Budgeting is not just recording income and expenses. It is a tool that helps you to manage your income & financial life. 50 30 20 rule is really powerful – if used properly, it can be used to allocate financial resources to different financial categories appropriately. A proper budget will take care of the following –

- Listing of Income and Expenses

- Allocation of Expenses to different categories

- Tracking actual allocation of money to target allocation.

Read – Budgeting: The First Step to Financial Success

Many of us start budgeting with earnestness but somewhere along the way, stop it. We find it cumbersome and time-consuming to budget. Some of us are not able to meet the target and get disillusioned and stop it.

Here is a simple way of setting up and managing the budget, which if implemented properly, I am sure we can manage budgeting quite well –

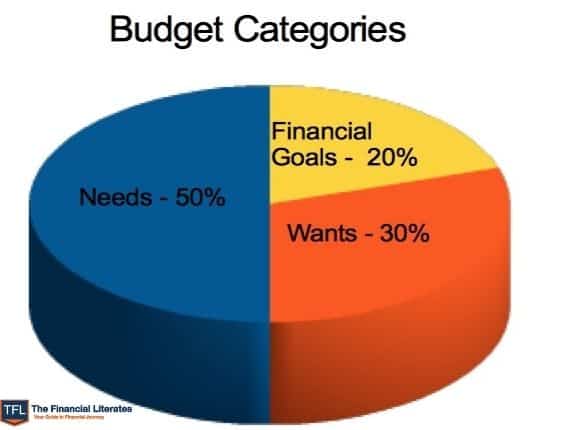

The 50 30 20 rule: The Basics Rule of Budgeting

This rule defines the amount to be allocated to different things in the budget –

50% of your income – Needs

Allocate 50% of your income to your basic necessities – Food, Housing, Utilities, Healthcare, Transport, and Insurance. The amounts spent on each of these can be flexible. For example, if you stay close to your place of work and your children’s school is nearby, your spending on transport will be less. If you are living in a prime area in your city, you might spend higher on rent or EMI for the home loan. The EMI/rent that you pay for housing usually should not exceed 15% of the total amount spent on needs.

30% of your income – Wants

You might have certain hobbies and would want to have a certain lifestyle. You can allocate 30% of your income to entertainment and hobbies. It can include dining out, travel, and other indulgences. Want for some people might be a need for others. For example, some might have photography as a hobby and some might want to pursue it as a career in the future or post-retirement. So such people might spend more on photographic equipment and lessons. In such cases, it is a need not a want. You have to ascertain properly your needs and wants.

This amount has to be watched keenly as it is easy to go out of the limit as we all want something more always.

Check – Budget for your savings not spending

20% of your income – Financial Goals

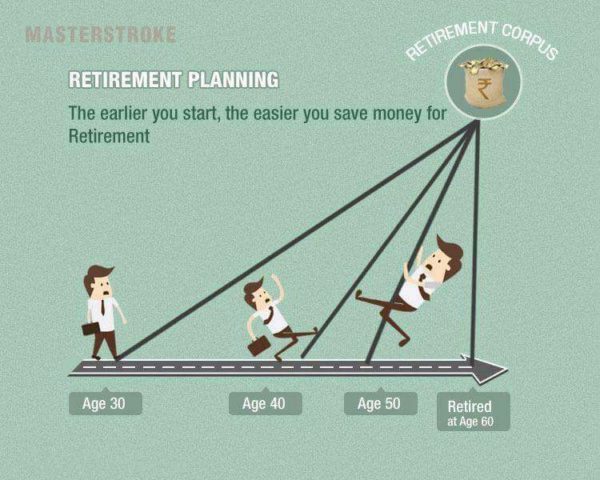

20% of your income should be utilized for financial goals. You have to allocate this amount to savings & investments. You will have to take care of your retirement and maintain an emergency fund. You might have loans to pay off. You might have financial commitments and future goals like children’s education or healthcare of spouse and yourself. You need to build an investment kitty that grows over a period of time so that you will have enough finances to take care of your goals and commitments. It is important to contribute to this 20% as early as possible as the longer your money works for you, the more you earn. The 20% is to take care of a secure future.

Note – 50 30 20 rule or 50% Needs 30% Wants 20% Goals is not perfect so take it with a pinch of salt. If you are in the 30s consider 30% Wants 20% Goals but if you in the 40s reverse this, 20% Wants 30% Goals. This image will clarify my point

Read – Is 1 Crore enough for Retirement?

Thumb Rule of Budgeting

The 50 30 20 rule is a good thumb rule to keep your finances in check. It ensures that you do not compromise on the most important things in life and at the same time allows you to indulge in your wants and interests. It also does not have strict rules on spending and gives you some flexibility. It is an easy tool to start financial planning. It helps to list down earning and spending. There is a target that you have to work towards achieving. It brings financial discipline. It helps you to be consistent in your spending and saving over a period of time.

The 50 30 20 rule gives you a broad plan to manage your income and expenses. It helps you form good financial habits. You may not follow it strictly month after month due to emergencies or sudden expenses or life-changing conditions. But overall when you make it work, you feel happy and empowered that you can achieve your financial goals.

Please share if you follow some similar thumb rules like the 50 30 20 rule to improve your financial life.

Good read and yes, it’s important to start as early as possible. But there must be a proper investment plan when people start saving to accomplish and achieve their security goal towards future and retirement planning. It’s never too late to start saving but the day you decide it starts reflecting in your character and your overall personality as there’s more relaxed and stress free feeling with you.

Future is uncertain is a common tag heard from the aspiring individuals today with lots of ambitions and high pay checks, but future is certain if you keep present in your hands and set aside a good amount for your needs.

Hemantji,

Very nice article.

I am looking for a simple expense tracker in excel, or freeware tool. A sheet or software in which I can add in my income, and deduct my daily expense. Can someone please share if you know ?

(on searching, I am bombarded with heavy,complex and paid software’s …my need is very simple and basic )

Hi Manu,

You can try Perfios software or vertex42 budgeing sheets

Excellent explanations and guide. Regards

Thanks 🙂

Comments are closed.