A Picture is worth thousand words. So today I thought to share few charts that are really important for you to understand. Let me share one more thing that most of the charts that you find on TFL are out of my own research. And sometime it not takes hours but few days to make them. Hope you will appreciate them by giving your few minutes.

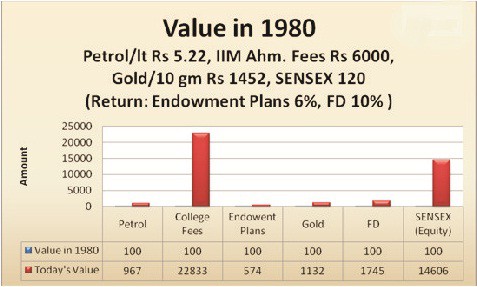

Long term investment chart – this is 30 years data of various investments & it compares them with few expenses. We can clearly see that in long term equity is a clear winner – difference is so huge that it can’t be ignored.

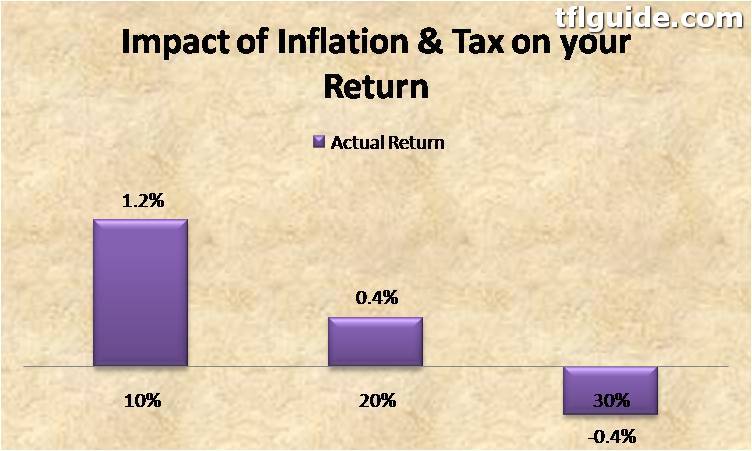

Negative Debt Returns Chart: Debt creates an illusion of safety but in long term safety is preservation of purchasing power. But here debt products fail. Most of the time debt products give negative return – if we consider inflation & tax.

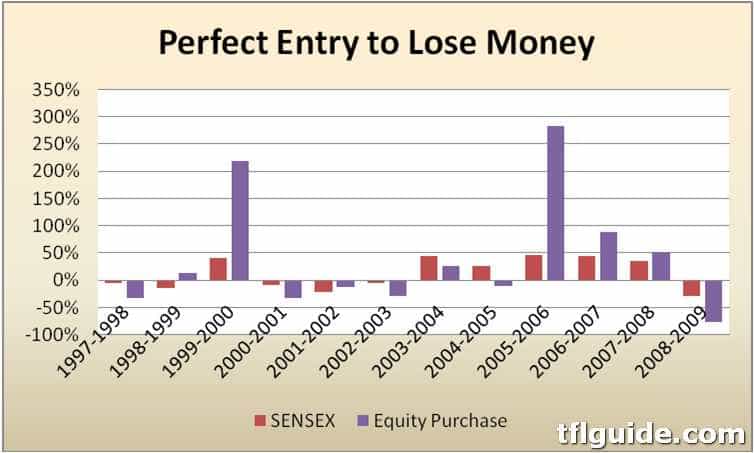

Related Article: Why Fixed Deposits & Debt Returns will always give negative returnsChart why people lose money in equity – I always keep saying that Investing is not a number game but a mind game. There will always be a big gap between Investor returns & Investment Returns. And this graph clearly shows how greed & fear rule our mind. It shows that when market start rising people pore more money & vice versa.

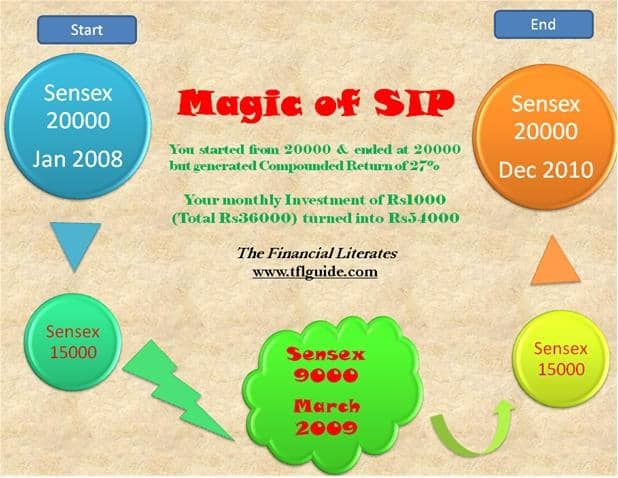

Related Article: Behave Yourself… FinanciallyChart Magic of SIP – Systematic Investment Plan(SIP) has become a buzz word now a days but I am sure people still don’t understand it in a real sense. SIP is a great tool which can help you in achieving your financial goals. For some, last 3 years were the worst part of their investment life but for SIP investors it was not less a dream that came true. Chart Shows market moved in a semi circle & investor made 27% CAGR return.

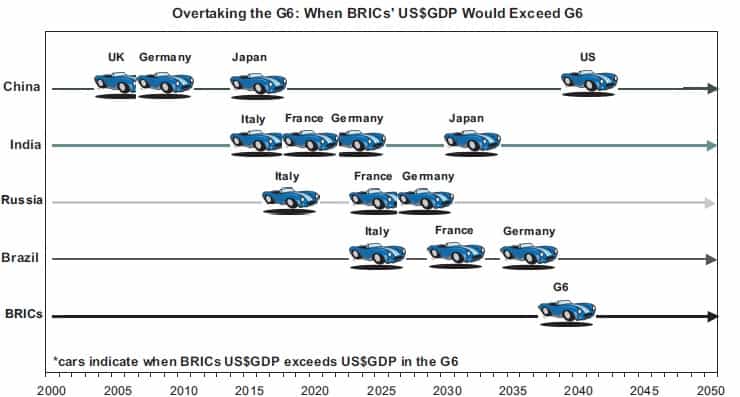

Related Articles: Systematic Investment Plan(SIP) – Complete Guide India Growth Story Chart – You will never have a faith in equity if you will not try to understand relation between stock markets & growth of economy. Stock Market is barometer of economic growth. If you don’t believe that India will grow & become a bigger economy in coming years, better you should not invest in equity markets. This graph is part of famous BRIC report by Goldman sach that says India will be 3rd largest economy around 2030. Related Article: India will rule the worldInvest in Equity and you will reap the benefits of Indian growth story. In the last 30 years, India’s GDP has grown close to 6% and now we are nearing 9-10% GDP growth target.

Also Check: 5 Funny Investment & Insurance Cartoons

Mandhupam added a comment – which gives better direction to this article. 🙂

Simplest explanation to the 5 basic questions, which bother an investor. And these are:

1) Where to invest? (India)

2) Which asset to invest? (Equity)

3) How to invest? (SIP)

4) What minimum return to aim? (Alteast above inflation)

5) When to invest? (Always, with no timing)

Must share your views & ideas on charts – I may try to build few out of them.

Dear Hemant,

A great analysis by you. I can clearly see the simplest explanation to the 5 basic questions, which bother an investor. And these are:

1) Where to invest? (India)

2) Which asset to invest? (Equity)

3) How to invest? (SIP)

4) What minimum return to aim? (Alteast above inflation)

5) When to invest? (Always, with no timing)

Very intersting and something like Gulzar’s poetry, which has simple words but have a deep meaning.

Thanks Madhupam,

Added your comment in the post.

i want to know about the wealth story of financial market of India from 2006 to 2011 please sent the same sir. thanks a lot

Thanks for suggestion – I will try. But you wrote something similar – which you can read by downloading e-book from top of this page.

Excellent Article and great analysis..Your hardwork really shows HEMANT regarding your research and projections..Only thing i find missing is returns from REAL ESTATE over this period..Please include that part also in the article..

Dhawal Sharma

Hi Dhawal,

Very limited data is available on Real Estate & that too is not reliable but still will try to add something in coming days.

Awesome post. Thanks.

The SIP return of 27% is a real example? Can you please point me to the data source behind the calculations?

Thanks,

Hi Ranjan,

27% is a real example & source is average of SIP returns.

Data on this article will help you

https://www.retirewise.in/2011/02/systematic-investment-plan-mutual-fund-sip-best.html

Visited many websites regarding financial guidance and learning. So far you are leading. Great job. Keep it up. Teach us something about currency trading as well.

Hi Anil,

You made me 🙂 by writing first part.

But made me 🙁 by writing second part.

There is no need for any retail investor to learn currency trading or any trading(including equity). Read this

https://www.retirewise.in/2010/05/keep-it-simple-while-investing.html

Excellent article, SIP calculation and Indian Growth Story are very strong example of why you should invest in Indian Market, and SIP comes handy in your investments, as it offers you multiple benefits like compounding the value of your money.

Thanks

Very good article Hemant. Keep up the good work.

Thanks Shinoj,

This is all bcoz of TFL readers – who keep me motivated. 🙂

This is pretty cool – very well presented and of course your research shows in the work itself.

I was most amazed by the data about stock returns and inflows. Does the inflow data include MF and FII purchases as well or is it just retail?

Great job!

Thanks a ton Manshu 🙂

Inflow data includes MF but not FII.

dear Hemant jee,

thanks to guid me how to invest.plz suggest me top 10 sip fund to invest.is there any web site to know update knowledge of mutual fund?

Hi Tinku,

10 will be over diversification – limit yourself to 5-6 funds.

check the list here

https://www.retirewise.in/2011/02/systematic-investment-plan-mutual-fund-sip-best.html

Very good article on stock market return. Iwant to know all SIP (equity fund) is eligible for Section 80C?

Thanks

Hi Mahesh,

Not every SIP. There are special fund called ELSS

https://www.retirewise.in/2010/12/elss-tax-mutual-fund-india.html

Hi Hemant,

U have doing xlent job ,by giving this kind on information and this encourage us to keep invest in good instruments to make good earnings in long term…..

U r on top….gr8 job..

Thanks Vijay – keep adding comments 🙂

Hi Hemant,

I am regular follower of this website 🙂 and its got a high quality , simple and detailed content. Great effort and keep posting more for yout readers \m/

Thinks Nikita.

Hi Hemant,

Sensex was launched in 1986

Which index are you referring to in the chart1 and what is the source. Would be most obliged if you can enligten

Hi Mr Debashis,

I fully agree with you that it was launched in 1986.

But “The base value of the SENSEX is taken as 100 on April 1, 1979, and its base year as 1978-79.” Wikipedia & RBI. Most of the Asset Management Cos use it in their presentations – check this link(slide 5 & 6)

http://www.bseindia.com/downloads/Kotak%20Sensex%20ETF%20low%20res%20PPT%20.pdf

Hemant,

I have seen that data at different places. It is probably wrong.

We all know, equity is great over the long run. But this data shows that from 100 “Sensex” went to 1000 in 10 years. 10 times in 10 years? You are very well read. Can you honestly believe this and trust this data?

The fact is, India has very poor system of data collection and maintenance. Ask yourself, why does BSE give Sensex data from 1990 and not from 1986 or from 1979-80 if this data is correct and robust.

We have been engaged in trying to create database of Sensex and earlier data of RBI time series. Neither BSE nor RBI have it/share it.

Dear Hemant,

I have heard this days a lot about Private Equity Invesment .

can you share some article / its Returns or write ups how good or bad is private equity and how to approach it

Regards

Chinmay

Hi Hemant

I liked the following points :

Debt creates an illusion of safety but in long term safety is preservation of purchasing power.

There will always be a big gap between Investor returns & Investment Returns.

thanks for all the articles Hemant. I am taking my own time in going through the articles..better late than never..you make complex topics seem so simple. Keep up the good work.

Thanks Hema 🙂

Hi Hemanth,

Excellent work.Your way of presentation is so simple that even a layman can understand, and so detailed to get enough information.

Thanks Sunitha.

A good indeed. Thanks Hemant for the details. I am a strong beleiver of investing in Equity-Debt mix in approporiate proportions. It will be good if you can provide the readers with some scientific tools which help them to calculate right proportions of investment as per their age and earning potential.

Hi Ajay,

You should check this

https://www.retirewise.in/2011/09/top-10-financial-planning-rules-of-thumb.html

Dear Sir,

I am weekly reading your TFL guide course very excellent sir.

Sir my one question.

My firend lic agent he saying you invest in LIC jeevan anand plan monthly 2000 for 21 year but pls.suggest to me Where i do invest acutal your i am very cunfuse LIC good OR equity market my future

Because my monthly salary is 8000

Pls.help me sir.

Nice article

It is an excelent article to understand that how SIP works and why we should invest through the SIP

I want to spend money pls guidens me

You completed certain fine points there. I did a search on the topic and found a good number of folks

will go along with with your blog.

Dear Hemant Beniwal,

I have started reading about financial planning recently and got your site, and you The Financial Literates E-course divided in 8 parts.

I am learning lot and getting my many doubts clear.

Thanks buddy to educate all of us.

I have rs.15000 and I want to deposit on sip ..how much I received after five years

Hi Subhash,

Bit wrong question – I will suggest getting in touch with MF agent in your city.

Comments are closed.