On Saturday we conducted a Financial Planning workshop which was attended by over 30 young and middle age employees of an organization. Though it was not really surprising when we got to know that none of them have enrolled to Systematic Investment Plan as SIPs are still understood by very few, but it was very disheartening to know that almost everyone had some investment linked insurance policy and none of them knew about Term Insurance. Though the better part was that they wanted to learn the right things. We will speak in detail about that workshop in our later post.

This just shows that how much Indians lack in financial literacy and how these insurance company’s virus have spread to almost every investor in India. Mind you these are not INSURANCE SCHEMES but these are INSURANCE SCAMS. We just can’t imagine how people can play with other innocent people’s money. For most of the Indians, it is not just their hard earned savings but it is career of their kids or their bread and butter for their golden years. The Insurance Agents who talk to you about some ULIPs or Endowment are none better than BUTHERS. They just kill and feel happy that they have earned today.

Must Read: Understand how to plan for Kids Future

Let me give you a real time example of Mr. Average Indian who landed up in my office after investing in BHARTI AXA ULIP.

He had asked his agent that he can invest only Rs.10000/- in a year. The agent agreed and took Rs.10000 worth of cheque but filled the form as Half Yearly without the knowledge of the investor. Surprisingly, the investor did not know the same until he landed up in my office with the policy papers.

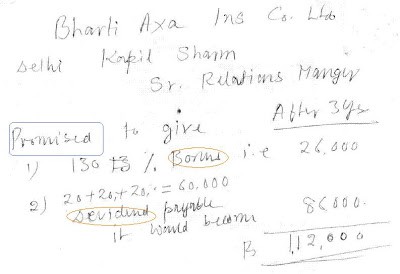

I then spoke to the Agent over phone acting as relative of Mr. Average Indian, who is also interested in taking this policy and following is what he told me:

1. Bharti AXA is a big company and we all know about Bharti. They are guaranteeing you a return of Rs.112000/- after 3 years if you invest Rs.20000/- a year. Wow!! A return of 34% a year. If I keep getting this high return over next 20 year, my investment of Rs.20000/- a year would become Rs.2,73,84,441/-. For god sake, why the hell we all are working so hard. Put all your money in BHARTI AXA.

2. I asked them how do you get such return when bank is giving only 8% return. He said sir my company is Delhi based and they are investing in Common Wealth Games to be held in Delhi and hence they will generate this return…. Believe me guys, I can never imagine such a reply.

3. Then as usual, as any ULIP guy tells.. you need to invest only for 3 years. The NAV is low and hence you get more units… bla bla bla..

4. When I asked him about Allocation charges, he said that there are no allocation charges.

5. He also tells me that company is giving you a guarantee of 160% of first year premium after 20 years.

Now let me tell you the correct picture.

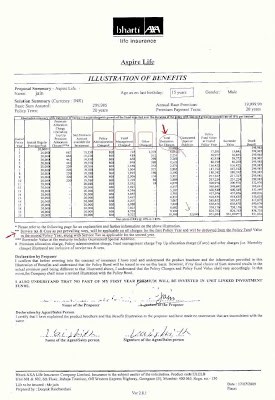

a. The total deduction from the first year premium of Rs.20000/- is RS.20000. Not only that, the service tax on such charges which are roughly Rs.2000 plus, shall be deducted from second years premium. This amounts to 110% charges for the first year premium. Please read the illustration

b. Indians like the word guarantee. So 160% of first year premium is Rs.32000/- which they will give after 20 years. Now it is less than 2.5% p.a. return. Even if you keep your money in savings bank, you will land up getting Rs.39000/- plus. In PPF it becomes Rs.93000 plus and in diversified equity fund giving 12% return, it would become close to Rs.2 lacs. Do you call it a guarantee?

c. Now this policy is taken in the name of a minor child. Please tell me any one who would want to be benefitted financially if his son/daughter were to die.

Please click on the sheet(illustration) which is attached here and take a look..

” I asked them how do you get such return when bank is giving only 8% return. He said sir my company is Delhi based and they are investing in Common Wealth Games to be held in Delhi and hence they will generate this return…. Believe me guys, I can never imagine such a reply.”

–No body can imagine by far this kind of answer from Advisor that too from Direct company employee. Wah Bharti

Aditya – but now a days this is kahani Ghar Ghar ki. 🙁

i’ve invested in ulips but now i’m hearing news about BAN ON ULIPS

is it right to continue or with draw

Hi Pramod,

Ban on ulip was removed – so there is no need to worry.

But ulips are not good investments so take your well thought decision.

Hey Hemant,

This is an eye opener really.

And you’ve explained it so well. Although I had an idea about the ULIP charges but I am really surprised to see that the entire first year premium goes into company charges and besides this they deduct service tax….etc from second year’s premium…

I am glad that I never opted ULIP plan for insurance -cum-investment 🙂

I have purchased Max Life – Life Maker Unit Linked Investment Plan 2 and I am paying premium every month.

Plan – Life Maker Unit Linked Investment Plan 2 – Growth Option

Premium Start Date – 15 Sep 2006

Premium Amount – 3000/= per month

Units Accumulated as on date – 6412

Current NAV – 31.58/=

Current Insurance cover – 8,80,000

Insurance Cover Type – Increasing

My Birthday – 15/04/1973

Questions –

1. I am not able to decide if I should stop paying premium foreclose this policy or continue.

2. I am not sure how much amount I will get if I foreclose this policy.

Dear Aniruddha,

If you foreclose the policy Fund valued will be paid after deducting surrender charges.

All insurance agent are like this only. I would say more than 95% of agents just want to earn their commission. They will never care customers real requirements. Fortunately I never got into ULIP and probably will never buy ULIP unless I understand it fully, mainly switching options.

Hi Hemant Sir,

I have taken ULIP named “Foresight Plan” of Birla Sun Life on 14th August 2012. Below is Details of My Policy:

5 Pay – 10 Year policy.

Premium- 3333000/- per Year,

Sum Assured- 10* Premium = 3333000/-

Fund invested in- Foresight Plan – 5 Pay – Guaranteed Plan.

Charges: Roughly 10% p.a

Guaranteed Option: Take 1 year`s Lowest NAV for each fund allocation and Guaranteed of 1st 7 year`s Highest NAV.

Death Benefit- Sum Assured + Fund Value.

Mat. Benefit- Higher of Guaranteed Minimum Mat. Benefit or Fund Value.

No Rider, no Bonus on Maturity

I have paid only my 1st premium and have now very confused to what to do with this policy i.e should i discontinue or hold it, as every person suggested not to go with ULIPs as its return are not more than 6 to 7 % in long term.

I am comfortable to pay all premiums and yes i have also comfortable to take exposure in Equity MF.

Tomorrow i.e on 13.09.2013, my 2nd premium grace period is going to end so please tell me what to do.

Should i continue this policy or Discontinue it now and take pure term plan?

Comments are closed.