Subsidy on fuel price

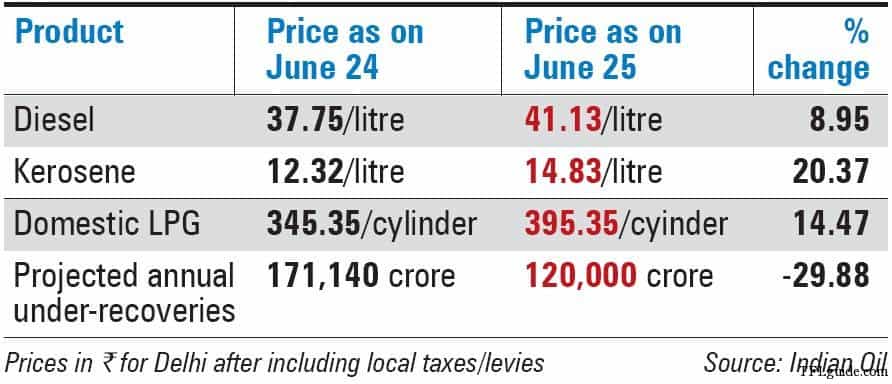

Last year Govt Deregulated the price of petrol – so price is linked to international prices and same is charged to us. But in case of other petroleum products government pay the difference of what were the international prices and what was charged to us, by way of subsidy. For example, if the prices of diesel according to international prices is Rs. 50/- per liter but Rs.40 was charged to end user from filling station the difference of Rs. 10/- per liter is paid by Government through subsidy. Now this Rs. 10 becomes rupees in lakh of crore when it comes to the entire consumption in India. Now to subsidize, government have to either rise taxes or print notes. Printing notes leads to higher inflation and raising tax leaves us poor. So, either way we were charged, either directly or indirectly. Last time when these prices was hiked international crude price per barrel was $72 & currently it is $107 – 50% more. Govt is not having any choice but to hike the price.

But Govt charges so much tax on fuel

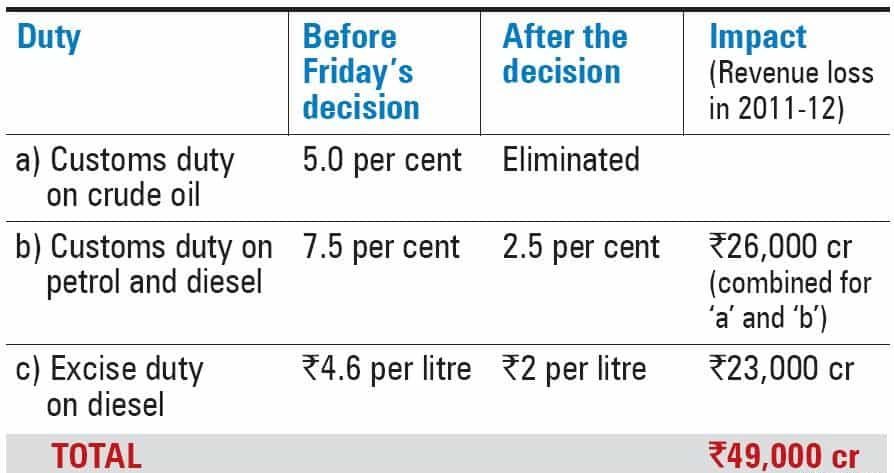

The notable point is that the prices of the petrol or diesel also carries the load of huge custom and excise duty. Government has tried to reduce it but still under recoveries for oil company are above 1 lakh crore. If government were to control their unnecessary expenses and expense that go waste, the price can come down drastically as the taxation shall come down. (have I wrote corruption)

Government Financial Health

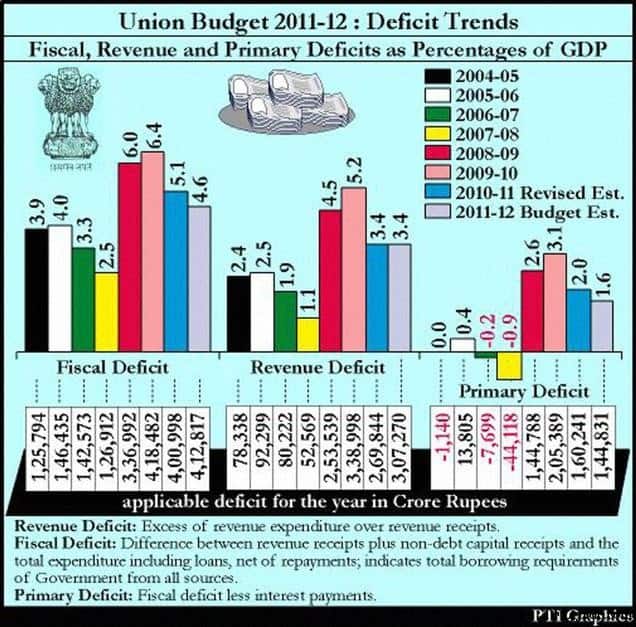

Now, imagine a listed company you are analyzing for potential investment. Its profit & Loss shows it spends more than what it earns. To fund this gap it raises debt every year. Will you invest in such company? We are talking about India as that company & investors are FDI, FII & people who trade with us. In economics it’s called the Fiscal Deficit. A fiscal deficit occurs when government spends more money than it collects in from of revenue. India’s Fiscal deficit target was 6.7% of GDP in FY 10 but they managed at 6.4% as they reduced spending on rural areas. You can check fiscal deficit figures in below table. In last table of duty cuts you can see government will loss Rs 49000 crore – which may turn into .5% extra fiscal deficit if we are not able to find any other revenue source. Pranab Mukherjee said “I have taken the risk of reducing the duties so that relief can be given to consumers”.

Economics Vs Politics on Fuel prices

“I am sandwiched between economists on one side and populists on the other. Political problems will always be there and economic problems don’t wait for solutions of so-called political crisis.” Oil Minister S Jaipal Reddy. I think that charging us directly is much better way than being charged indirectly by way of subsidy and then raising taxes or printing notes. In fact, mechanism of linking to international prices should have been in place much earlier but due to political reasons, such decisions were never taken and therefore delayed. The economic sense is kept on back burner and politics took the front seat – Diesel, kerosene and LPG are still heavily subsidized. Now, when the government really could not afford to further carry on subsidy mode – the market should determine what should be the prices. The only thing is that timing of such decision is not appropriate in our view as public is anyway under tremendous pressure of rise in prices. It would have been a great if the same could be done when the inflation was 5-6%. [Government keep saying that we have to import 80% of the petro products – true we agree but are you using other natural resources in most efficient manner. India in world no.1 source in Iron ore but we are waiting it. ]

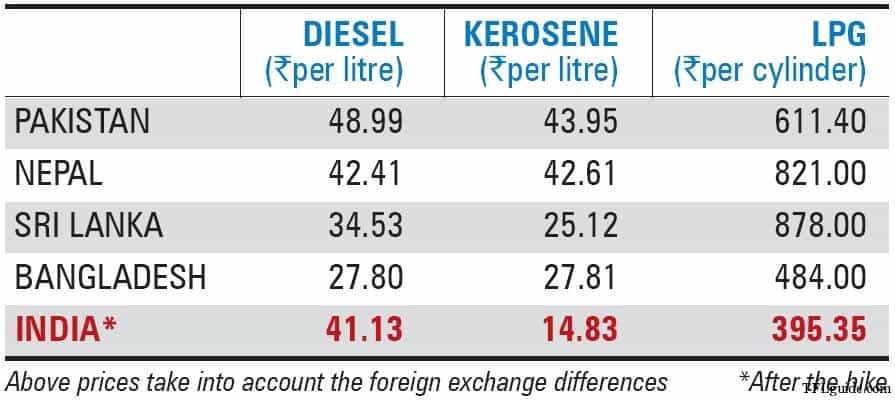

The matter would be hot for some time and there will be lost of debates but soon people will forget and get used to paying the increased prices. Also check what are neighbors are paying.

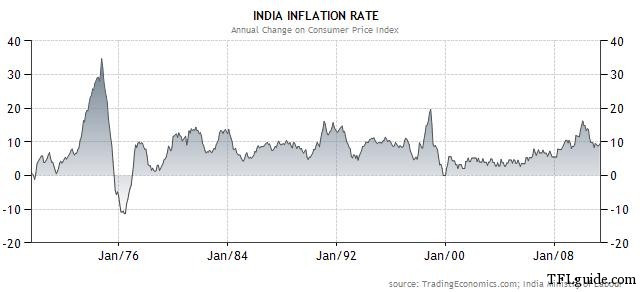

Inflation in India

Please understand that Inflation in India will remain high as it is a developing nation and demand of goods and services is much higher than the supply side. Due to this demand and supply mismatch, the prices will keep going up. When it comes to investing, our aim should be to beat the inflation by a margin. Now, the major concern is that people invest their savings which give them return less than that of inflation rate. Current inflation rate(Chart) is above 9%. This rise in current fuel prices can add another.5% to inflation. Check Historical graph of inflation in India. (since January 1969)

Inflation & your Investments

Now look at where most of our investments are lying. Indians have more than 60% of their saving in Bank Deposits or Post Office or they ENDOWMENT or MONEY BACK policies which give even lesser return than FD. The return on fixed Deposit Currently is less than 9% and if we subtract taxation liability to it, then the net return is even less. Does our investment really keep track with the rate of inflation? Is Our investment leaving us poor at the time of maturity? We need to think about all this before we actually invest.

Credit: Few tables used in the article are taken from Business Standard.Mind you, it is not where you stand that matters,

but in what direction you are moving that matters the most!

Please share what do you feel about Fuel Price Hike Now.

The step in right direction. The govt should also remove subsidy on kersosene prices.

@ Rajiv

This is very much possible, you may see this in coming years.

Removing subsidy leads to optimum utilization of resources.

The price of petrol in New York today is $2.85 per Gallon. That translates into a Price of Rs 50 per litter. Are our prices not too high?Since years, we have been listening that govt is going into losses due to susidies, etc etc. The govt has a reason and an excuse for everything..What about food price hike?? Are we not growing enough food in our land that its price is rising?? Does the Central Govt have any reason for that?

@ Tash

Do you want India to be US(present condition) – multi trillion debt. Secondly fuel prices are different in every country, depending on many factors. we should remember that crude oil is the biggest item in our import list.

If you have read complete article, we have clearly written “if government were to control their unnecessary expenses and expense that go waste, the price can come down drastically as the taxation shall come down.”

Food prices are rising across globe due to multiple reasons including changing weather conditions, farmers are not geting loans, low inventories across globe etc. We are not saying Indian govt. is doing great effort but believe them as we have given them this responsibility.

Hope it clarifies your questions.

It does..but it has become a vicious circle now..with interest rates on deposits so low, the free market so risky and with high inflation, the poor r to go nowhere..the financial and social disequilibrium is rising..hope Delhi Govt.looks at all the factors inclusively..thanks

@ Tash

Difference between rich & poor(vote bank) is increasing from quiet some time, govt. is very serious about this. NREGA(political decision) was launched for this purpose only but corruption ate all the benefits.

Focus is shifting to common man, you will see many changes in next 3-5 years. (hopefully)

I fail to understand that first the Govt enforces taxes on Oil and then gives subsidy. Why is this happening?

And taxes should be kept fixed like Rs.1/Rs.2

As these taxes are on %age basis, as the price of petrol increase, the Taxes also increase. And that is how they are increasing the Indirect Taxes which is not the right way to be doing so 🙁

Hi Karan,

Govt must be confused or trying to confuse people. They can play this tax & subsidy thing if they are giving subsidy to some particular section of the population.

Right now it looks like circular trading.

Here you can see the solution – allow rupee to rise.

linkHi Mohan,

Economics is not so simple – even appreciation of currency has its negative impacts. India is a service economy & that too export – think for a while if infosys, wipro, & other software cos start firing people.

China became so strong just by not allowing his currency to appreciate or linking it with US $. I am not saying this is good or bad but things are much more complex than what we think.

Hi Hemant

One interesting observation from the table is that it is only in India that there is so much of difference between the price of Diesel and Kerosene.This clearly shows that the price of Kerosene has been artificially kept very low by heavy subsidy. The Government calls Kerosene fuel of the poor which is not correct.Even the poor know that it is much more economical and efficient to use LPG.I don’t see anybody using Kerosene stoves these days.This low price of Kerosene is a boon for people who use it for adulterating Petrol and Diesel.Then there is a gross misuse of LPG which is meant to be domestic fuel for cooking in commercial activities.The market is flooded with LPG Kits for cars, LPG Heaters, LPG Electric Generators, LPG Gas cutting and welding sets and other appliances.I wonder why there is no ban on these which openly use cooking gas cylinders.

Hi Hemant

It is a fact that common man in India neither understands markets nor he has any respect for them.Unfortunately, the distributors of mutual funds are operational only in metros and big cities and they are only after people with high incomes. Since majority of the people are investing in post offices, it will be a good idea if just like banks people can invest in mutual funds through post offices.Mutual fund houses can not increase investments in equity mutual funds unless they do agressive marketing in smaller cities and villages.

Hi Hemant

The reason for high inflation in India is not only due to supply and demand mismatch.High food prices in India are also caused by the presence of a large number of middle men who do not allow the produce to directly come in the market.Traders create artificial scarcity of food items by storing them in cold storage and then slowly releasing them in controlled quantities at high price.

Hi Anil,

In food definitely multilayer distribution system is responsible upto some extent. But food is a small part when we talk about inflation.

Hi Hemant

You are right.

Overall a common man feels that he is being cheated.I am already feeling the effect of the hike.The minimum fare which I had to pay for auto rikshaw was Rs 5/- before the hike which has now been raised to Rs 10/-.The price of milk has been hiked by Rs 2/- a litre. All fruits and vegetables have become costly.Though the ministers can call the price hike small but its impact on the common man is huge.

Very good article.

I have few queries

1) Under recoveries means loss to the companies is it? does last year results of these OIL companies shows that?

2) Under recoveries before price hike is 171140 where as after price hike is 120000 crores, This is not matching hike + duty cuts.

Loss to GOI bcoz of Duty cuts 49000 crores, what about gain to Oil companies because of price hike?

I think more benefit is for the traders/institutions playing in the stock market than to the companies itself.

Hi Narasimha,

Under recoveries are losses but govt support them through issuing oil bonds – I don’t how this is shown in their P&L.

These are projected figures for next 12 months

Hey Hemanth,

Very informative article. Four points that I would like to bring up –

1. Taking into account all factors (import of oil, excise duty etc) would you say that the current price of petrol, after hike, is fair ?. Or is the Govt. overcharging the common man ?

2. Obviously the earlier governments knew that because of the subsidies this

problem was going to happen in the future. So did they just let it happen for

the political card ? In the sense, did they leave it so that some other govt.

would face the problem ?

3. Hypothetically speaking, if everyone in India stopped using petrol for a month or so , would it stabilise oil prices by reducing demand ?

4. Will the subsidies for diesel, kerosene etc lead to a price boom in the future ?

Hi Lijo,

Subsidies are definitely not going to help anyone other than politicians to gain some votes. Schemes like Nrega & Food Security bill are pulling us back – I am not blaming congress but every ruling party is doing same thing.

I am not sure if we will ever be able to find a right solution 🙁

It is the advoleram levy of Taxes that is compunding the increase of Fuel prices.

If Government has a will and real concerns for the plight of the ordinary citizens, trade commerce and industry, let it freez the advoleram rated/computed quantum of both State and Central Taxes at the level of 2004, the time present government came to power and leave the market forces oriented pricing in the hands of oil companies and also remove all subsidies.

The prices will fall drastically.

Taxing in billions and dressing the wounds by subsidising in millions theory should be rejected.

For every rise of single paisa in the costs, there is also equal or more than equal rise in Taxes of the governments and thus it is not appropriate to blame the international rise in the pricing alone. The greed in levying and collecting the higher taxes is equally responsible which the governments are unwilling to cure.

It is more like feasting on the corpus of ordinary citizens and what more one can expect from the government ?

Hi Chamaria,

You rightly said but governments can’t live without taxes. Taxes can be reduced if govt. utilizes other available resources well but we all know corruption is eating roots of our country. 🙁

The central govt needs to cut down import duties on crude and excise on refined crude coming out of refineries.Otherwise the dismantling of APM may well see the petrol prices crossing the Rs 100/l mark in coming years.

No body is bothered about common man… they know they will keep quit….. after some time they will be used to it….now there is a hike in diesel price… government also do not have any option…

Comments are closed.