Beta in mutual funds represents market risk or systematic risk. Standard Deviation measures volatility of fund in comparison to its mean return but beta measures sensitivity of a fund to its benchmark/index. (Sounds alien – let’s make it simple)

How often have you tuned into a business channel or opened the pages of a pink paper to be told where the markets are headed? The word currently going around is that markets should move up by approximately 25 per cent in the next year. (added just to make you happy) This seems so reassuring. Wouldn’t it be equally reassuring if one could get an indication of how a mutual fund would perform in the future? Especially when all performance data is just an indication of how a fund has performed in the past. And more so when this ‘past performance’ is accompanied by the warning that it may or may not be replicated in the future.

What is Beta ?

There are statistical tools, which can give you an idea of how a fund will move in relation to the market. Beta is a statistical measure that shows how sensitive a fund is to market moves. If the Sensex moves by 25 per cent, a fund’s beta number will tell you whether the fund’s returns will be more than this or less.

The beta value for an index itself is taken as one as it is expected that this funds will just mimic INDEX.(so you would have heard this song “tu jahan jahan rahega mera saya saath hoga”) Equity funds can have beta values, which can be above one, less than one or equal to one. By multiplying the beta value of a fund with the expected percentage movement of an index, the expected movement in the fund can be determined. Thus if a fund has a beta of 1.2 and the market is expected to move up by ten per cent, the fund should move by 12 per cent (obtained as 1.2 multiplied by 10). Similarly if the market loses ten per cent, the fund should lose 12 per cent (obtained as 1.2 multiplied by minus 10)

This shows that a fund with a beta of more than one will rise more than the market and also fall more than market. Clearly, if you’d like to beat the market on the upside, it is best to invest in a high-beta fund. But you must keep in mind that such a fund will also fall more than the market on the way down. So, over an entire cycle, returns may not be much higher than the market.

Beta in Mutual Funds

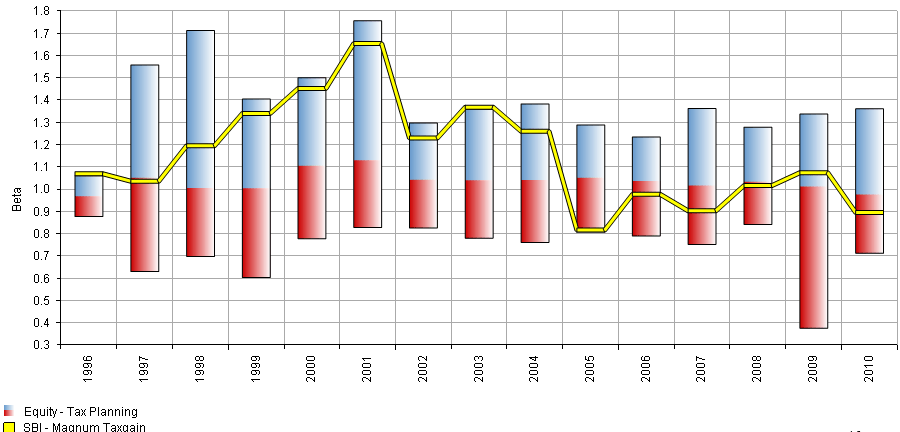

SBI Magnum Tax Gain fund was made open ended in 1999 & it was managed by Sandip Sabharwal till November 2005. You can check the beta of the fund in comparison to its peers – Yellow line.

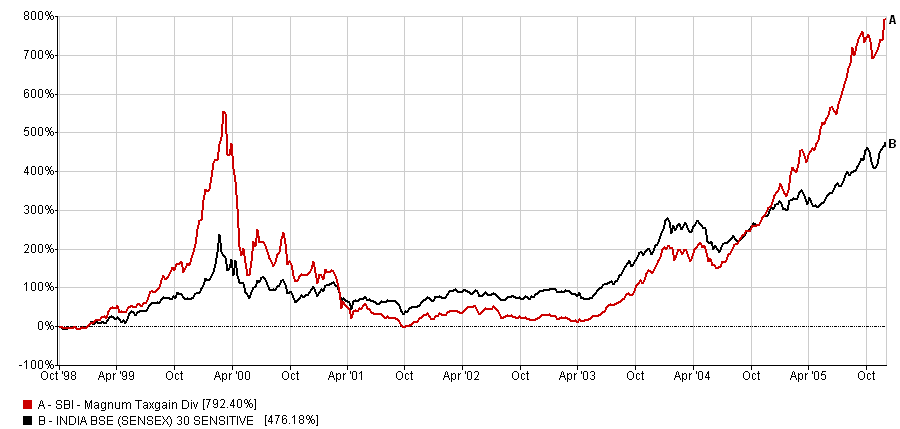

Performance of a High Beta Mutual Fund

You can clearly see how a fund with high beta performs in different market cycles.

Similarly, a low-beta fund will rise less than the market on the way up and lose less on the way down. When safety of investment is important, a fund with a beta of less than one is a better option. Such a fund may not gain much more than the market on the upside, it will protect returns better when market falls.

So beta seems to be just what the doctor ordered. But as in the case of all things which seem to be too good to be true, there is a catch. The problem is that beta depends on the index used to calculate it. It can happen that the index bears no correlation with the movements in the fund. Thus if beta is calculated for large cap fund against a mid-cap index, the resulting value will have no meaning. This is because the fund will not move in tandem with the index.

R-Squared in Mutual Funds

R-Squared in Mutual Funds

Due to this reason, it is essential to take a look at a statistical value called R-squared along with beta. The R-squared value shows how reliable the beta number is. It varies between zero and one. An R-squared value of one indicates perfect correlation with the index. Thus, an index fund (check DSP Equal Weight Index Fund) investing in the Sensex should have an R-squared value of one when compared to the Sensex. For equity diversified funds, an R-squared value greater than 0.8 is generally accepted to mean that the underlying beta value is reliable and can be used for the fund.

Beta and R-squared should thus be used together when examining a fund’s risk profile. They are as inseparable as risk and return.

Some Funds with high & low beta

(data March 2011)

| Fund | Beta | R-Squared |

| JM Emerging Leaders |

1.54 |

0.86 |

| Magnum Emerging Businesses |

1.34 |

0.87 |

| Magnum Midcap |

1.33 |

0.86 |

| Taurus Discovery |

1.27 |

0.86 |

| L&T Small Cap |

1.25 |

0.84 |

| Canara Robeco Emerging Equities |

1.24 |

0.88 |

| ING C.U.B. |

1.23 |

0.89 |

| Escorts Growth |

1.01 |

0.69 |

| IDFC Premier Equity Plan A |

0.92 |

0.87 |

| Reliance Long Term Equity |

0.92 |

0.89 |

| Principal Dividend Yield |

0.88 |

0.92 |

| Tata Dividend Yield |

0.88 |

0.92 |

| Birla Sun Life Dividend Yield Plus |

0.84 |

0.9 |

| Escorts High Yield Equity |

0.7 |

0.79 |

Findings from above Beta table:

- Someone who has ever invested in mutual funds can clearly see that why JM funds were so volatile.

- Escorts Growth has R-Squared of .69 – data is unreliable similar to this fund

- Birla Sun Life Dividend Yield Plus beta is low so if you see last 3 years data it is one of the best performing fund. Will it participate in next Bull Run – check its performance when SENSEX touches 40000.

If you like this article you must read about Standard Deviation in Mutual Funds – which tells you about volatility/risk of a particular fund or portfolio.

Do you think it’s important to see factors other than returns while choosing a fund?

mind blowing article Hemant…. your articles are always so good, i can’t resist myself reading these in between my work. I have sent you the data asked by you in mail yesterday, but didn’t get any response till now can you please take it further.

I need one advice. my father wants to purchase SBI Life Insurance, the agent is promising 12% return compounded yearly and a bonus of 25,000 i.e, if we are investing 20,000 every year for 5 years the total return will be around 1,80,000+death cover of 2 lakhs.

I suggested him not to mix insurance with investment, either take pure insurance or pure investment…. Can you please throw some light on this.

Thanks Saurav.

Regarding your query on “the agent is promising 12% return compounded yearly” – it’s a clear misselling. Ask you agent to give this commitment on SBI Insurance letter head. Also read this

https://www.retirewise.in/2010/08/mis-selling-tricks.html

Dear Mr. Hemant,

Your article are crisp clear with your logic and some real life instances make them more interesting. I almost read all of them and trying to invest in equity markets, but unless i know the subject i won’t invest. I go through many articles on financial aspects but so far to my knowledge u r the best one to go through.

I always try to get the logic how the market determine the prices of the shares and how we can ascertain that the company is over valued or under valued. What aspects do we need to know about investing in equities. My goals are clear that i need to invest 70% of my allocations in equities and balance in other assets classes which are less riskier. My age is about 34, and need to stay invested in the market for the next 25 years. How should i proceed and i do not want to make quick money in the market by intra day trading rather to stay invested in value driven companies or would be in future. like Sun Pharma or Infosys etc.

It would be great if you can give a guidance about the same. If you are willing to charge for the same i do not mind for your consultancy. .

Thanks

Raj Kumar

Hi Raj,

2 things i would like to add:

First we cannot learn swimming by sitting outside the pool – we have to enter the pool. If not 7 feet – start with 3-4 feet.

Second my suggestion to retail investor is they should take mutual fund root rather then direct equity.

Dear hemant,

one more example ….. i used to ask my dad to pave the road with mattresses when i was learning riding bicycle…so that i do not fall and get bruised……he had only one answer for it…. a nice slap!!!!!

similarly in any business the slaps and bruises are a part and parcel of the learning process…..you endure them to enjoy the speed, and freedom and thrill of beating the pedestrians…

happy investing

Another excellent article to understand MF linked to the index. I did not understand the first para, the rest made it very clear. I believe, you as a financial planner, might have generated these analysis for the funds as I do not find these data readily available for all the funds. Please correct if I am wrong.

Does the Beta applicable to the debt funds as well, or is there a different way to predict.

Thank you for the great articles again.

Hi Mansoor,

Ya some of the data I use is not available in public domain – either part of our research or the paid software that we use.

In debt beta is not used – here modified duration & yield to maturity are used.

When you get a chance, please write about the best fund houses in India, would love to read your take on that.

i think there are no best fund houses….there are either smart investor or dumb investors……

smart ones find the opportunity and turn good fund house into the best one.

Hi Mansoor

Mudit has rightly pointed out that there is no best fund house as there is no best fund. There are some good fund houses which have some good funds. Right now there are 41 fund houses. I will give you a list of a few fund houses which can be called good.

Different people use different criteria for evaluating the performance of fund houses.

The first factor to be considered is the performance of the fund house which is judged by the number of highly performing funds the fund house has.

The second factor is the Sortino Ratio. It is an indication of the downside volatility of the funds of the fund house.

The third factor to be considered is the size of the assets managed by the fund house.

Based on the above methodology, the list of good mutual fund houses is as follows.

1 HDFC Mutual

2 Reliance Mutual

3 DSP Blackrock Mutual

4 UTI Mutual

5 ICICI Prudential Mutual

6 Birla Sunlife Mutual

7 Fidelity Mutual

8 IDFC Mutual

9 Franklin Tempelton Mutual

Thanks Mudit and Anil for your insights. I sort of agree with you.

Hi Hemant

You have posed a very interesting question :

Do you think it’s important to see factors other than returns while choosing a fund?

The answer is yes indeed!

I am giving here some factors which I think must be considered apart from the returns while choosing a fund.

1 Risk Profile

The selected fund should have a risk profile which is in line with the risk appetite of the investor.

2 Background of the Fund House

The philosophy of the fund house, the people managing funds, systems and processes, the number of top performing funds and investor services are important considerations.

3 Fund Management

Experience and reputation of the fund manager and his team in generating superior returns in the funds managed has to be considered.

4 Fund Performance

It is to be evaluated by comparison with benchmark index of the fund and its peers over different market cycles. The fund should deliver high risk adjusted return with lower standard deviation and higher sharpe ratio.

5 Cost

This includes fees and charges. The fund should have low expense ratio and exit load.

6 Fund Portfolio

It should not have high concentration in stocks and sectors and should have

low turn over rate.

7 Taxation

Tax implications of investment in the fund must be understood.

Hi Anil,

Thanks for sharing this – hope this information will be helpful to other readers.

Dear Hemant/Mr. Kapila,

All the points discussed by Hemant in the main article and later by Anil in his post are valid and sound enough. But the main problem is not with the piece of advise that you are giving to the investors, but it is something else.

For elaboration, i would like share my experiences as a teacher of IT in a self-financing university. We know of many students who are good enough to score 70-80% in theory exams but are poor in practical exams. Similarly, there are students who might not be able to score good in theory papers but may do exceedingly well in practicals. The problem with the first set of students is that they depend heavily on the notes (the readymade stuff …. or rely on spoon feeding as i often say in my classes) from friends, teachers, seniors and Google Devta (:D). And they form the bulk of students in any class these days(sic but true….so the India growth story can falter any time and we would know why). The problem with the second category of students is that they know how to do it but cannot express it properly when it comes to words.

But, when it comes to financials the same attitude of the first category of students can prove to be disastrous. Unfortunately, this attitude that has become a norm in our schools and colleges becomes so ingrained in our minds that it is impossible to even identify it, let alone getting rid from it.

The second category of students will no doubt find it difficult to compete in job-interviews but will certainly make for good investors as they will do their own research work, spoiling your feet in mud is the only way to reap the harvest of paddy.

Then, there is a third category also, who are good in doing things on their own and have developed their skills to express it appropriately. Certainly, Hemant falls in that one that is why he could discuss such a confusing and complex topic is the terms that are not alien to lay persons. Kudos.

regards and happy writing.

Hi Mudit

My daughter is a student of BCA third year but I am finding it difficult to put her in one of the categories mentioned by you as she has some traits of all the categories. She is able to score easily around 70% marks in theory without doing any serious study. She gets more than 90% in her practicals. She has no problem in expressing herself. Her only problem is that while she can type very quickly on her laptop her writing speed is very slow. Whenever she tries to increase her writing speed, her hand writing becomes so bad that probably her teachers find it difficult to read. Because of this problem she is not able to attempt all the questions in her theory exams.

Fortunately she has the option to give her project reports in printed form. Yes, she takes the help of Google Devta for preparing her presentations and project reports.

Dear Sir,

It is good to know that your daughter is doing great in studies. My best wishes for her. She certainly belongs to the third category of students (with Hemant), but has a handicap in the form of her bad writing. And as far as i know apart from people belonging to your generation or mine (i am 32) or earlier, most students who are exposed to laptops/PC/smart phones will always have this problem and it will only increase. We win some, we loose some….

Now, for the investment style or rather research style of investors, i still believe that most investors belong to the same category as the first one. Being part of a private institution and being in the thick of the things, i know how marks are awarded to students. As a protest to the system in my institution, i have stopped evaluation answer copies or being the examiner for practicals long time back as i know i would be forced to award higher scores than they actually deserve. it is done to boost up the overall result of the institution. Same happens with many MFs and stocks, where the fund manager or company management keeps on giving huge dividend payouts despite being in hot soup (remember Satyam).

I do not despise seeking help from any source, be it Google or the notes from seniors. But i wish that my students at least learn and understand what they are putting in their copies/files before showing it to me. i even allow them to get their work photocopied from other students to save time and energy in re-inventing the wheel, but they will have to show if they really understood the concept and could now solve similar problems. Similarly, tips and advise from multiple sources is always welcome, otherwise how on earth i would have known about TFL, but one must be able to filter the relevant from garbage and act accordingly. One must own up to the consequences of the actions/decisions taken be it a windfall gain of torrential losses and should not attribute those to the agent/advisor or somebody else.

“All profits are made because I acted on something or I believed in an idea….All losses are incurred because i was ignorant or I was lazy or over optimistic.”

That should be the motto of the investor. No doubt the advisor/agent will get his share of accolades or brickbats like a teacher does, but finally the person most affected by a report card is the student and not the teacher.

regards and again best wishes for you and your family,

Hi Mudit

I always enjoy reading your comments because you provide new insights. I completely agree with the motto which you have suggested for the investors. You have all the attributes of a good teacher. Good teachers enjoy their job and this breed is very rare. On the teacher’s day I also remembered my teacher of electrical machines when I was an engineering student.

So much has been written about the types of investors. Hemant has a very good post on this topic. All investors must be clear about the category to which they belong. Only then will they be able to take correct decisions during a crisis.

Hi Mudit,

Awesome thought “but finally the person most affected by a report card is the student and not the teacher.” 🙂

thank you, Hemant ji and Anil ji,

wish i get your support and BOOSTER doses regularly…….. 😉

First of all i thank you for having a passion to write on a matter which most of human race doesn’t share……. Knowledge. The knowledge of SIP. Second I really like the way you made us ( me) understand about choosing MF. There is one question with respect to a statement above “Birla Sun Life Dividend Yield Plus beta is low so if you see last 3 years data it is one of the best performing fund. Will it participate in next Bull Run – check its performance when SENSEX touches 40000.” I meant the last part I didn’t understand. Are you telling this fund will do well.?????…….. Lastly THANK YOU. I know you must be knowing or all the above people …… ICICI direct mutual funds allows you to comapre as many funds you want including technicals. Thanks again as I googled your words and ended up in ICICI website … thats how i know this info… Funny

Comments are closed.