Investments in stocks (Equity), bonds (debt), and mutual funds involve a certain amount of risk. You cannot estimate the level of risk accurately as there are many variables in play – past performance, current performance, micro, and macroeconomic factors. You cannot eliminate risk entirely and therefore you should make the portfolio diversified such that the risk can be managed – plus you should have a clear idea about your Holding Period or in simple terms Investment Horizon for a particular Goal.

I can assure that this post & data will blow up your mind 🙂

What’s your Investment Horizon?

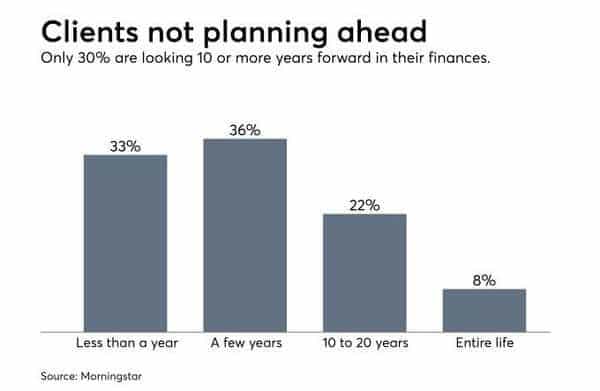

This is US data – clearly shows that only 8% are planning for entire life. The situation in Indian will not be much different. A decade back when I was in the job – I was not discussing goals with the clients but I always asked them about their investment horizon. Whatever that number was I took that at face value & suggested an investment that matches that. (still, most of the clients & advisor follow this) But when I started working on plans – I never asked this question because I know client’s time to reach a goal is going to be his investment horizon or Holding Period.

For example, if your age is 30 & daughter is 1 year old – for her higher education goal, the investment horizon is 16-17 years. If you are planning to retire at the age of 55 & we assume the life expectancy of 80 – your holding period for part of your portfolio will be 50 Years. 50 Years. 50 Years.

As above image shows – people don’t think that long term. This article is only relevant if you understand your investment horizon.

Holding Period

The holding period is the period of time during which an investment is attributed to a particular investor. The holding period is an important factor in risk and returns. Holding period of the portfolio has weightage on individual assets too.

The Holding Period Return (HPR) is the total return earned from an investment or an investment portfolio over the holding period. The holding period is the tenure for which the asset or portfolio was held by the investor.

Holding Period Return formula

Income + (End of Period Value – Initial Value) / Initial Value

Annual Holding Period Return formula

{(Income + (End of Period Value – Initial Value)) / (Initial Value+ 1)} 1/t – 1

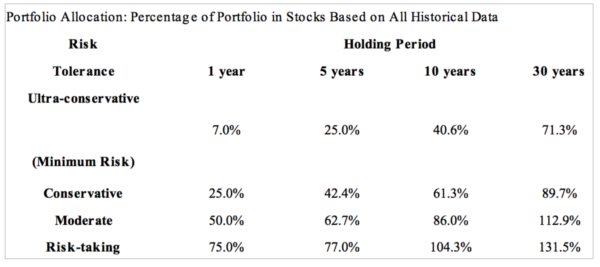

Here is a study of the portfolio of stocks and bonds and the holding period for 4 types of investors –

Usually, you hear that the higher the risk, the higher the returns. But all of us cannot invest in the most risky assets to get the maximum returns. It is not prudent to do so. And we all have different risk appetite and risk tolerance levels.

The four types of investors considered are –

- Ultra-conservative investor – He requires maximum safety irrespective of the returns,

- Conservative investor – He accepts some amount of risk to get extra returns

- Moderate risk-taking investor – He accepts a higher amount of risk to get more returns

- Aggressive investor – He is willing to accept substantial risks in for high returns.

What percentage of an Investors’ portfolio should be in stocks?

Source : Stocks For The Long Run

If you are not rubbing your eyes right now – you have not understood above table. Check again 🙂 (above table is suggesting that even if you are an ultra-conservative investor but your horizon is 30 years – you will be better off by taking 71.3% equity exposure in your investment portfolio. That doesn’t mean there’s no risk.) As you can see the lower the risk tolerance level, the lower the share of stocks but it increases as the holding period gets longer. In the long run, stocks have the potential to give the best returns. So even as a person wanting to take low risk, the stocks allocation can be increased provided the holding period is substantial.

Author Jermey Siegel did research on last 200 years US market data & reached this suggestion. Can this be applied to India? No idea but universal truth is “in long term stocks are safer than bonds in terms of purchasing power”.

Read – Long term & short term Investment

Risk, Return & Holding Period

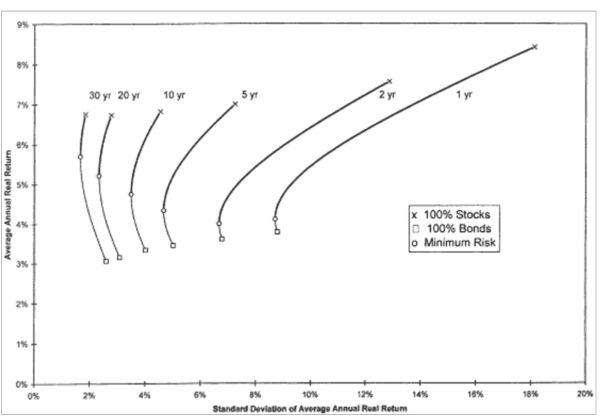

The chart below shows the average annual returns of a portfolio over different time periods. The square in the curve indicates an all bond (Debt/FD) portfolio and the ‘X’ indicates an all stock portfolio.

The circles in each curve indicate the minimum risk possible by combining investments in stocks and bonds. The curve that connects these points represents the risk and return of all types of portfolios. The portfolios can be 100% stocks or 100% bonds or an equal mix of stocks and bonds. This curve is called the efficient frontier. By finding the points on the longer-term efficient frontiers that equal the slope on the one-year frontier, one can determine the allocations that represent the same risk-return trade-offs for all holding periods.

Note – Standard Deviation (investment volatility) is Considered as Risk. (Read – 15 types of Risk) This is US data & Indian numbers can be totally different but another universal truth that “risk will reduce with increase in holding period” will not change.

Source : Stocks For The Long Run

Minimum Risk Point – You can observe that in long term overall risk is reduced with an increase in equity exposure. Once Minimum Risk Point is crossed increasing exposure to equity can increase return but the risk will also be increased.

Read – PMS services in India – are they better than Mutual Fund?

Indian Example – Relationship between Holding Period & Risk

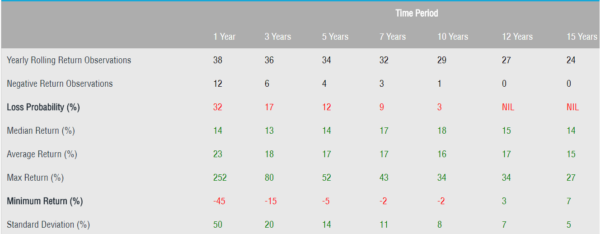

- This is 38 Years Sensex data & table is prepared by one Mutual Fund Company

- Be frank in investment world 38 years is very short term to reach any conclusion but still, findings match with the US data

- Loss Probability & Standard Deviation (Risk) are reducing with increase in time horizon

- If your Holding Period is less than 10 years, there are still chances that you see negative returns. (theoretically, if I add dividend of approx 2% – 7 & 10 year period can go in green)

- If we look at Average Returns (5 to 15 years) is around 15-16% – this is very close to Indian GDP + Inflation (So in long term fundamentals will decide the direction of market)

- The range of returns (the difference between Max Returns & Minimum returns) will become narrow in long term.

- Not in the above table – but till date in India, Average Mutual Funds have done better than Index. But no guarantee that this will be repeated in future.

It is important to factor in holding period of the investment portfolio in the calculation of returns and assessment of risk. In the long run, holding only bonds/debt based instruments is not the best action as they will not be able to sustain your purchasing power. In the long run, stocks are a good bet to beat inflation but your expected returns should be lower.

Of course, it goes without saying that stocks have to be selected after careful research and analysis of stock and market factors or it will be better that you stick with Mutual Funds.

Please share in the comment section what comes to your mind when you think about risk & returns.

Definitely, you can observe that in long term overall risk is reduced with an increase in equity exposure. The more is the holding period, the less is risk and minimum risk point is crossed. In the long run the returns would increase and be definitely bring better results.

Thanks Seema for sharing your views.

Excellent put up, very informative. I ponder why the other experts of this sector do not

notice this. You must continue your writing. I’m sure, you’ve a huge readers’ base

already!

Thanks Gopal 🙂

Your way of analysis is different and genuine. Worth reading.

Thanks

Comments are closed.