We are in the last month of Financial Year 2012, and once again LIC has come up with a new plan with name LIC Jeevan Vriddhi. And once again just with the announcement of launch queries are raining.

- “I want to know your opinion (merits and demerits) on Jeevan Vriddhi launched by LIC. I will be really grateful to you for your reply.” Mayank

- “What about LIC Jeevan Vridhi, can I invest some amount in that?” Vishal

I don’t understand that why people get so curious about products launched by LIC. Even if the product with different name and with different company is already there in the market, but if LIC has come up with it then people feel “there must be something special”. And moreover when a product by LIC comes up with a word called “GUARANTEED”, excitement gets doubled – limited period offer always excites people so this will LIC Jeevan Vriddhi will be closed before 31st May 2012. Let’s see how this plan looks like & should you put your hard earned money in it.

Check-LIC Jeevan Arogya Review – Should you buy it?

LIC Jeevan Vriddhi Plan – Review

LIC Jeevan vraddhi is a single premium payment plan which offers a guaranteed maturity amount plus Loyalty additions if any at the time of maturity. The insurance cover would be 5 times of the premium amount. (Review of LIC Jeevan Ankur)

Basic Features of LIC Jeevan Vriddhi

- Person between age group of 8-50 years can apply for this plan.

- Minimum Premium Rs 30,000/- thus minimum sum assured would be Rs 1,50,000/-

- There’s no cap on maximum premium payment.

- Policy term is 10 years , but this policy can be surrendered after 1 year.

Must Read- LIC Wealth Plus – Aapki ya Aapke Agent Ki

Other benefits of Jeevan Vriddhi

The major feature of this policy is that it offers guaranteed maturity benefit which depends on the age at the entry and premium paid at the time of purchasing the policy plus

The loyalty additions if any which depends on the corporations experience with the policy. Also the rate and terms will be declared by the corporation, that too at the time of maturity.

Check – New LIC Jeevan Akshay VI a Crazy Guaranteed Annuity Plan

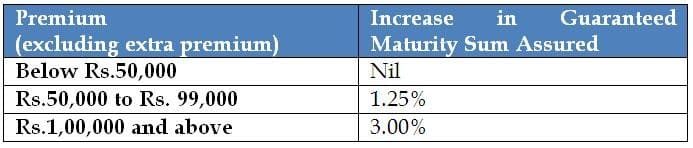

INCENTIVE FOR HIGHER PREMIUM in LIC Jeevan Vriddhi

Incentive for higher single premium by way of increase in the Guaranteed Maturity Sum Assured is as under:

Tax benefits on Jeevan Vriddhi LIC

As the sum assured is 5 times the annual premium , so right away as per current income tax laws the policy gets eligible for Section 80C benefit and also the maturity will be tax free as per Section 10(10)d. (Read Year End Tax Planning Guide)

Check- LIC New Jeevan Nidhi Review – Pension with Tension

Let’s do some MATHS – LIC Jeevan Vriddhi Policy?

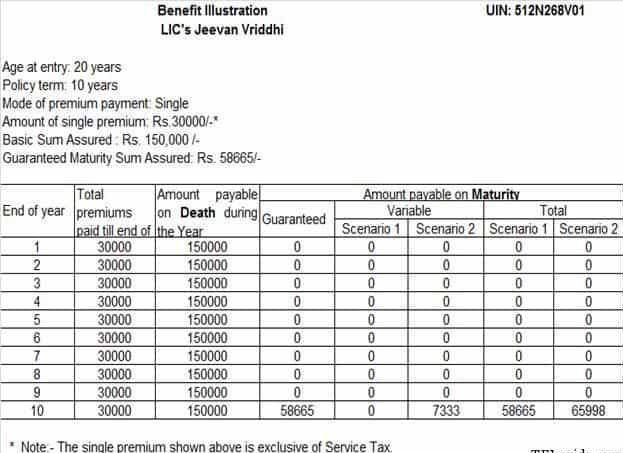

Certainly on the face of it LIC Jeevan Vriddhi looks quite attractive, but when it’s a question of finances one should be double careful. Let’s see what guarantee they are actually offering. I am sure that you are interested in guaranteed maturity benefit and not in the loyalty additions which may or may not be declared. Below is the illustrative chart as on the website of LIC which clearly shows the guaranteed maturity value one will get by investing Rs 1000/- in this plan. I have added 2 more columns just to get the actual premium outgo after adding Service tax and what would be the annualised yield at the time of Maturity.

The above table clearly shows that like any other endowment policy, this plan also is generating return in the range of 4%-7%.

Now let’s look at the illustration which shows the variable part also, i.e. loyalty additions

Read – What is Insurance?

The above illustration is exclusive of tax, but your premium will be inclusive of tax. So we need to calculate returns on with tax premium which comes out to be Rs 30463/- ( @1.545% service Tax). Thus with the guaranteed maturity value of Rs 58665/- the annualised return comes to 6.77% , and with assumed variable return maturity benefit of Rs 65998/- the annualised return coms to 8.03%.

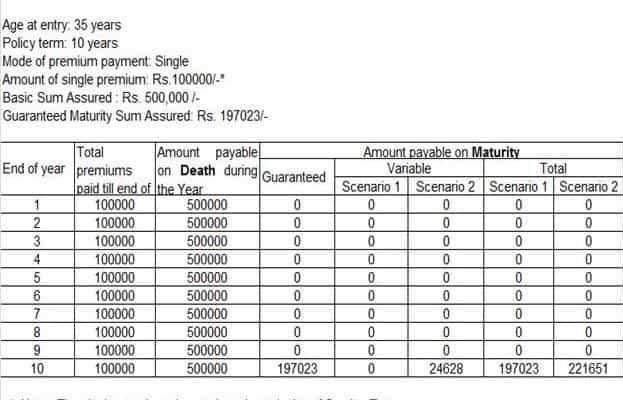

In this case your Premium inclusive of tax will be Rs 101545. And annualised returns will be 6.85% Guaranteed and @ 8.12% NON Guaranteed.

Read- Review: LIC New Term Plans – Amulya Jeevan II & Anmol Jeevan

Should you invest in LIC Jeevan Vriddhi

We are always of the opinion that whatever financial decision you make should support the overall financial goals and thus for the betterment of Finances. You should always keep 3 points in mind before zeroing onto any policy

1. There should be a proper reason attached to any of your financial product purchase.

You may want to attach reason for doing tax saving or investment with this product. If you invest in this for tax saving then the annualised return will improve as the net outflow from your side will be less, but this product is not looking suitable for investment purpose as the returns are just at par with average inflation rate. Even if talk about insurance it’s just 5 times of premium.

Read – What is Family Floater Health Insurance Policy?

2. Besides return you should also be aware of the risks associated.

- Inflation risk. As this product is not offering that much return which can beat inflation.

- Taxation risk: Pls keep in mind that the proposed Direct tax code provisions of taking sum assured equals to at least 20 times the annual premium , only then that policy will be non-taxable at the time of maturity. As the DTC is yet to be announced and this policy has 10 years term so ambiguity is still there.

- Opportunity Risk: 10 years is a very long time. You may get very good returns if you invest in equity related instruments for this much time frame. If you or your advisor knows how to invest in duration funds then you can take advantage of debt funds also.

Read – Types of Risk

3. You should be aware of all the alternatives to decide better

There is alternative for everything like for tax saving there are many other options available like ELSS, 5 year fixed deposit, National savings certificate etc., for investments also there are many options and even in this policy category (guaranteed maturity benefit) there are many options like ICICI I Assure single plan, Birla sun life Rainbow fund, Bajaj Allianz guaranteed maturity investment etc. My advice is not to mix investment with insurance.

I hope I have empowered you with enough calculations, reasons to invest or reject LIC Jeevan Vriddhi. Now better take informed decision and that too for the betterment of your finances.

Review of LIC Jeevan Vriddhi is done by Manikaran Singal, CERTIFIED FINANCIAL PLANNERCM – the views expressed herein are the author’s personal views.

If you have any questions related to LIC Jeevan Vriddhi or any other life insurance policy – feel free to add it in comment section.

Dear Readers,

It will be interesting to see how this change will impact LIC Jeevan Vriddhi

“Budget 2012-2013 has tightened the eligibility criteria for life insurance policies to qualify for benefits u/s 80C and 10(10)d. Now only those insurance policies where the premium paid does not exceed 10% of the capital sum assured will qualify for such deductions. This condition applies to policies purchased after 1 april ’12”

Added on March 18th 2012

I’ve been offered to invest in ICIC GSIP, the guaranteed sum assured it Rs. 2,10,000 (excluding some bonuses and maturity benefits) for a yearly premium of 30,000. Does it qualify for tax deductions.?? Is there is any benefit of such policy.

Im also considering Reliance guaranteed money back plan.

Kindly, let me know should I go for such policies for tax saving purpose.

I want to buy this lic jeevan vraddhi, it is available to buy this time. if yes please provide brief information with procedure of buying this policy.

Hi Manikaran,

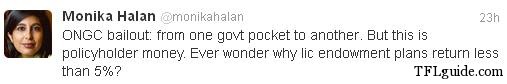

Thanks for sharing detailed review of LIC Jeevan Vriddhi for TFL Readers.

I would like to share yesterday’s tweet by Monica Halan, Editor Mint Money (Hindustan Times).

I think there is a big point in this short message – if people really want to understand….

Thanks hemant for allowing me to write for your readers.

Though i feel that readers of your blog comes under “The Financial Literates” category, and launching of new products doesn’t bother those who have done there financial planning in a proper way. But still products like this creates so much curiosity among general public, that many times they gets ready to compromise the planned finances.

There’s nothing good or bad in any product, but what matters is its suitability to your finances .

So i have just tried to help people take informed decision.

Thanks Manikaran,

I will also appreciate if you can reply to all queries on this post.

Thanks in advance

Dear Manikaran,

Please don’t compare debt product returns with equity returns as you said for 10yrs time frame one should invest in equity market.

I have some basic questions,

1) Do you think that people doesn’t need secure returns for their hard earn money? I think, All people are not risk takers that’s why whenever their MF SIP investments gives negative returns, many people want to exit from it asap, even though they know if they can stay invested they can earn good returns, that’s why we saw more redemptions when market crashed in 2008.

2) In LIC’s Jeevan Vruddhi you are saying returns are not even beats the basic inflation. Please tell me one debt product which can beat the inflation guaranteed? Do you have any such product in the market? LIC plan gives you 7 to 8% guaranteed tax free returns plus loyalty additions if any, do you think it’s not good enough from a debt product? Currently only PPF is better than this policy but without Life Cover and there is no guaranteed that the interest rate which is today will stay for 10 yrs. Does anybody or Govt. can give guarantee for PPF rates?

3) Why always LIC manage to achieve their targets with these types of products? Why informed people also bought these policies from LIC? What is the reason behind it?

A CFP always tell people that endowment policies giving less returns for long term than equity market and it’s true, but one should not compare debt product to equity product it’s not reasonable. And if you remove the insurance cost like mortality charges and other charges and if you calculated yield on your net investment you will find that the LIC’s endowment plans gives better Tax Free long term returns than any other debt product in the market. As you know all other debt products except PPF are taxable, then why not an endowment plan which have good returns and risk cover combine in one product? One should always do asset allocation but should not ignore endowment plan because it’s make your savings habit and gives you tax-free returns with protection.

well said anil , on one hand Manikaran is saying do not mix insurance and investment and on other hand he is suggesting ICICI I Assure single plan, Birla sun life Rainbow fund, Bajaj Allianz guaranteed maturity investment etc, contradicting his own statement

Chetan, you should write that one one side Manikaran is giving alternatiives but at the end he’s specifically advised “don’t mix investments with insurance”

Alternatives are half part of my 3rd suggestion while someone is going to chose a product and which is in continuation with the other 2 advises which are giving reasons to investment and understanding risk. Please read in continuation , then you will understand that what i am saying is quite right.

Anil, Nowhere in the article i have written that for 10 years timeframe one should invest in the equity products. I request you to read the article again. What i have mentioned is ” one may get good returns if one invest in equity for this much time frame”…along with that i have specifically mentioned that if one knows how debt funds work or if one’s advisor knows how to make use of durations than again one can make good returns. Asset allocation and rebalancing can only happen in the case where the investments are flexible. If we talk about investments then it should be into that product which is with least expenses and more flexibility. If the investment need of a client is of 2-3 years, then i may not recommed any equity linked product, but yes if the horizon of 10 years then one should definitely include equity in the portfolio.

People have withdrawn there MF SIPs in 2008 was because of uninformed decision they took while investing. Moreover for general investor, mutual fund is about equity investment only. Slowly they are coming to know that MF is just an investment vehicle which make them invest in many asset classes. One can design a good and stable portfolio as per one’s risk and taxation profile by combining different asset classes ( Equity, debt, gold) through mutual funds. and If one keep insurance and investments seperate , and use insurance products for sum assured and investment products for generating optimal returns than one can achieve the financial goals more comfortably. You yourself admit that PPF is among the suitable debt product available.

These days interest rates are at peak, and so many interest bearing instrumenst are offering good rates. If you have a flare towards investment products then you may very well check that 1 year bank CDs are coming in the range of 10.20% – 10.40%.

But If i want people to take informed decisions then as i have written in the article that one should be aware of the taxation aspects, other opportunities and risk associated.

I also agree with yu that if i exclude the insurance part and other charges then the returns on this product will improve and more suitable for investors , who are actually seeking returns…but this is not the case in this. That’s why for return seekers we advise investment products and for insurance seekers we advise insurance products.

Franklin Templeton buys big in ONGC auction

Franklin Templeton Investment Funds (FTIF), a foreign institutional investor (FII), could emerge as the second significant investor in the auction of Oil and Natural Gas Corporation (ONGC) shares by the Union government two weeks ago.

FTIF’s holding crossed one per cent, according to a company filing late on Monday, suggesting the fund bought a significant number of shares in the government’s auction last week. FTIF holds 90.93 million shares or 1.06 per cent in ONGC as on March 9, 2012, according to the filing dated March

Hi Arun,

13.75 million shares by FT and 377 million shares by LIC – what we are comparing.

well Mr. Arun,

LIC is holding 9.8% share of ONGC. more than any body else.

Hello Hemant,

Really thankful to you. I was keen to take the policy but after reading your advise, I will rethink twice, thrice.

Sujata

Hi! Ms Sujata Gupta,

Pl do think and decide whether to buy LIC’s Jeevan Vriddhi because it is always good to take a decision after carefully thinking. But let me tell you that this product of Lic has got everything i.e good returns,life insurance cover, tax benefits and highest safety in the form of govt guarantee.Returns after deducting mortality charges and considering the tax-benefits rerurns come out to be better than those of an bank FD with 9.25 % int rate. Then why will it not beat the inflation? Also, the proposed changes because of the DTC are expected to be with prospective effect. Even the changes announced in the budget of 10 times cover for tax benefit will be with effect from 1.4.2012. Those who buy before 31st march will not be affected.

Deepak-Jeevan Vriddhi good returns? when normal 10 yr NSC (Interest rate 8.90%) is giving 9.09% effective rate of return (Revised rate of interest from 1st April 2012) then how it can be a good return? Life Insurance Cover-I mentioned about the Jeevan Vriddhi life insurance cover in below comment where I tried to reply to Harikrishna, you may refer my reply for that. Highest Security-NSC and Bank FDs less secured? Even if you invest in NSC you will get the tax exemption right? So I am saying the same thing to Sujata Gupta what you told “Pl do think and decide whether to buy LIC’s Jeevan Vriddhi because it is always good to take a decision after carefully thinking”. I will recommend to invest some portion of your portfolio into this plan if you are so fond of LIC, but not whole.

Dear BasuNivesh,

NSC will give you the tax rebate not tax free maturity.Today people are not bothered of the tax rebate because they are thru with the one lakh limit by investing in their PF contribution or repayment of housing loan principal or by paying their children school fees. The most attractive thing about jeevan vriddhi is the tax free maturity.A person saves from 10 to 30% of his interest income which would have otherwise gone by way of income-tax. This increases your nett-in-hand return substancially which is very important for high income group people. No other debt instrument other than life insurance policies has got that except PPF. But PPF will not have life cover,rate of interest is not fixed and there is a ceiling of 70,000 or 1,00,000 investment p.a. Hope you agree on this point -Deepak

Deepak-I agree NSC will give tax rebate during the time of investment. But you can show the next years interest income under the head of “Income from Other Source” and claim it as re-invested to get the benefit of Section 80C. Currently for 5yr NSC till 4th year interest you can use this facility for reducing your tax liability of maturity (About 10 Yr NSC not have any clear picture). Where is the tax free maturity when your premium is more than is more than 10% of SA (From this budget)? About investing in such product read my conversation with Manikaran below. I am not against LIC or Jeevan Vriddhi. But it is foolishness to invest all the money in such low return product. Investors need to diversify according to his goals. If his whole investment is in such low yielding product then what will be the impact of inflation on his financial life? We need to seriously think before judging about the product and recommendations. Hope you agree with my point.

Dear BasuNivesh,

In your comment you are again talking of the Tax rebate i.e sec 80c. As I mentioned earlier people nowadays cover their one lakh investment in sec 80c by way of PF,PPF,school fees,housing loan etc. The interest is taxfree maturity and when we were talking 31st march was not over. The new budget provisions had not come into effect.They will come into effect only after the loksabha clears the buget proposals.

Dear Deepak,

Your comments are exactly what an insurance agent is expected to say, rather LIC agent. If you are looking at tax benefit under sec 10(10)D, equity mutual funds invested for over 366 days will also qualify for 10(10)D benefit. There are other debt and FMP options available in MFs which give double indexation benefit which will be also not taxed on redemptio/maturity. Insurance industry as such in India is still a long way to mature. Insurance for the sake of Insurance is the right thing to do. All insurance companies irrespective have started focusing on traditional plans which are not at all transperent (I would rate ULIPs far better in this aspect) so that they can shore up better performances at the cost of investor. If at all IRDA has to really act as a development authority, they should bring in strict rules against sale of such policies where the customer is not being given a fair deal. Please educate yourself with the financial markets and options of investments available in the market, study them and understand what the customer requirements are and then suggest a proper solution. Do not think insurance is the solution for all requirements. I really pity the customers who go for such traditional insurance savings plans. Jago India Jago. Ignorance is not bliss when it comes to money.

To all the investors out there, “IT IS YOUR MONEY. YOUR HARD EARNED MONEY. MAKE INFORMED DECISIONS. INSURANCE IS NOT AN INVESTMENT. HAVE TRUST WORTHY ADVISOR. IT IS WORTH PAYING FEES OF AN ADVISOR THAN TAKING AN INSURANCE POLICY WHICH IS NOT SUITABLE AND MAKING THE AGENT EARN THE 30-40% IN COMMISSIONS.”

HAPPY TO ANSWER ANY QUESTIONS OR COMMENTS

Narendra Babu S

DEAR MADAM, SORRY, IF U OWN AN ENDOWMENT POLICY OF LIC(TABLE 14,PREMIUM Rs.4889.00 YLY) OF 100000S.A. AT THE AGE 35YRS OF21YRS TERM THEN U GET 100000S.A.+Rs.100800.00 BONUS ASPER PRESENT VALUATION+Rs.5000.00FAB,THE TOTAL RETURN WILL BE RS.205800.00 ON MATURITY! IRR IS 6%.

Hi Hemanji,

I was really wondering about this LIC policy this morning, so happy to see your article

I still cannot undertsand why people still feel insurance is an investment?

Thank for making us SMART, it was your article that really worked for me.

Regards

Thanks tonyg

Good to know that you don’t feel insurance as an investment.

Keep spreading the word, and help us in making more and more people financially literate.

hello sir.

earliar i thought only insurance and money market instruments are safe.but having gone through ur article..i m now completely careful..and sharing it with others!!thanks a lot..fantastic job..done by you.

Thanks Rupali

Hii Manisir

Awesome work done by you sir. Again LIC had launched a plan in march end and moreover it is only open for a short period. But as we look at the guaranteed maturity benefits it is only at par with the inflation rate. So if nothing happen to me in 10 years than i will only get 58,665 plus the loyalty additions comes around 7,300 which are non-guaranteed. So it is bad for investment but for life cover it is somehow good.

Regards

Hussain Namakwala

Why do you say it is good for life cover?

Dear sir

you have given your opinion in brief but i would like to inform you Lic’s sum insured and declared bonus both are guaranteed by central goverment of india u/s 37 of lic act this guaranteed is only with lic not private players.

Every body knows lic is very loyal in the terms of death claim settelment. also offering 7% for 10 years means your money will grow compound for 10 years you can not compare this product with equity or any mutual fund. every investor has a temption to encash mony before maturity in such case money will not grow as per my opinion there are few people who hold their mutual fund for 10 years. or continue their sip for 10 years

In past Lic has introduce jeevan dhara plan no 96 guranteed returns of 12 % life long even today policy holder enjoy such excellent return.

As per my opinion every people must park their some amount in the risk free and tax free return. just like long term endowment plan, ppf , tax free bond etc.

Hi Tejas,

I totally agree with u

Tejas

Just to add here. that recently there’s been a small amendment done is section 37, which reads as follows:

“In Section 37 of the principal Act, for the words “by the Central Government”, the words “to the extent as the Central government may, by order, from time to time, determine” shall be substituted”

To make it more comprehendable , ministry of finance issued an explanation to it which says:

“Section 37 of the LIC Act, 1956 provides for guarantee of the Central Government to the payment in cash of the sum assured in the policies including bonuses issued by LIC. However, no monetary value is assigned to the Government guarantees. Government has taken a view that it will not discontinue the Government guarantee assigned to the policies including bonuses issued by LIC but will keep the flexibility of determining the extent

of Government guarantee from time to time.”

Banking and Insurance are 2 pillars of an economy, so no government ever wants any of this go bust.

The point here is not to prove you wrong or i am against any LIC product. I just want to say that investor should understand his/her requirement first and then enter into any product. I am perfectly fine if someone has a trust in LIC and is even ready to pay extra premium to get adequate insurance coverage under LIC term plan. But for investments, one should be very cautious

I also agree with you that investors don’t continue with mutual funds like investment for long and withdraw the investments much early, but that doesn’t mean that we make them invest in a product which gives return just equal to inflation rate. Its high time for people to get financially educated and take informed and planned decisions

“I am perfectly fine if someone has a trust in LIC and is even ready to pay extra premium to get adequate insurance coverage under LIC term plan”, as said by mr Manikaran Singal clearly shows that you are against LIC.

Respected shri Tejas Shah,

I 100% Agree with you. This policy is equal to jeevan dhara. And its most recommand to Plan Jeevan Vriddhi as per need.

Other than LIC & PPF or ELSS (Non-gaurantted) will be taxable.

My question is, (1)How many people or % of population of india enjoying with equity or MF returns? While Mostly indians know LIC (2) Inflation Rate & Maturity taxabllity is also consider in other investment like NSC, Bank FD, Bond Etc; (3) Its a Gauranttee by Central Gov. (4) With Tax benefit Returns is near to current Bank FD. (5) In LIC -Agent will help, other than LIC people care himself. Here are so many more positive points to invest in LIC’s Jeevan Vridhhi.

Dear Mr. Tejas,

Sum Assured and Bonuses once declared become a guarantee by default for any insurance company, LIC or Private insurers alike. Now for the central Govt. guarantee you are talking about, to what extent it will be guaranteed by central Govt. is not clearly stated. Further, for private insurers, if any private insurer fails, there is a three stage protection in LI act. 1. Merger, 2. Acquisition. 3. Conversion to PSU. So, theoritically if any private insurer fails, either it will be merged or acquired by another private insurer or LIC with all its liabilities, or Govt. will acquire it. This is again kind of a Govt. guarantee and this provision is there to protect the investors.

I have nothing against LIC, in fact I think LIC offers some of the best policies in Traditional policies segment. However, I believe insurance should not be treated as a savings or investment option. In my opinion any insurance plan other than a PURE TERM PLAN is not good for anyone. For every kind of financial planning there are better options available beyond insurance. So please do sufficient Term Insurance Plan to protect your loved ones, and for savings & investments look for other options.

hi Tejas

m totally agree wid u. jeevan vriddhi is really best plan its also cover life with five times of invested amount no FD and Equity instruments do.

MF or Equity products never suggested for those who wants gurranted returns without any risk.

People should understand diffrence Btw “INSURANCE” & “INVESTMENTS” products.

Hussain

giving insurance 5 times of annual premium is a normal feature in any insurance policy. it is not new in this. also this is the basic condition required to get the Tax benefit of Section 80C and 10 (10)d

But its always better to take adequate sum assured through a term insurance policy and then invest in a suitable instrument after understanding the risk and return parameters.

Insurance cover of 5 times annual premium is “NOT” a normal feature in a “Single premium” plan Mr.Manikaran Singal.

I think by giving a Guaranteed maturity amount(double the premium paid) along with 5 times AP(NOT COMMON),

this plan is a VERY VERY GOOD as per my view.

Dear Saju S R,

Even in a single premium plan if you want the maturity amount to be considered u/s 10(10)D, 5 times sum assured is a must. Otherwise, 10(10)D would not apply and the maturity amount will be taxable.

Dear Hemant,

I have read your article on LIC’s Jeevan Vridhi, Please explained me following points for why i should not invest in this policy?

1) As you suggest for investment alternative like ELSS; NSC; Bank Fixed Deposit etc. Explain me that if i invested in ELSS what benefit i will received in the scenario of very high fluctuation in Share Market since 2008, as the ELSS return totaly depend upon movement of Share Market. Further can you tell me their investment pattern? Because as far as my knowledge what ever fund received in ELSS invested in Debt Instrument. I request you give me your elaborate explaination of particular ELSS fund except HDFC.

2) If i invested in NSC can you explain tax treatment on maturity?

3) If i invested in Bank Fixed Deposit, can you explain tax treatment of maturity?

4) Further explain me what i have received incase of death happen from ELSS;NSC;Bank Fixed Deposit? Please do not suggest me about term insurance; SIP; investment in Mutual Fund.

5) Which Insurance Company offered the same plan/policy like Jeevan Vridhi?

I will let Hemant answer your detailed questions but here are my 2 cents: –

– You have got it right when you say ELSS returns are dependent on the market but where do you think LIC invests their customers money?

– In case of death you will not receive anything even from LIC, it is your family who will receive the money. While investing in ELSS, NSC etc. make one of your family members as nominee and they will get the returns at the time of maturity.

– For lumpsum benefits it has to be term insurance, what’s wrong with it? Why don’t you want it to be a suggestion?

In case of death why will not receive anything even from LIC? In jeevan vriddhi The Sum Assured is 4 times more than invest amount will be payable to nomiee. It’s more than ELSS, NSC, Any FD Returns.

Kaushik, the point vivek want to put here is that in insurance the ultimate death benefit goes to family and not to insured ( and this is the main purpose of doing Life insurance)and secondly to make your family financially more secure one should go with term insurance plan with adequate cover and for investments one can look at other alternatives.

dd, i assume that you want me to answer your questions vis a vis my interpretation and alternatives mentioned in the article. Let’s go one by one:

1. If we are talking of 10 years product than we should compare it with 10 years Return of ELSS. You are not interested in HDFC as it is among the Top performing ones, but still for readers sake i am mentioning HDFC’s returns also

Since 5 March’2002 , HDFC Tax saver has generated CAGR of 27.19%, Franklin Templeton Tax shield has generated CAGR of 23.30% and SBI Magnum Tax gain CAGR for the same period is 15.62%

Last 3 years average CAGR of ELSS category fund is 28% and Last 5 years CAGR 7.50% (Source Value researchonline as on 5th March2012)

I understand that past performance is not assured( neither 10 years and not even 5 years) and there’s lot of volatility in stock market, but this is what it is. That’s why we always want people to take a long term view on equity investments and those who are not so comfortable with it should stay out of it. NOWHERE in my article i have written that one should invest in ELSS or should not invest in LIC jeeva vriddhi.

2) NSC’s interest is Taxable. For this year 10 years NSC is available at 8.70% (Guaranteed) p.a and it is half yearly compounding product. Please do check the post tax returns as per your Tax slab

3) Bank Fixed deposit’s interest is Taxable. You may get 10 years FD in the range of 8.75% – 9.25% (Guaranteed). Interest is quarterly compounding.Please do check the post tax returns as per your Tax slab

4)There’s no Sum assured attached to ELSS, NSC or Bank Fixed deposit. But as you yourself has rightly pointed out ( this is not suggestion , you already knew it) the combination of TERM Insurance+SIP/Investments in Mutual funds, is the most effective combination to get the adequate sum assured and effective /good returns.

5) somewhat similar plans i have already mentioned in the article

Dear Mr.dd,

Investment planning is not done in that manner. Which product will fit you depends upon your income, expenditures, liabilities, number of dependents, your age, your long term and short term goals, your tax slab, and your risk appetite. Wheteher you are salaried or self-employed also matters.

However, let me explain in general terms. If you are risk averse and looking for guaranteed or safe investments with all tax benefits(EEE) of a LIC, first invest one lac in PPF. If you are salaried, then exhaust the maximum permissible limit of investment in EPF. This will give you 80C and 10(10)D exemptions and much higher returns than any LIC policy. For insurance cover go for the Term Plan, the premium invested in term plan will be much less than the extra returns you will get from PPF/EPF instead of LIC.

So, your 80C needs are over with PPF only, now if you still have funds available for investments, then look for Fixed Deposits. Presently you can get upto 9.50% (10.50% for senior citizen) in Fixed Deposits, you can also get 9.50% (10.25% for senior citizen) for Fixed Deposits upto 10 years with IDBI Bank (Nationalised Bank). If you are in lower tax slab, FD is good. If you are in highest tax slab, you may also consider several options from short & long term debt funds for tax efficiency.

For your information, ELSS funds are basically diversified equity funds with 3 year lock-in and tax benefits. Since your 80C needs are covered with PPF/EPF, you can invest in open-ended diversified equity funds, and also in Balanced funds for lower risk. Now compare the returns for a period of 10 years or more, like the LIC policies, you will understand why equity investments are most efficient investment in long-term. Again the returns are tax-free under long-term capital gains. And why you don’t want to consider SIPs? Have you tried SIPs over a period of 10 years or more? Try it and see the returns.

For life cover, I think you have no option other than Pure Term Plans to cover you life risk. I mean how much life cover you need to protect your family? one crore? At least 50 lacs? If you want to have such huge life cover from endowment kind of plans, how much you need to invest? Further, your life cover will end with the plan, and at that time you may not get a new life cover, as you would be old and might develop some health problem that will prevent you from getting new life cover. Even if you get one, premium will be very high.

So, for life cover go for Term Plans, they will charge a premium similar to the mortality rate charged in a endowment or Ulip plan. No life cover comes for free. On the investment part, you will earn higher returns by investing in other options mentioned above. Do not mix insurance & investment, its a thumb rule.

but what about 10(10d),which is not in other product.

Grt work Add what is loyalty addition,how is it calculated it is company wise or scheme vise and what are the earlier loyalty additions declared by lic till date.But it is still better than bank fd if you are in highest tax slab .Though one can use it for tax planning : Buy it in name of all family members Claim tax free return ( You can do this policy from one year back also )In next one month now you can take loan against this policy.surrender value is 90% .All family members become guranteers and one guy whi is running business takes loan from LIC or OD from bank.Claim it as expense u/s 37(1) .;)

Thanks harish

Can you pls share some data on earlier loyalty additions declared by LIC, it will surely be helpful to our readers.

Also i do agree with you that this product certainly looks better for the investor with highest income tax slab.

Rest whatever you have written/advised will be helpful for business persons but if the call is for personal finance i feel that investments should be commensurate to overall financial goals.

Hi Manikaran, can you put some numbers around how is it better for people under highest tax slabs?

hi manikaran

Thanks a lot for the review i was visiting the LIC office after I show an advertisement and now i had change my mind.I had taken endowment policy(LIC) in 2004 and komal jeevan plan for my daughter of 3 yrs since 2010. I seek your good advice whether to surrender the policies?

Thanks Collin.

and also sorry as i cannot advice you on surrendering your policies just like that. I feel that if any of the above 2 policies are proving hindrance in achieving any of your financial goals than you should go ahead with surrender but otherwise if your cash flows are intact and you are able to make other investments for your future requirements then it is purely a personal choice.

hello friends, the article is superb to induce u away from the LIC policy as agents & advisors r paid better commission by private companies. if LIC gives u investment & life assurance both in 1 deal, u require no advisor to help u. just grab it. same policy sighted on ICICI gives 125% returns on maturty while LIC gives 500%. is there any comparison. wake up pl.. It will take atleast 10,000 years for these pvt. companies to come anywhere near LIC.

Hi Raj

u r right

Dear Raj,

Assuming you want to pay 30k premium for this policy. Try and break down this amount into two: –

1) Pay 10k towards a term insurance premium.

2) Pay 20k in a debt mutual fund or tax free FD if you don’t like MFs.

Compare the returns and life assurance amount and tell us which one is better?

Raj, why are you interpreting my article in wrong sense.

I agree with you that LIC ROCKS.The Corporation is adequately solvent at this moment and also enjoys a great amount of goodwill and brand recognition across the country. It is the oldest financial institution of the country.

But still investment and insurance should be seperate.

Hi Raj

Absolutely agree with you. Have been going thru TFL post for some time now and surprisingly I have rarely come across any critical comments against any of the private insurance players. Maybe the returns from the newer LIC plans are not that attractive when compared with Mutual Fund schemes but we should not forget that the LIC investments come with an added feature of Life Insurance which no MF can match and the argument that Term Insurance + SIP in MF will give better returns does not hold water as is the case now, where SIP investments are giving negative returns over a 3 year period. We should also not forget that none of the private insurance players have been able to match the returns offered by LIC.

Amit, point here is not about going with ICICI/Birla or any other private player for that matter and avoid investing in LIC . Point here is whether one should go with a bundle of product which offers insurance and investment in one version or one should keep insurance and investments seperately. You have rightly pointed out that last 3 years returns in MF SIPs is very miniscule, but last 3 years onetime investment returns in equity mutual funds has almost doubled the investment.(working of SIP and Lumpsum investment is different in different market conditions) Though still i don’t want investors to have 3 years horizon to invest in equity oriented product.

Can u pls tell me what would be the surrender value of any endownment plan after 1/2/3 years term. it would not be even equivalent to capital invested. Moreover, when we talk about Mutual funds it does not always mean equity mutual funds, there are many other asset classes where one can invest by way of mutual funds.That’s why, look at your requirements, needs , time horizon etc. and take informed decision.

I think we are missing tax benefit while calculating the retruns received by any person after investing in jeevan vridhi if he is in 20% or 30% slab difinetly this will increase the retruns.

It may or may not. Read below excerpt from the article carefully: –

Taxation risk: Pls keep in mind that the proposed Direct tax code provisions of taking sum assured equals to at least 20 times the annual premium , only then that policy will be non-taxable at the time of maturity. As the DTC is yet to be announced and this policy has 10 years term so ambiguity is still there.

Vivek,

I guess you missed Ajay’s point. What , I think, he is saying that the premium paid could be part of 1 Lakh tax exemption under section 80C which in turn could make the returns higher. This, obviously, holds true only when some one has something left in the 1 Lakh. If someone has already exhausted the 1 lakh limit, then this policy does not make sense in terms of returns offered. Even a 5 Year Tax Saving FD offers better return even after Tax.

Now coming to question of whether the maturity amount will be tax free or not under the tax provisions existing after 10 years, no one knows. My guess is that half of LIC’s business will be gone if the govt takes away this provision of maturity amount being tax free. Since Govt is using LIC to bail out banks and PSU’s , I really doubt they will do anything that will have an adverse impact on LIC’s business.

“If someone has already exhausted the 1 lakh limit, then this policy does not make sense in terms of returns offered. Even a 5 Year Tax Saving FD offers better return even after Tax.”

Exactly my point! Even if someone has not exhausted the 80C limit, other instruments can offer better returns. Why this policy then?

Dear Vivek

My wife’s earning is 4.9Lacs and she has not done any tax saving till now.

Now we have got around Rs 80000 which we want to invest for Tax savings.

Please suggest me, how to go about it, which policies are best suited for this purpose.

Pls consider that I am not that finance educated, & also the time left for Tax saving is very less.

Pls suggest the best option.

Thanks.

Manish

Though you have not shared any other detail which is required to advise you from financial planning perspective, so purely from Tax saving / Investment purpose, my advise is to buy a pure term plan, open a PPF a/c and put the whole money into that. Better to plan for next years tax saving in the april month only, so you don’t make any decision in haste.

This Plan is open till 31st may’2012. You may consider( if at all you want to) for next year.

This plan is open for 120 days Mr.Manikaran Singal.

Launched on March 1, 2012.

It will NOT close on 31st May 2012.

Please calculate.

I think retruns will increase if we consider tax benefit and specially if some body in higher tax slab.

Ajay, you are right. If someone invest in it for tax saving u/s 80C and he/she comes in 20%-30% tax bracket then the net returns in his case will be higher, provided maturity amount remains tax free.

as tax laws keep on changing and one very big change is about to come in few years, so we can’t say it with surety that maturity will remain tax free after 10 years also.

Sir,

What formula you have applied to work out the annualised return..

Sir,

Surprised why my small query is lost among all this informative posts..

Hi,

The author has applied basic Compound interest formula:

FV = PV* (1+i)^n

FV = Future value – the final payment

PV = Present Value – premium paid

i = interest rate – to be determined

n = 10 years

To get i = interest rate:

i = (FV/PV)^(1.10) minus 1

If an aged grand mother or grand father wants to give gift to his grandchild for his/her marriage then Jeevan Vridhi would be best option because that amount will goes to the grandchild only at the time of maturity and no body will tuch that amount whether grand parents are available or not

you are absolute right sachin

That’d be a decision based on emotions and not calculation. Grandparents can also gift a FD in grandchild’s name and if at the time of maturity grandchild is 18 then it will be all tax free. As of today tax free 10% compounded return on FD is a terrific return.

I agree with vivek saying,”That’d be a decision based on emotions and not calculation”. This is the most popular selling technique i.e emotional selling. when sellers don’t have anything better to offer they use this technique. I never recommend anyone to do such a blunder. If someone is retired then he/she should concentrate on enjoying his golden years, by investing as per his/her requirement of monthly inflow. one should never gift and lockin money in such kind of instruments.If at all one wants to do something for his/her grandchildren than better to do a proper estate planning.

Without knowing total facts, if a person just passes comment, it seems that the person’s EGO is very high than his knowledge.

” NEEM HAKIM KHATRE JAAN”

If you are in 20% or 30% Tax Slab, Jeevan Vruddhi is perfect option ( Please check the IRR properly, & Tax Free Maturity also.

1) Tax Free maturity is NOT GUARANTEED as DTC may spoil the party

2) Even if the return is tax free this plans ranks below PPF and Tax Free bonds. If you have exhausted them perhaps this is a good policy to look at but again you need to consider the premium you can shell out, age and other such factors before investing. It is not a PERFECT option but definitely worth looking at to be added to a Debt portfolio

Ansu, you may be right in one sense. But to take the benefit of this so called perfect option, one should be of younger age so the mortality cost is low and also he/she should use it for Tax saving u/s 80C. If someone is using it from investment angle then i differ in opinion.

Also as 10 years is a very long time to park the money, so i feel that one should also look at some other alternatives before deciding on this policy.

to add to it, we are not sure what will DTC bring in front of us, so why is so hurry. Better to wait for actual law come into effect. These kind of products keep on coming.

Even IRDA is not making any action against the Gaint LIC, when the stake is going beyond 10% (as it may not be >10%).

So there’s no chance of DTC….

Govt is using LIC to bail out some public sector Banks and PSU’s , I really doubt they will do anything that will have an adverse impact on LIC’s business.

Saju…just for your information…Budget 2012-2013 has tightened the eligibility criteria for life insurance policies to qualify for benefits u/s 80C and 10(10)d. Now only those insurance policies where the premium paid does not exceed 10% of the capital sum assured will qualify for such deductions. This condition applies to policies purchased after 1 april ’12

Every one talk Bonus from LIC is not Guarateed…..

Basic structure of LIC is….

Total Profit -5% Gov. Share

Balance 95% to Policy Holders as Bonus

Last year Gov. Share Approx. 1100 Cr. (agenst Gov. Investment of 5 Cr. in 1956)

Are you still think that LIC will Bonus is ?????????????????

Atul, can u pls share the bonus and loyalty addition track records in different policies of LIC. That will surely be beneficial for our readers.

It is a very nice policy.

Manikaran,

Nice review thanks for the Detailed analysis.

I see some LIC loyal people (or agents:) are interpreting it in wrong sense…Guys no one says donot go with LIC or go with Private.the point here is just get a term plan for you (Take it from LIC ) and then think of some investment points depending on your goal of tax saving or wealth creation.

And also the claim ratio which we always talk about donot forget LIC has most of the lower Sum assured policies since you cannot take adaquate insurance if you mix both investment and Insurance…..

So await for Online Term plan from LIC if you donot trust other players……..

And if you still think this plan will get some real vriddhi then go for it…..

“Insurance is the Subject matter of Solicitation”

Yes suhas, you have understood it correctly. The main aim of this review article is to help people take informed decision. No one is against LIC . One can surely buy a term plan from LIC with adequate cover, but for investments keep your goals in mind and weigh the alternatives.

Thanks

Very nice article.As a whole LIC itself is under the control of government and the people money is used at the will of gov.As of today lic is suffering a big loss with investment it has made in ONGC.Who is going to take responsibility for this.Thanks for allowing all the people know about the games that the govt. is playing with public money and we shall better choose other options available.

Thanks suresh. You have rightly pointed out one of the major concern.Where it is advantageous for the investors that LIC investments carries a sovereign back up, there it is also risky as investors will have to compromise on the return part.

As hemant has quoted Monika Halan in the beginning saying “ever wonder why LIC endownment plan returns around 5%”.

Safety is Risky

Sir

I am 36 years and need some advice on my financial planning. I have following assets/investments –

1. Properties – Loan Free

2. SBI PPF (Continuing since 2002)

3. ULIP – Started in 2006 – Birla Sunlife (Enhancer and Flexi Lifeline) – Premium 120,319 PA

4. ULIP – Bajaj Allianz Capital Unit Gain (Equity Growth Fund) – Started in 2007 – Premium 50,000 PA

I need some investment advice for long term.. i can invest 30K – 40K Per Month.

Thanks in Advance..

Prashant

Prashant, please understand Financial Planning is not about Investments only. It involves understanding of your assets, Liabilities, cash flow, goals etc. as in the end you have specificall asked for investment advice on the investment of Rs 30k-40k p.m, i would suggest you to Check out Mutual fund SIPs or Bank RD.

But better decide after understanding the Risk, returns and taxation. also better to decide onto your goals so you can fix up the time frame of your investments.

Also if you don’t have adequate insurance coverages, go with those first.

Dear Prashant,

As Manikaran wrote, Financial planning involves lots of different factors. However, since your needs are long-term, and you do not need 80C benefits, you may consider SIPs in diversified equity based mutual funds with proven track record of at least 3 to 5 years. You may also consider investing 10% of your fund in Gold ETFs or Gold fund of funds.

I must also mention, you may also consider real estate investment. Just check your investment horizon, surety of inflow of investable fund, liquidity requirements, and effect on tax.

I think the DTC will really determines the final outgo. In the extended calculations done on the above numbers the true return of a 6.77% for someone in 30% tax bracket is the same as 9.67% CAGR over 10 years taxed at 30% – this is considerably a good return and should make a decent addition to one’s debt folio after exhausting PPF. You can invest in a FD at current rates and sit tight as well.

In general almost all LIC plans are designed so badly but the offer here appears decent – an exception from LIC.

Hi Hemant,

I am searching some info about a child plan from LIC and have gone through your site around 3 days ago and you won’t believe that afterwards I have spent many hours going through many of your articles. It changes my whole approach towards finance planning. I came to know about some blunders I have done for last few years. I want to make some amendments so that I rectify some of my mistakes. I just want to take your opinion on 3 products in my current portfolio which I think require immediate attention. Could you please suggest whether I should close the below three products or should I continue?

1. ICICI LifeTime (ulip) – 24,000 per annum – Cover 250,000 – Issued 25/07/2005 – Current Value 212704.15

2. LIC Future Plus (ulip) – 10,000 per annum – Cover 200,000 – Issued 17/01/2006 – Current Value 84192

3. Jeevan Anand – 33,000 per annum – Cover 10,00,000 – Issued 28/09/2010 – 2 installments paid (Premium payment term – 30 years; Ploci term – 69)

Other than the above 3 products I have 2 more products through which I have a cover of 15 Lakhs and I am not going to amend those. And I already have PPF account for last 6 years. Now I will be going to buy a term insurance for 1 Crore and start investing in SIP’s from the month of April.

Thanks a lot for increasing my knowledge on financial planning.

Regards,

Gagan

Gagan, continuing or dis conituing the fund totally depends on the cash flow situation of a person. You have mentioned 5 policies out of which you are asking about only 3 and are comfortable with the other 2. After reading so many articles on TFL you must have understood the importance of keeping investment and insurance seperate, that’s why you are going to buy a term plan and want to invest in SIPs. Now when you are going to start investing in SIPs, take a look at your cash flow position. Hope you must have some goals in mind for which you have invested or want to invest . Check out whether the existing products are bothering you or helping you in achieving your goals and then take decision to stop or continue with it.

No product is good or bad in itself, it just how you will use it and for what purpose, that matters.

Dear sir,

my age is 28, which will be the best LIC policy for me,

Jeevan Anand, Jeevan Saral or Bima gold

Kindly suggest good one

Vikaram, please understand that asking such kind of questions may put you in financial mess sometime. You are asking for products and not solutions. Financial Planning wants people to understand solutions and then zero on to any product.

Better be clear on your requirement and financials and then ask for solutions. and one thing more , pls don’t make your financial life complicated by purchasing number of different products. Understand that there are only 4 asset classes – equity, debt, gold and real estate. match your goals with asset classes which will help you in selecting better product

Dear Manikaran Sir,

I’m aged 31 and having a term plan from LIC of 50 lakhs (Amulya jeevan, Term 35 Yrs, Prem-Rs 16300 Yly). I also have a jeevan anand of 5 lakhs SA of 35 years term for which I’m paying Rs. 1133 through SSS. (the advisor says that in jeevan anand i may get Loyalty addition of about Rs 2000 along with bonus of Rs48 per thousand Sum insured if the present rate persists. ) Now he is presenting this jeevan vriddhi as it gives 6.99% guaranteed return at my age. I had invested in two ULIPs and now having only the capital as surrender value ( also no loan facility). So I was planning to surrender these ULIPs and invest the amount in Jeevan Vriddhi. Is there any other option where I can get guarantee in return in this volatile market. I’m in 30% tax slab and my 80c provision of one lakh is already covered. Will the return of this plan be tax free? I don’t want to buy equity as it gives only tension.

Hi Deepak,

Its good that you have term plan from LIC.

I will suggest you to Check with your agent what you will get after paying these many premiums to LIC.

Will like to suggest not to invest in insurance + investment products.

If you are investing in insurance policies just for the sake of saving tax-you are on the wrong track Mr.Deepak. You can invest in mutual funds if you are planning for longer term.You can expect return in mutual funds to be around 10%-14%.

Hi deepak

Your investments should always make you happy at the time of investment and at the time of maturity. So one should keep in mind the ultimate goal for which one is going to invest and then select the investment product accordingly. Returns should not be the goal. Now you also have to understand that where that particulr investment product will furthur invest your money in, as there are only 4 asset classes where the investments will go into.understand the risk, return factors and then decide onto the product. I don’t know if you have done this exercise while investing in ULIPs, as if you have selected the equity allocation, then it’s bound to be volatile and moreover every insurance product has some expenses which will also dilute the ultimte return.

I am not in favor of selecting product just like that. Surrendering ULIPs and investing in Jeevan vridhhi is a pure personal decision, but i feel that should be helpful to your overall finances. So do some maths for it.

Yes, today i can say that the maturity amount will be tax free but as i wrote in article , that i don’t know how these investmnts will be taken care by DTC.

it seems what we are asking and what we are commenting are not in coherence. the “THINK TANK” tries to make sense by comparing two different products of different nature . i can not compare “cheeta” with “elephent” on a particular aspect. saving, investments, insurance, parking money, all comes under one roof called financial planning. and one can customized his financial goal by opting different instruments. now my question is it right to compare insurance plans with bank deposits/mf/elss………? i guess when we talk about insurance lets talk about similar products offered by other insurance companies? i guess now we will make a”valid argument” there is no other company stands near LIC when we talk about bonus rates/final addition bonus/ claim ratio/ i give you a mammoth figure ,you know total premium amount collected by pvt insurance was almost half of the amont LIC settled in claims only……….

now lets talk about MF/ELSS/EQUITY it is some what a gamble and one can not solely plan his daughters marriage on the pretext that on a particular day he will get money to get her daughter married where there is no grantee of sum…. i would love to invest in equity only when i’ll have some surplus money to keep at stake.

now talk about a riksha wala can you plan for him with a little amount

that he earn?? is there any product which can catter his need for insurance/investment/banking of money/loan ?? i know there is plan for him in LIC which can offer him a fairly right mix of insurance/investemt/parking of money/loan etc. now which pvt company can offer him product in accordance with his pocket size??

“JEEVAN VRIDHI” not investment plan i agree, but can you tell me what is investment ? can you tell me same plan offered by any pvt. ins, company? if yes lets compare them and make a valid argument

Sir, you are very true. M exactly saying the same thing. we cannot compare insurance plans with bank deposits/MF/ELSS etc. Insurance plans are meant to provide insurance cover, so one shold use these instruments for this purpose only.

We as Financial Planners have never been in favor of Mixing insurance with investment. You seem to be more experienced person to me ,may i please request you to share some data on the past experienec of LIC products on bonus rates/or loyalty addition etc. this will help our readers to make some decision. Regarding claim ratio i some how agree with you that’s why i support the decision to buy term plan through LIC. But claim ratio and premium collection does not have any impact on the scheme performance. Please correct me if i am wrong.

Now let’s come to your saying that MF/ELSS/Equity are somewhat gamble products…..Deepak singh ji, if this is the case than why LIC came up with products like Future Plus/market plus which are ULIP in nature and invest people’s money in Equity. I am not saying that what LIC did was not right, infact i appreciate the corporation to come up with one more asset class i.e equity in its product portfolio.It has actually helped those who treats insurance as investment to diversify into one more asset class.

I also agree with you that one cannot solely invest in that instrument where there’s no guarantee of returns, but that’s why we say “ASSET-Allocation” is the key. One needs to keep on reviewing the products and investments when there’s some goal attached to it. But the review should be after understanding the basic nature of asset class.

I once again reiterate the basic crux of the review – Take informed decision.

Look i agreed with you on many points, so there’s no need of argument.

Dear Mr.Singh,

When you are buying an insurance plan which also serves as an investment, like an endowment or ULIP. you have two things in mind: 1. Life cover, 2. Returns. Product is not the goal…protection and returns are.

Now, why do one necessarily need to compare an insurance product with another insurance product only? I would prefer to pitch a Term Plan+PPF against a traditional endowment plan, and a Term Plan+SIP against an ULIP and compare their returns, as my goal is to find a better solution for my financial & protection needs. So, what is wrong in comparing two different types of product?

thank you very much sir..

Our Pleasure, hrishikesh.

I am going for this policy as I trust in LIC. LIC is the only company which has very high settlement rate.

Is this the only criteria you have for taking any policy?

Agree LIC has high settlement rate. This is because they don’t get high value claims, maximum would be 5-10 lacs. Most of their products are investment based products where LIC would be earning 15% and passing on 6% to the investors. Any company can have high settlement rate with this business model.

Agree with you that LIC has very high settlement rate. Go with LIC term insurance.

sir, i have one child ageing 0 age , please suggest good child insurance plan which includes waiver of premium and income benefit rider and also get good returns after completion of the term of the policy.

Go for mutual funds sir, child insurance plans are not going to give you any benefit.

If you have risk appetite go for equity mutual funds [recommended for long term] otherwise go for debt mutual funds. This will not only give you returns that can beat inflation but also generate corpus for you child’s higher education.

Almost all child plan comes with the 2 riders that you have mentioned above, but you need to understand that more the riders, more will be the cost and thus less returns.

Child plan always works best in case of demise of parent and thus not good for investments. and if at all you are looking for this benefit only then why don’t you buy a term plan with adequate sum assured and invest in PPF or MF for your child’s future.

I am sure that would prove to be a better combination

Having invested in various insurance policies and over 30 years, and sad to realize that there is nothing called “life” insurance but “death”. Further, concept of the insurance is a very pessimistic. Have you all asked or every questioned that you are 1 in a million to die?

Also the rig-ma-role of running around & documentation worth that you put the living people run around for worth?

Don’t you think the sprawling buildings of insurance companies insurance agents haunting, stressing you up. So, forget all that in the name of Insurance and all it’s tax benefits…

A bird in hand is better 2 in the bush….

suggest good child insurance plan, ppt is 18 years

its better if you design your own child plan by buying seperate products of insurance and investment.

It seems that Mr.Manikaran is showing acute favoritism towards private insurance companies. The deliberations are very much prejudiced and with an intention to tarish LIC, the reliable face of insurance business in india. I am one suffered a lot on account of investing the ICICI and Birla insurance schemes suggested by you and my experience is that I neither got any premium addition nor majority of the amount invested by me and I was a loser in every respect. But my experience with LIC is different. I got the sum assured plus a reasonable additions when i got one LIC policy matured last month. I am satisfied with the service of LIC. I request Mr.Manikaran to consider the case of the hard earned money of common people of india like me is losing by investing in private insurance schemes, while write negative comments about LIC, the only trusted player of insurance in indian market.

Manoj, you have got me wrong.

Nowhere in the article i have written that one should go in for ICICI or Birla insurance policies, neither i have written that one should not go with LIC. Also i strongly object on your saying that icici and birla insurance has been suggested by me or hemant through TFL. Readers of this blog are definitely with me saying that this blog never promoted any particular product and we are also against mixing insurance with investment. So whatever gain or loss you booked was totally your decision. I totally respect your trust towards LIC, and i understand that this is the most trusted brand in the country. But that doesn’t mean that one should purchase each of its product with closed eye. And yes, i am considerate about the hard earned money of common people that’s why i want people to take informed decision.

Dear Manoj,

I hope you are not comparing apple with oranges!! I think you are comparing ULIPs with traditional plans!!

1. Those Pvt. insurance products you bought were ULIPs or traditional plans? I guess ULIPs. Which fund did you choose? I guess equity fund. Now, during the same period when you were invested, how much returns LIC’s ULIP plans with equity fund investment delivered? Is it more, less, or equal to the returns generated by Pvt. players? You should compare that.

2. If you invest in traditional plans of Pvt. insurers, on maturity you will get similar benefits like sum assured, bonus, terminal bonus etc. like LIC. Returns will also be more or less similar, i.e. pathetic.

3. I also guess that you exited Pvt. insurer’s ULIP plans before maturity. So if you consider premature surrender of policy, then surrender clause for traditional plans are “30% of all premiums paid excluding the 1st year’s premium” – for both Pvt. insurers and LIC…..excited??

Please note that I am not against LIC or in favor of Pvt. insurer. I am against all insurance policies sold as investment plans. Pure Term Plans are the only insurance plan one should buy…from any insurer of one’s choice.

Hi, Hemant

I was very eager to know about this policy, when i saw this add.

But now its very clear to me..I m agree with you that why people want to mix investment and insurence..

Thanx for making me Smart investor.

Thanks ranjan for your appreciation. It feels very great.

I read your article. I personally thinking your are absolutely biased. As you wrote in your article that this policy is giving 6.85% guaranteed and 8.12% non guaranteed. Lic will invest your money in government securities. In government securities the interest rate is on an average is 9.00%. There are some charges also like agents commission, d.o.’s salary, administration charges. First and foremost is that a person is get insurance. Because it is a insurance company. Please tell me which company will gives you this kind of returns. So lic is giving you good returns, according to my self. As you discussed about the f.d. and n.s.c. you forgot that this scheme are taxable. The tax payer will get only benefit of 80c not maturity benefit. In insurance the maturity is non taxable u/s10 10(d).

Please reply

please do not hide this discussion from this website.

THANKS

REGARDS

S.K. AGARWAL

How about putting the same money in debt mutual fund? Will it not give you tax free returns? And I am sure it will be more than 9%.

Mr Aggarwal , I have only calculated the return percentage as per the illustration on LIC website. Also to make clear for the readers , the illustration is of person with 30 years, which means that returns will be less for the investor with higher age.

If you are happy with such returns than it is good for you. Its all about acceptability of product after understanding the pros and cons. as far as taxation is concerned, though i am sure that one will get benefit u/s 80c but not of 10 10(d) as it all depends what will tax laws say at the time of maturity.

Dear Mr.Agarwal,

Whether it is LIC or any Pvt. insurer, investment mandate for traditional plans are similar…roughly 75%-100% in G Sec., rest in high-rated corporate bonds. Now, all insurers have cost like admin, overheads like rents and utility bills, other office expenses, salaries and benefits for staffs. To make things worse, agent commission for insurance products are obscenely higher compared to any other investment option. And after that these companies need to make profits also (including LIC). So, how much of total return they can really share with customers? Just check if these insurance plans including LIC’s protect against inflation, if not, then these plans are actually shrinking the purchasing power of your money over time.

You can also have a look at the reply I gave to ‘Mr.dd’ above for different investment options other than insurance. However, since it seems you prefer traditional insurance plans, consider buying a combination of Term Plan+PPF instead of endowment plans. That will suffice all your purpose of investing in LIC including life cover and tax benefits. and also generate better returns.

lic is giving more return than any other insurance coin india.. if you want both insurance cover and return than jeevan vriddhi is a wise choice..

Forget about pvt insurance co there return is -ve from market ..even in worst condition lic return is more than 5% from ulip policy..

LIC protect the face of Gov by buying 41 core of share ..total no of shares were 42.27 crore..

Now think what is LIC of India..

There is no need to be too much praise of LIC. They do business and we buy products.

The insurance part in Vriddhi is a joke. Jeevan Vriddhi is a decent policy but that is only if you have exhasuted your PPF and HAVE A TERM Insurance.

And LIC buying 41 crore shares ONGC shows 2 things:

1) It has a deep pocket that is put into use for unproductive things like bailing out a Government sale

2) It has no say on it own which means it can not always necessarily deliver good things to its customers even if it wanted to!

Hello Manikaran,you know why people go for LIC,FD and similar type of products because they femiliar with them and using all of them from a long time and getting retruns wether it is low but they having peace of mind now few years back when they tried ULIP produts and MF without knowing the product fully lot of people had high losses so this all means one should only go for financial product if you know fully about it.

That is a lame excuse. To begin with do you know how to calculate the IRR or simply put – the rate of return of a LIC policy?

Inflation eats all LIC and FD returns and there is ABSOLUTELY NO WAY TO GET AHEAD without exposure to Equity. So you may ask how people in 1970s, 1980s and 1990s managed things without much of Equity. Well – the inflation was same or even marginally lower than today and Government sponsored PPF and NSC provided even 12% returns for long time – which was enough for them. It is not the case today.

You cant shun from MF just because you do not understand it. You HAVE to take the pains to get educated and then make a judgement.

I am not being harsh but until all of us come out of the mentality that fixed income products alone are sufficient it will be difficult to improve our fnancial lives.

Totally agree with you. to add to it, more than financial product one should understand himself first. Decide onto goals, give them inflation adjusted monetary figures and select asset classes to help you reach those. Then search for the product and invest after understanding the pros and cons.Investing in product and then searching for the reason or excuses for this investment is a BAD IDEA.

Ajay, it will take time but we take it as challenge and keep on doing our bit.

Hi Manikarnan

I gone through all comments here and your suggestion also.

Is any of investment product will give in writing that assure 10 – 14% returns. After 10 years if market crashes suddenly like Feb 2008, what happened to our hard earned investment. if not growth is our investment is intact? Ans- Not predictable Secondly What things are there in ICICI, BIRLA or BAJAJ policies which is not there in LIC. Bonus ratio, Life fund, settlement ratio, Co., Profit, Govt guarantee. Let me know the reasons for all.

Thanx

No there’s no investment product whhich can assure 10-14% return. One can calculate only on assumption based on past experience. Asset allocation is very importnat so one can comfortably face the market crashes like Feb 2008. your second question reminds me of Amitabh Bachhan in Deewar, to which LIC can comfortably say “mere pas government Guarantee hai”.

hi

please, when you go for insurance cover and don’t look for returns and when going for returns don’t club it with insurance .keep investment and insurance separate.

I like it , Vinay.

Hi Hemant,

Why I feel that you writing look like Anti LIC.

I have not seen you writing about Private Insurance company.

One side you suggesting ELSS, 5 year FD.

In case of ELSS… My personal experiance says that i have invested Rs. 75K and save my 20% Tax… But even after 4th Year not more than 50% are recovered from investment.

In case of FD… There is also Interest Risk and top of it, FD interest is Taxable.

I think you should not be un-biased while explaining any product… Let reader decided what is best for them.

Further… we would like your comment on all the products come into Market and not only LIC products.

Hi Atish,

Let me start with “Products (ULIPs/Endowments) from Private Insurance companies are even worse than LIC” – this is a generalized statement but I hope this will satisfy you that I am not supporting any private company.

Most of the ideas for writing articles on TFL are generated either through queries from readers or my interaction with people. As LIC has the biggest market share in all financial products – most of the time people ask questions on same. But that doesn’t mean we have not written reviews on Private Insurance Company products – check

Bharti Axa Aspire Life

https://www.retirewise.in/2009/08/insurance-schemes-or-insurance-scams.html

Metlife Monthly Income Plan

https://www.retirewise.in/2009/11/ad-mad-mad-advertisementmetlife-monthly-income.html

Just to add – my less than 10% articles are on particular products so out of 200 articles that I have added on TFL – less than 20 will be speaking about any scheme. And hardly 2-3 reviews are positive.

But mixing insurance with investment is a wrong thing be it ULIPs or Endowment Plans. And we have made people aware about it.

https://www.retirewise.in/2010/04/what-is-insurance-investment-or-expense.html

We have also tried to explain that Indians don’t understand insurance

https://www.retirewise.in/2010/12/psychology-indian-life-insurance.html

We have also shared that how these products are mis-sold but as an end user if you don’t want to understand – that’s clearly your choice.

https://www.retirewise.in/2010/08/mis-selling-tricks.html

This doesn’t mean I have supported products of Mutual Funds –

Mixing Insurance with Mutual Funds – wrong idea

https://www.retirewise.in/2011/08/reliance-sip-insure.html

or MFs pushing gold products

https://www.retirewise.in/2011/08/sbi-gold-fund-review.html

I don’t think there is any need to clarify further but people, who are reading articles on TFL, must read the Disclaimer “All the content on this blog (tflguide) is solely for the readers’ general information. This blog contains our personal commentary on issues that interest us. Nothing on this blog is intended to be a personal advice and reader is himself/herself responsible for their decisions. Before acting on any of the information provided, consult your financial advisor.”

We have only 2 options in life – CHANGE or ACCEPT. So, try to Change what you can’t Accept & Accept what you can’t Change. Hope you got my answer.

Dear respected sir

There is One more plan of Bajaj Alianz is similar to jeevan vriddhi

(Single Premium, term 10 year & Guaranteed Maturity)

Please tell which one is better.

Thanks

betterment of any product is there where it suits your requirement. personally, i wuld not advise mixing insurance with investment.

Don’t ever invest on MF’s or in share market. Just plan and think of investing in real estate, invest in land which will always give you better returns.

I had an LIC endowment policy which is maturing this month. Against a policy of 1 lac i was told that i am getting around 1,60,000/- after 15 years. I want to invest money that I received from LIC + willing to pay a monthly premium to the extent of 10,000 per month in some descent policy which gives me value for my money and live cover. Pls suggest what is the best option for me.

Umesh, your investment cum insurance product has generated annual return of 3.18% p.a. Are you still looking for same kind of investment, as in your question you are specifically asking for a policy. DID you get the value of money in your last investment?

As any good financial advisor would do, I always recommend equity based products for long term portfolio. ( without which you can’t conquer the long term enemy – that is inflation).

But investors come from different color and different flavor. Not every one can sleep with equity based portfolio peacefully.

Among all the endowment products, that are available to this community, this is not a bad product at all. Jeevan Anands and Jeevan saral are best selling plans and they make more people in this country poorer every day.

We must appreciate LIC for bringing this kind of product. We should not criticize LIC even when they do things correctly ( for a change),

Taking 80C benefit and 10(10D) benefit into consideration, a 35 year old is looking at 11% yield. Show me a product comparable to that today.

I would say if you are time pressed, and have to buy some thing before this March end, go for it.

Thanks Raja for your views. But what would you advise to a person who’s already exhausted 80C investment limit , and in this kind of uncertain Taxation scenario where we are not clear what would the proposed DTC do with such kind of investment. And moreover if a person is older than 35 years

No, I wont.

You are picking a situation for whom this product won’t work. why ?