Which is the Mutual Fund for ELSS or which is the best Mutual Fund for SIP or which is the best term plan? This is the most common trick to ask secrets from Hemant. 🙂 And as usual my answer is “There is nothing called best – best comes after postmortem”.

If you don’t have much idea about Mutual Fund ELSS (Equity Linked Saving Scheme) – You should read ELSS the best instrument for saving tax.

Do you know “Average Equity markets in US have given return of 9.14% from 1991 to 2010 but what investor got was just 3.27%.”

Can you guess why this happened? Because people were looking for BEST FUNDS & not concentrating on other factors which are more important.

https://www.retirewise.in/2013/01/best-tax-saving-mutual-fund.html

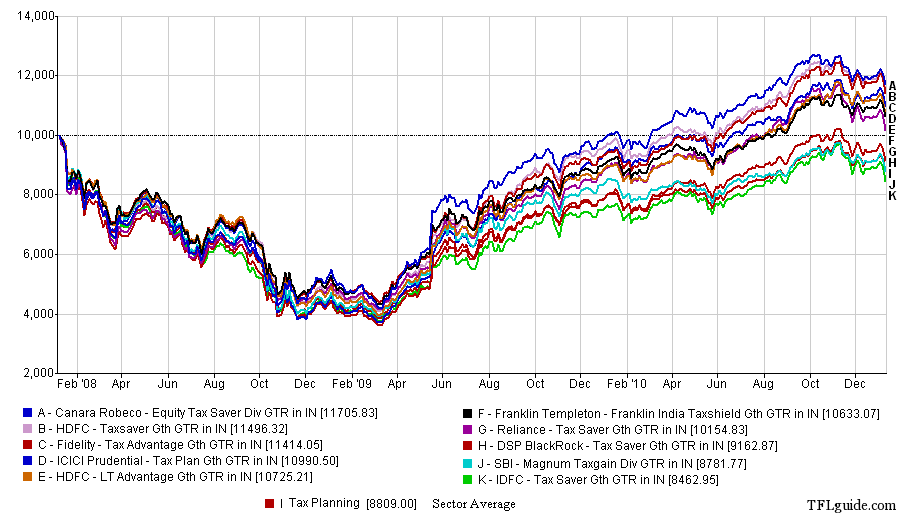

But won’t you like to ask what happened if someone made investments when the sensex touched its highest point in last bull run. If someone had invested Rs 10000 in ELSS Fund on 9th January 2008 (Sensex 20800) & withdrawn it after 3 years on 10th Jan 2011 (luckily Sensex 19100).

Must Read – Compare ELSS Vs PPF

So couple of funds have given negative returns in this period & if you notice in middle of this period funds even lost almost 50% of their value. Equity is the most volatile asset class & it always work like this – if you don’t have risk appetite or if you want that your investments should never go negative, please don’t invest in equity or equity related instruments.

Read – What is Equity?

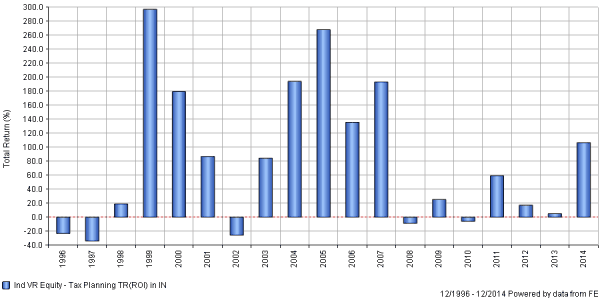

So we have seen a single period but this cannot be much helpful in any judgment. Let’s see what happened in all 3 year periods since ELSS came to existence – for that we have to understand rolling returns.

Definition of Rolling Returns: The annualized average return for a period ending with the listed year. Rolling returns are useful for examining the behavior of returns for holding periods similar to those actually experienced by investors.

3 year rolling return of ELSS

For example, the three-year rolling return for 1996 covers Jan 1, 1993, through Dec 31, 1996. The three-year rolling return for 1996 is the average annual return for 1993 through 1996.

So you can see there are couple of negative periods here – all 3 year period that are starting from a peak of bull market. Deepest fall, almost a 30% negative in 1997 because this is talking about investments done at the time of Harshad Mehta’s Scam (1993).

Read – High Return Investment

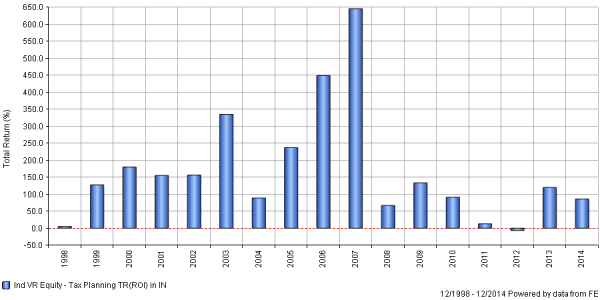

5 year rolling return of ELSS

If we look at 5 year period there is only 1 negative period – ending 2012. If you do a Prima Facie observation – on an average investments has given more than 100% return or doubled in period of 5 years.

If you look both the rolling charts there are a two important learning:

- First, with increase in investment horizon (3 to 5 years) volatility substantially reduces.

- Second, investments done when actual returns were negative have generated a good return. (Check 3 year period)

But question is which fund to invest.

https://www.retirewise.in/2016/03/when-not-to-invest-in-equity-linked-saving-schemes-elss.html

Best ELSS Mutual Fund for 2015

This is just a list of 10 tax saving mutual funds – you can take a decision with your own research. (Top 10 ELSS funds based on assets under management)

Long term Performance of ELSS Funds (absolute return)

| ELSS Funds | 1yr | 3yr | 5yr | 10yr |

| Axis Long Term Equity | 77.68 | 162.59 | 211.77 | |

| Birla Sun Life Tax Relief 96 | 71.13 | 126.45 | 108.04 | 448.84 |

| DSP BlackRock Tax Saver | 61.97 | 114.15 | 119.73 | |

| Franklin Templeton Franklin India Taxshield | 65.81 | 108.91 | 139.62 | 514.53 |

| HDFC Taxsaver | 60.25 | 89.35 | 109.16 | 489.44 |

| ICICI Prudential Tax Plan Regular | 60.10 | 111.65 | 124.94 | 472.73 |

| L&T Tax Advantage | 53.85 | 87.54 | 111.20 | |

| Reliance Tax Saver | 96.51 | 148.21 | 176.63 | |

| SBI Magnum Taxgain | 58.83 | 107.84 | 88.66 | 531.88 |

| Sundaram Taxsaver | 57.19 | 86.44 | 85.81 | 434.99 |

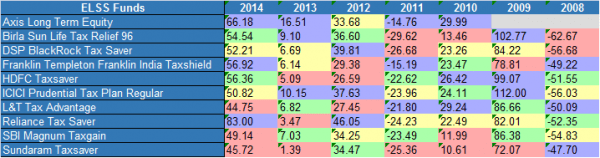

Year on year of ELSS Funds

Read – You can also have SIP in ELSS

If you have any query relating to ELSS or tax saving – feel free to ask. But please don’t ask which is the “Best ELSS Mutual Fund”. 😉

A fund is good if it does better than average in the bull run (2009, 2013), does very good in the bear market (2008,2011).

My go to ELSS funds are Franklin Taxshield and Axis Long Term Equity

hi,

good post . i am investing in quantum tax saver . what are your views on it.

Dear sir, I have been investing through sip in hdfc long term advantage fund growth since Aug 2012 then to same scheme direct option from Jan 2013. Scheme was rated 2nd by crisil during period of Aug 2012 & now it’s rank 5. Should I switch it to axis long term equty

Dear sir, I have been investing through sip in hdfc long term advantage fund growth since Aug 2012 then to same scheme direct option from Jan 2013. Scheme was rated 2nd by crisil during period of Aug 2012 & now it’s rank 5. Should I switch it to axis long term equity or continue same. I want to invest for long term may be more than 10 yrs.When should v change to other scheme.

Kindly reply.

Thanxs.

Hello Hemant,

I would like to know if i can invest a certain amount in elss through sip mode for 7 years and whether i can get tax benefit for 7 years in 80C?

Dear Rohit,

Yes you can invest & get tax benefit every year.

Burnt my fingers in Sundaram Tax Saver, which at the time of investing, was the top-ranked fund. Staying away from ELSS now.

mr. kc , i advice u for axis long term equity. in last 5 yrs. it the best performer in this group.keep patience because your money is gonging through sip in equity. wait for long term.

Dear sir,

I have go through with your Post,

i am planing to buy a term plan to secure my family. request to help me buy a best term plan for me.

I am 31 year old and income is 6L/A, depend are my wife only hope after few yr a kid also.

i am smoker a day 3-4 max and light drinker in month only.

i am confused with LIC, HDFC and ICICI, i want to buy a term plan which accidental death also.

please help for 50 lacs cover

Thanks

Kripa

What is the difference between investing in MF directly and through an agent. What difference does it make in servicing and in terms of returns.

Hello Sir,

I am new in mutual fund investment. Need support.

I am looking to invest in ELSS.

Can you please suggest me best 3 or 4 ELSS funds to invest based on current market performance or situation ?

As per my analysis, Axis long term equity & Franklin India Tax shield are good one.

I saw top 10 performing, but confused which one to select.

Hopping for quick support.

Thanks.

I think that one should select the best elss for him on the basis of his investment time horizon, risk profiling and acceptance level for volatility. Past numbers are useless.

If I want to invest in a lower risk scheme then elss with large cap bias with low beta is suitable and if I want to invest in high risk high volatility scheme, obviously either a tactical call or long term investor or long term sip investor, then one can think for funds with small and midcap bias.

Hemant jee, can you please carogarise the elss schemes wrt risk and rewards?

I have been invested since couple of years in ELSS & other mutual funds through SIP mode. I have at present investment in Axis Long Term Equity – Direct (G) 2000 rs/month, Reliance Tax saver – Direct (G) 1000 rs/month. Also investing in SBI emerging fund (G) 1000 rs/month & UTI opportunity fund (G) 1000 rs/month. Till date I am getting positive return considering all funds accumulation.

I want to invest another 3000 rs/month in ELSS funds to get tax benefits along with higher return then conventional tax benefit investment options. All present & new investment are for long term investment horizon and I am open for low to medium risk fund houses.

Can you suggest where should I invest for 10 + years of investment horizon.

Sir,

I am an NRI, 42 years old, working in Muscat. I have been reading your web articles since 2011. Even though new to mutualfund investments, I used to watch your fund analysis carefully to compare fund performance and return.

I have started an NRE Recurring deposit A/c last year for Rs.10000 per month with 9.5% interest. I will get Rs.20 lacs approximately from this RD as maturity amount.

Now, I would like to make a mutualfund portfolio with Rs.12000 per month in SIPs with a tenure of 10 years. As I have already started investing in RD, I have selected 6 mutualfund schemes which are aggressive in nature but follows the value investing method. The schemes are : Birla SL Pure value fund, Canara Robeco Emerging Equities, Franklin India Smaller Companies, ICICI Pru Value Discovey, L&T India Value fund and ICICI Pru Exports and other services fund (Rs.2000 pm in each fund).

The above portfolio gives allocation in main sectors as follows : Finance-14%, Healthcare-13%, Technology-11%, Construction-10%, Engineering-8%, Chemicals-8%, Service-8%, Automobile-7%, Energy-6% and FMCG-3%.

I have included the ICICI Pru Exports and other services fund in this portfolio deliberately to give sectoral weightage in healthcare and technology. (Without this fund, the above portfolio will have an over-weight in financial sector and under-weight in healthcare sector). Is it a right allocation strategy.?

Also please note the stock characteristics of this portfolio : P/E Ratio-17.58, P/C Ratio-6.13, P/B Ratio-2.75 and average portfolio management fees will be 1.38% pa.

Can I go ahead with this plan.? I will be obliged if you could analyse and share your expertise to fine tune my selection. Please help.

Comments are closed.