The turnover of stock trading via mobile phones has increased significantly in 2022. The number of trading accounts created on trading platforms of brokerage firms has significantly increased.

COVID-19 lockdown resulted in different things –

- More time in people’s hands

- Unemployment or loss of pay

- Work from home

- Surplus money in people’s hands due to lesser opportunities to spend

Must Check – How and why the stocks price change

This led to people trying out their hand at stock trading. The stock markets have risen too in spite of the pandemic affecting every sphere of human activity. This may not paint a realistic picture of the actual economy or performance of the companies.

Brokerage houses are making the most of this situation by offering attractive products and services at attractive prices. For example, Zerodha has deployed a product that allows retail investors to use semi-automated trading strategies. Curated portfolios, simplified transactions, algorithmic trading, and high-quality data points pull people, especially the more digitally savvy ones to get into trading.

Direct Stock Investing Global Issue

This is the case not just in India but across the world. In the US, Robinhood, the brokerage and financial services firm offers a platform with an intuitive user interface, easy account opening process, gamification features, trading in fractional shares, and commission-free trading. It has managed to lure many people to trade in stocks and even complex derivative instruments. This has led to some people being in the money but a majority of people making losses at varying degrees.

If you are new to the stock market or to managing your investments, trading directly in stocks may not be the best course of action irrespective of the attractive offers of the brokerage houses or even a few wins in the stock market.

I can see few long term investors trying to become traders ? pic.twitter.com/ghIxMcWdDT

— Hemant Beniwal, CFP (@hemantbeniwal) December 31, 2020

Why is it not smart to trade and invest in direct equity?

Timing the market

Traders try to time their trades. They aim to buy and sell stocks based on their prediction of the price fluctuation. It is not possible to predict stock performance accurately & consistently. There are many factors at play that an individual cannot control. It can lead to losses and the investment portfolio will be unbalanced.

Gambling

Trading or Direct investing in stocks in India is a form of gambling as many risks are involved. Many young people treat it as a game. They buy and sell to make profits and win money rather than with the aim of investing or creating wealth. This can backfire as in the long run you never win in a casino.

Retail investors depend on market news and views to trade and invest. They usually get the information late. By then, the big players have already factored in the news and views in their trading or investing decisions and the retail investors’ actions backfire.

Also Check: The ART of Thinking Clearly in Personal Finance

Behavioural Biases

People get emotional when it comes to money and their decisions around it. People are unable to sell at the right time, they try to hold on to stocks losing value as they will not be able to bear the real loss, and sometimes, they buy on wrong analyses and refuse to admit that they are wrong. Such biases can hurt one’s finances terribly.

Costs and Taxation

The more trades you do, the more costs you will bear. Moreover, there are short-term and long-term tax implications. There is a lot of time and effort involved in trading. So, consider what you are spending in terms of time, effort, and money to fulfill your direct investment aspirations and analyze the worth of your endeavours.

Read – Mutual Funds Vs Direct Equity

Your Portfolio Vs Index

Few people who recently started investing in stocks in India are happy with their performance. My question to them is it’s because of your skills or markets? (bcoz small & mid-cap indexes doubled from march lows)

Check – Foreign Institutional Investors in India

How to Invest in Direct Equity?

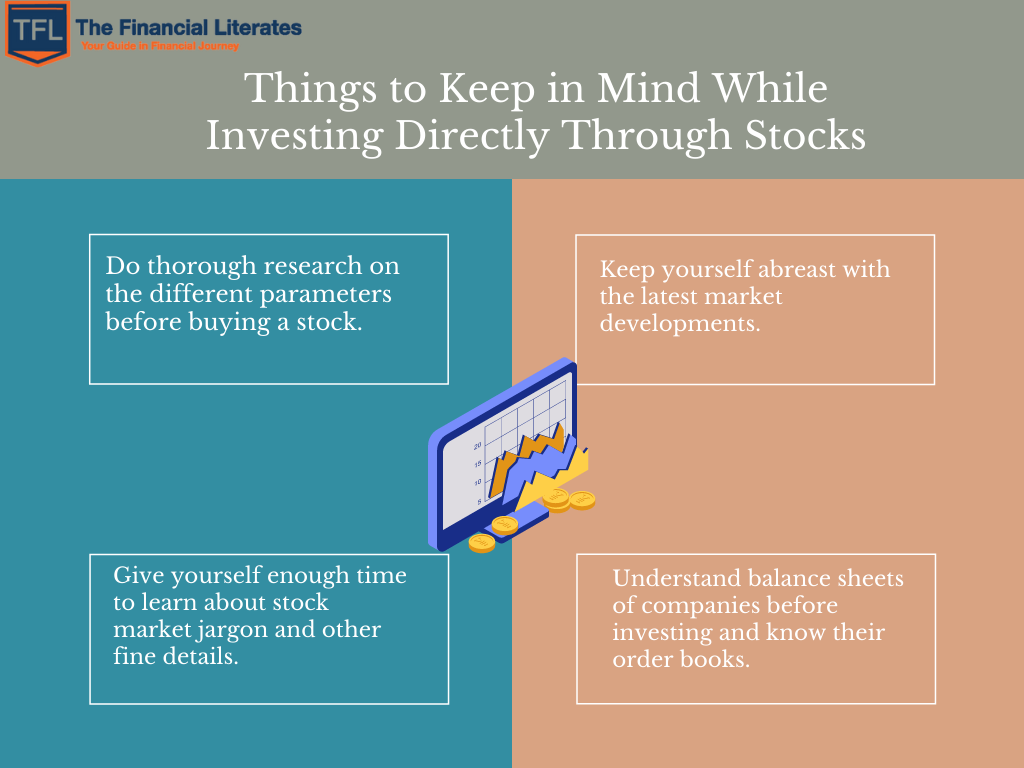

Direct equity investments have the potential to give better returns provided you study, research and analyze before taking action. (which most people can’t) Even then, there is no guarantee of returns or price movements in your favor. So how does one invest in direct equity?

Slow and Steady Wins the Race

Start slow. Prepare before investing in direct stocks. Understand the stock market, individual stocks and their performance potential. Pick out stocks that you would like to invest in for the long term. Do not buy all the stocks in one go. Create a diversified portfolio made up of different asset classes such as stocks, mutual funds and other investments, and grow it gradually over time.

Balanced Investment Portfolio

Create and review your investment portfolio such that it is balanced for your current life stage, near-term and long-term goals. A carefully designed investment portfolio will allow you to generate wealth with the power of compounding over a long period of time.

Also Check: Is it the Right Time to Re-Balance your Portfolio

Fulfill your desires

Many people want to try out stock trading. Others probably are habituated to it. Some people do make money in short-term equity trading and want to continue to do so. They can limit 5-10% of their equity allocation to trading. They should not use up their insurance money, emergency fund or other long-term investment funds for trading. They can set up limits for losses or number of trades so that their hobby or addiction does not cause financial ruin.

Investing in the stock market is exciting when you make profits else it can bring despair. So do remember, that you can always participate in the equity market using other products such as ETFs and Mutual funds.

But if you still want to trade and invest in direct equity, invest carefully and after understanding the impact of the investment on your financial life and emotional well-being.

Hi, Hemant Beniwal

I’m a big reader of your site please give more information.

Comments are closed.