It is a common practice across the mutual fund companies to launch new NFO’s (New Fund Offers) when markets are doing well. As more and more people invest only when the market performs well, automatically it becomes an opportunity for Mutual fund companies to come out with the new product. In the last few months of Bull Run (oh! It’s there without announcement), many NFO’s has been launched out of which most of them are close ended funds. Hardly there is any company left which has not launched NFO. Also, the no. of NFO which were launched in the bear phase of 2009-2013 equals the no. of NFO’s launched in the last year.

Read – DSP Healthcare Fund NFO Review

So what exactly is New Fund Offer (NFO)

People are quite familiar with the term IPO which is a direct offer by the company to buy its share which can be later traded in the stock market. Likewise, NFO is the first time subscription offer for a new scheme launched by the mutual fund companies. During the subscription period an investor can buy the units at the fixed rate of Rs.10 per unit. If it is a close ended fund then investor can buy the units only during the subscription period and will have to hold the units for the said period, whereas in the open ended fund, one can buy units even after the subscription period is over and can redeem it at any time.

Read: Should you invest in equity IPO?

The reason behind launching NFO’s in Bull Phase

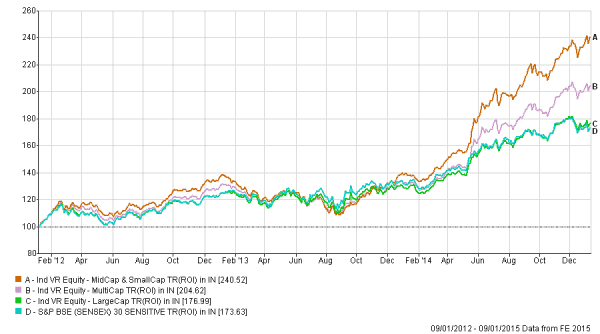

It’s a common mentality of investors to invest while markets are at the higher level (be it any asset class including gold & real estate) and they try to find out opportunities where they can invest at a cheaper rate. As in NFO, units are allotted at a fixed rate of Rs.10 and thus people find it cheaper than other available funds (myth) and invest heavily into NFO to earn better returns. And to seize this opportunity MF companies come out with the NFO and try to increase their AUM. Infographics – It’s a bull run when…

Read: Mutual Fund Vs Direct Equity

Why not invest in New Fund Offer(NFO)?

Since NFO’s are opportunistic in nature, many Investment advisers and financial planners suggest to stay away from these funds. So, is it really risky to invest into NFO? Let’s find out:-

1. No proven track record

Since NFO’s are launched with a new idea or a theme/sector it is very difficult to analyse the future of the fund. One can always find a similar kind of fund already running in the marketwhich has a rating from the experts and where qualitative/quantitative analysis can be done on the basis of its past record, which cannot be done in case of NFO.

Must Read: Magic of Mutual Fund SIP

2. It is not cheaper than its other peer funds

Many investor thinks that NFO’s are available at cheap price compared to other ongoing schemes, which is totally wrong. Suppose an investor invests Rs. 10,000 in an NFO at NAV of Rs.10 and invests the same amount into an ongoing scheme whose NAV is Rs.20. Now the growth of the NAV in both the schemes depends upon the kind of portfolio they holds. Here the percentage growth of the NAV is important rather than the value of NAV. So there is no point in investing in a fund which has a lower NAV.

Read – 11 Mutual Fund SIP Myths

3. Comes with high initial expenses

The marketing charges and other initial expenses are high in case of NFO’s. These expenses are capped to a certain percentage and are managed out of the NAV over the period and hence are responsible for the lesser return. So it’s better to avoid new funds as charges are high.

Read – Benefits of Mutual Funds

4. Limited Diversification

Generally NFO’s are sector specific (normally at the top of bull market) or have focus on certain category like Mid cap, small cap. People are advised to invest with a proper diversification because if one sector does not perform the returns are compensated by another sector and proper balance is maintained. So it is better to read the investment objective of the NFO before investing and avoid those which have limited scope of diversification. Your portfolio should be designed based on your goals……

Check – 5 Awesome personal finance sketches

5. NFO are not exactly like IPO’s

Many people are of the view that there is no difference between NFO and IPO which is not true. In NFO the NAV is fixed at Rs. 10 per unit and is not affected due to the demand or some other factors. While in IPO the listing price depends on the demand and expectation of the market with the company. So the price may fall or rise while listing. So please remember the growth of NAV in mutual funds only depends upon the growth of the underlying securities.

Please remember Mutual Fund companies launch different types of NFO to increase their AUM and to complete their bundle of products, to attract different kind of investors and to fulfill their needs. So this does not mean that every NFO will suit your profile. Sometimes a plain equity or balanced scheme will serve your purpose. So it’s better to avoid NFO and if required you can always check the performance of the other schemes already available in the market.

Informative article.

Hi Hemant

In the past I have done the mistake of investing in NFOs but now I am able to resist the pressure of bankers and agents.

Hemant

Once again a nice and informative article from you. I use to regularly follow your articles. I would like to know about NFO launched from Birla Sun Life today on “Make In India Theme” — BSL Manufacturing Equity Fund.

Can you please provide your views on this. I am interested to invest in this fund, based on feed back from you.

Thanks in Advance again .. AMAR

Clear and concise article by Mr Hemant.

I do sometimes wonder on the attitude of the fund manager towards existing funds that have been running for long time for e.g > 10 years; do their monitoring and work including excitement reduce on these funds as NEW funds keep coming into market and these need to be shown for performance in the fist 1, 3, 5 years to get more money inflows?

How does one ensure that I am not in a fund that has lost attention of its fund manager? There are quite a few cases where after 5, 7 years the fund performance starts going down however one is resistant to switch due to its long term track record.

Also as the same fund manager keeps managing multiple funds and will obviously will be given short term, long term objectives for the funds in his portofilio

Mr Hemant and others; your viewpoints are requested

Nice article , thx fr the information.

Hemant ji,

At present Birla sun life manufacturing equity fund (NF)) is there. Shall we go with it.

kindly put your valuable comment on it.

Regards,

Munish K. Singh

One reason I believe is that RMs gets more commission here and they try to hard sell. In financial markets, anything which is hard sold should never be taken.

Nice article… Thanks for the information.

I’ve recently purchased Rs 1 lakh worth of DSP BR Microcap Fund, Rs 70,000 worth of Reliance Smallcap Fund & Rs 20,000 worth of ICICI Pru Exports & Other Services Fund. Have I made good choices. Kindly help me out.

as per the my opinion is u have withdraw from dsp black rock half money and half u have to have invest in hdfc balance fund

Is it right to invest in NFO of IDBI bank costing Rs.10/- to be launched in August 2016

Hemant ji,

At present Birla Sun Life Resurgent India Fund – Sr. 3 – Direct Plan (D) (NFO)) is there. Shall we go with it.

kindly put your valuable comment on it.

Regards,

Munish K. Singh

Dear sir

I am new in this market. Please suggest nfo or ipo or mutual funds for maximum profit with low risk

Hi Harish

I think you should consult with a Financial Planner in your area.

Thank you very much .I could take a decision based on the article.

Hi Vishnu,

It’s good to hear that this article helped you 🙂

Good advice is given and I am pleased my name is chetanlparikh

Thanks Chetan

Dear Hemant

I want to invest NFO ICICI Prudential Value Fund – Series 19 please suggest if its ok will invest soon it will be based of your suggesation

hello team,

Thanks for your valuable feedback regarding New Nfo, Please suggest one Nfo Launched Mahindra Unnati Emerging Bussiness Fund (Mid Cap Open Ended Fund)

Please suggest is it good time to invest NFO

Good advice Hemant ji. Thanks a lot. I was thinking to invest in new funds thinking on same lines as you have elaborated. You saved me from that. Thanks once again.

Welcome Mr Sai 🙂

Is kotak bank nfo a good investmeritint ?

Thanks Hemant I am new investor. I was thinking purchasing new fund will give better return because it’s NAV is less & have scope for growth. Thanks for clarifying my doubts.

Can we have your view on newly launched NFO Axis Equity Hybrid fund which have 65-80 Equity and 20-35 others

Your views will help us to decide on its investment.

Thanks – Madhu P.M

Comments are closed.