of these provisions only on themselves is not only selfish but also imprudent. If you can spend on your family, invest for their health and future, and even given them gifts or loans, then you can make substantial savings in your overall tax liability.

When you save tax by making use of provisions applicable with regards to family, you not only get tax refunds, but you also get higher post-tax returns on any investments you make in their names. Though, all such expenses, investments, gifts, or loans are not admissible for rebates and deduction under the IT act. Certain rules govern what and up to how much is eligible for rebates and deductions.

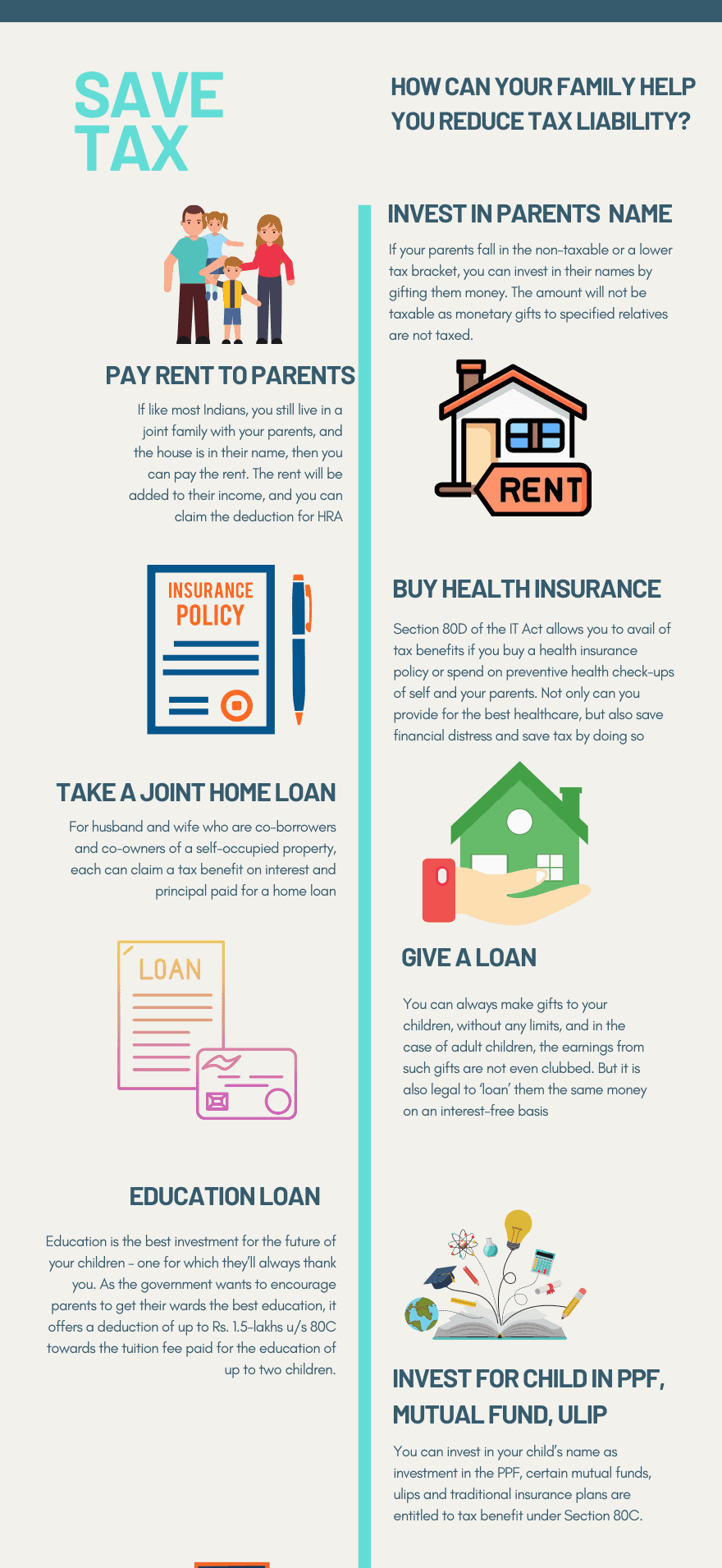

Family help you reduce tax liability

Here we present a simple categorization of perfectly legal ways your family can help you reduce tax liability. We have categorized these rules under three categories – Parents (including Parents-in-law), Children, and life partners – for simplicity. Some of these provisions are applicable across multiple categories.

Note: Consult your CA before implementing any of the suggestions.

1. Parents always help!

The government wants you to take care of your parents directly and indirectly, and therefore, there are many provisions in the IT Act to help you save tax when you spend on them or invest in their names. Some of these provisions are applicable for your parents-in-law too.

Most of these provisions are applicable if your parents are dependent on you, and some are eligible even if they are financially independent.

Must Read – 11 Unusual Ways of Smart Tax Planning

2. Take Care of Their health.

With seniors, a medical emergency is around the corner and it can entail hefty out-of-pocket expenses. At such times, the health of your parents is much more important than your personal financial well-being.

Section 80D of the IT Act allows you to avail of tax benefits if you buy a health insurance policy or spend on preventive health check-ups of self and your parents. Not only can you provide for the best healthcare, but also save financial distress and save tax by doing so. This benefit is available irrespective of the financial status of your parents or in-laws.

The benefit available is dependent on parents’ age as follows:

- Under 60 years: Rs. 25,000 on health insurance + Rs. 5,000 on preventive health check-up = Rs. 30,000

- Between 60 and 80 years: Rs. 50,000 on health insurance + Rs. 5,000 on preventive health check-up = Rs. 55,000

- Over 80 years: Rs. 50,000 on health insurance + Rs. 7,000 on preventive health check-up = Rs. 57,000

U/s 80DDB, you can avail up to Rs. 40,000 or Rs. 1-lakh as a deduction for medical expenses incurred on treatment of ‘dependent’ parents. The limits are applicable for parents under 60-years of age or above it, respectively.

3. Pay Rent to Them

If like most Indians, you still live in a joint family with your parents, and the house is in their name, then you can pay the rent. The rent will be added to their income, and you can claim the deduction for HRA. This way you can actually contribute towards the household budget and ensure a steady source of income for them.

Your parents can claim the rent as maintenance charges for the house property and the rest will be added to their income. Therefore, it is better to draw the rent agreement and receipts in the name of the parent who has lesser income but is the owner of the house. If the parents co-own the property, then they can split the rent and save further individual tax on rental income.

Tax exemptions for HRA will be calculated as per applicable rules – u/s 10 if the employer grants HRA or u/s 80GG if it doesn’t. Overall, as a family, you’ll save substantially by paying rent to your parents.

Also Check: Should I Buy or Rent the House?

4. Gift them the bonus

If your parents make investments in their name in direct equities or equity mutual funds, then long-term gains (LTCG) on such investments are at a flat rate of 10% if such gains are over Rs. 1-lakh. It means all gains made below that amount are tax-free. (in case of investments like Fixed Deposits tax savings can be huge)

This presents another opportunity to save tax. In your IT return, you have to show a gift to your parents, and they need to make a purchase of equities or equity MFs and hold them for more than one year. There is no limit on the amount or method of the gift made to parents and the gifted amount is not added to their income.

As the clubbing provision does not include parents, any re-investment of the gains will be considered their earnings and you will have no further tax liability against it. You can do similar tax planning for your parents-in-law.

11 Unusual Ways Of Smart Tax Planning

Like caring for your parents can help you in saving taxes, so can planning for the future of your kids. You can invest in their education, health, and secure their future with insurance and savings schemes. Let’s see how.

5. Think long-term.

With kids, the goals are usually distant in the future with a time horizon of 10 to 20 years. There are many schemes, government-backed and otherwise, that allow you to plan ahead for that long period.

You can open a PPF account in the name of your minor children and invest in it, to avoid clubbing of their income. Another secure and safe debt instrument is the Sukanya Samriddhi Yojana (SSY) available as a lucrative investment vehicle for female children.

If you want to invest in growth and have faith in the long-term returns of the equity markets, you can invest using ELSS from mutual funds, or a ULIP, or a Child plan from an insurance company. (we don’t recommend missing insurance investment)

Also Check: ELSS VS PPF- Save Tax and Make Money

6. Secure their health.

The deduction u/s 80DDB is available for any ‘dependent’, meaning any medical bills up to Rs. 40,000 are admissible minus the insurance reimbursements, incurred on treatment of your children. The treatment must be for specified neurological, malignant cancer, AIDS, renal, or hematological diseases.

7. Secure their future.

A life cover taken on the life of yourself is an expense made towards securing the future of your dependents, especially children. The IT Act grants special status to all life insurance premiums – for the term, endowment, money-back, or unit-linked – paid to insure the life of the proposer, as well as any dependent family member.

Life Insurance is an EEE instrument in case your policy assures returns at maturity or fixed intervals, such returns are also exempt from taxes. The deduction is available up to Rs. 1.5-lakh limit u/s 80CCC.

Also Check: ULIP vs Mutual Fund + Term Insurance- Which is better for me?

8. Education pays.

Education is the best investment for the future of your children – one for which they’ll always thank you. As the government wants to encourage parents to get their wards the best education, it offers a deduction of up to Rs. 1.5-lakhs u/s 80C towards the tuition fee paid for the education of up to two children. A further exemption of up to Rs. 100 p.m. and Rs. 300 p.m. are available u/s as education and hostel allowances for each child.

Sending children to the best colleges can be expensive, and you may need to avail of an education loan to sponsor your kid’s university fee. The entire interest paid on such education loan, taken for kids’ or spouse’s higher studies is eligible for deduction u/s 80E. This deduction, however, can be availed for only up to 8-years starting from the date of the first EMI.

9. Disability Care

If unfortunately, anyone in your family – children, parents, spouse, or siblings – has a permanent disability and requires constant care and supervision, then section 80DD allows you to avail deduction on expenditure incurred to support such person and to provide them the best possible medical care and rehabilitation.

You can avail of a deduction of Rs. 75,000 if the disability is between 40 and 80 percent, and of Rs. 1.25-lakhs for disabilities more than 80%, irrespective of the actual amount spent. The only condition is that such a disabled person must not have availed the same benefits u/s 80U in their person ITR.

11. Go fund them.

You can always make gifts to your children, without any limits, and in the case of adult children, the earnings from such gifts are not even clubbed. But it is also legal to ‘loan’ them the same money on an interest-free basis.

Each of your adult children has the same tax rules and slabs applicable as you do, and therefore they also can earn a tax-free income up to Rs. 3-lakhs/year. So, any loans to your adult kids will earn income in their names, and hence your tax-liability on such earnings will be nil. You can start by transferring all investments done for them, when they were minors, in their name once they turn eighteen.

Read – Understanding clubbing of income & blunders people make

12. Make your Life-partner a partner in finances!

Married and engaged taxpayers can make their life-partners, their partners in finances and save substantial taxes. You just need to file a separate return in the name of your spouse – some people show all extra earnings as a transfer to her/his name from time to time.

However, consult your financial advisor while making a gift to your spouse, as clubbing provisions may be applicable from case to case.

13. Give a loan or gift to your spouse.

If the annual income of your spouse is below the minimum tax threshold or falls in the lower bracket, then you can loan her/him any extra income you may have. When they will invest it in their name, any earnings on such investments will be considered theirs and not yours.

If the property is registered in the name of the spouse with lower income, then any rental income, actual or presumed, is added to their income, after a standard deduction of 30% towards property maintenance charges. To make the transaction legally binding, you can charge your spouse a nominal interest on the loan or keep their personal property (shares, jewelry, etc.) as collateral.

In the case of an engaged couple, the usual limit of Rs. 50,000 on gifts is not applicable. Therefore, one can gift any amount to the other that they will invest before the wedding. Any income from such investments will be treated as the income of the beneficiary and not the giver of the gift.

14. Share the home, and the debt.

Your home, probably, is going to be your biggest investment, and to save on registration charges, most likely it will be registered in the name of the wife. If you have taken a joint loan on the house property, then it always makes sense to share the deduction also.

You can avail following deductions:

- 1.5-lakhs u/s 80C on the repayment of principal. You can also avail of the deduction for stamp duty and registration within the same limit, but only in the financial year of such expenses.

- 2-lakhs on repayment of the interest u/s 24.

- 50,000 u/s 80EE for loans up to Rs. 35-lakhs, on property worth up to Rs. 50-lakhs.

OR

- 1.5-lakhs u/s 80EEA for loans on property worth up to Rs. 45-lakhs.

You can claim tax benefits either for points 3 or 4, but not both. With a joint loan, each joint holder can avail of all the deductions. Therefore, a couple can avail up to Rs. 10-lakhs of deductions from joint ownership and a joint loan on the house property.

Conclusion

Your struggle to save taxes can be eased by your family, only if you are aware of the multiple provisions available to you. With such savings, you can meet their expectations, invest the amount in their future, and save any further tax liability arising out of earnings on such investments.

By showing that you really care, you not only earn their respect and trust but can save your hard-earned money. It just needs a little planning, some guidance from an experienced and certified financial planner, and the enthusiasm to take it to a conclusion.

So instead of rushing into the infamous March-Madness, you can take your time, and make a game plan to lower your tax liability by using your most precious wealth – your family – in a perfectly legal way.

If you want to discuss your Financial Life with a Professional

Please share your views & queries in the comment section.

I beleive it is a typo above where it is written as “missing investment insurance”

Comments are closed.